- Home

- Publications and statistics

- Publications

- Out-of-court proceedings to help compani...

Post n°234. Using out-of-court proceedings to resolve companies’ financial difficulties can help them to recover by preserving their reputation. However, directors seldom use them, partly because of a lack of information available about these facilities. It would be beneficial for small companies to make use of these "crisis exit" restructuring mechanisms, which are designed for them.

Book IV of the French Commercial Code deals with the treatment of ailing companies. There are two main categories of proceedings: out-of-court proceedings and collective proceedings. The former have a number of advantages that are still relatively little-known. It is therefore crucial to clarify their respective workings so that companies can choose the procedures best suited to their situation.

Out-of-court proceedings such as the ad hoc mandate and conciliation proceedings stand out in that they are confidential. Only the creditors selected by the director are invited to renegotiate the company's debt, under the supervision of an ad hoc representative or a conciliator. The operation remains confidential: non-signatory creditors will not be affected or even notified of the renegotiation. The company's reputation is therefore protected, which maximises its chances of survival: according to experts, on average 70% of companies reach an agreement via an out-of-court proceeding, although this figure is difficult to estimate due to the confidential nature of the proceedings (Borga et al, 2018).

Conversely, safeguard, receivership and judicial liquidation procedures are public. Their initiation is reported in the official bulletin of civil and commercial announcements (BODACC) and appears on the company's K-bis extract. All creditors participate in the renegotiation of the company's debt, which is why they are called "collective". Under safeguard proceedings, around 60% of companies reach an agreement to restructure their debt, compared to 25% under receivership proceedings. On average, 5% of companies decide to sell their business completely (Epaulard and Zapha, 2021).

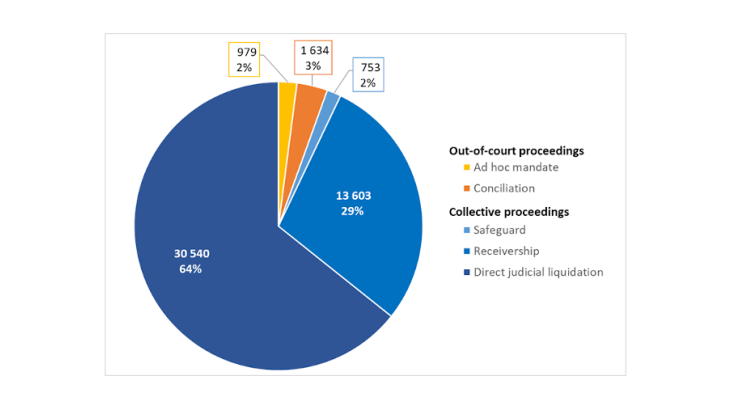

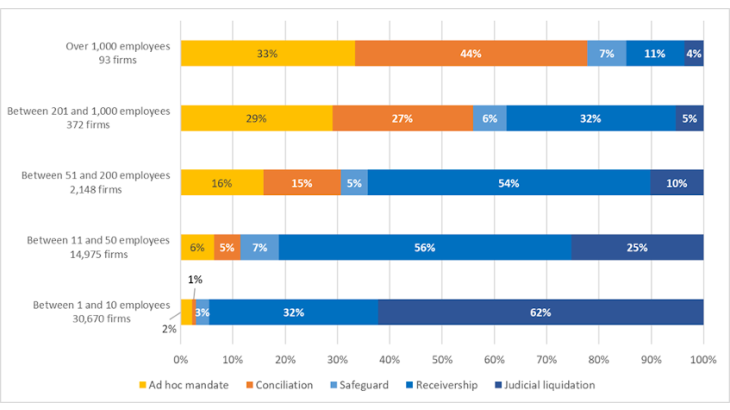

Despite the higher survival rate associated with out-of-court proceedings, companies make very little use of them: they account for only 5% of all proceedings initiated, with almost two-thirds of them consisting of direct judicial liquidation (Chart 1). There are two possible explanations for this paradox. The first is related to the size and degree of information of the companies entering the proceedings. The majority of direct receiverships and judicial liquidations concern micro-enterprises (95% of insolvencies on average). Chart 2 shows a correlation between firm size and the use of out-of-court proceedings. The lack of awareness among micro-entrepreneurs of the existence of alternative proceedings could thus explain why they do not quickly address their financial difficulties.

A second possible explanation for the low use of out-of-court proceedings is that smaller companies probably find it more difficult to anticipate their difficulties. Unlike large enterprises, they are likely to be less resilient to a less predictable and more rapidly irredeemable cessation of payments.

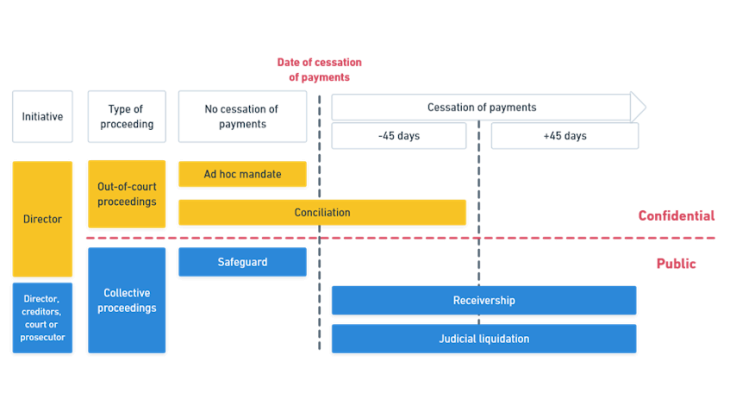

Cessation of payment is a key component of bankruptcy law

Cessation of payment is defined as the inability of the company to meet its current liabilities with its available assets. As shown in Chart 3, cessation of payments differentiates between:

- Preventive procedures: the ad hoc mandate, conciliation and safeguard proceedings, which can only be initiated by the firm’s manager and provided there is no cessation of payments (or for a cessation of payments of less than 45 days in order to file for conciliation).

- Insolvency proceedings: receivership and judicial liquidation, which must be initiated once the business has been declared in cessation of payments (if conciliation has not been initiated beforehand).

The company's accountant is responsible for establishing cessation of payments and the date on which it starts. He or she should, where possible, warn the director in advance to provide advice on the preventive proceedings that will maximise the company's chances of recovery. Going into receivership, and even more so into liquidation, generally indicates that the situation was dealt with too late. The advisory role of the accountant is especially important for very small companies, whose horizon for prevention is probably limited.

Protecting the company's reputation to optimise its survival

Epaulard and Zapha (2021) show, by comparing the safeguard proceeding with the receivership proceeding, that the chances of survival associated with each proceeding are partly due to a reputation effect.

The mechanism is as follows: the low restructuring rate in receivership (25% of receiverships result in a restructuring agreement) could scare the stakeholders of the ailing company. Fearing an adverse outcome, they would distance themselves from the company, thereby damaging its economic situation and reducing its chances of survival due to a self-fulfilling effect. In addition to filing for receivership late, the indirect costs generated by this procedure are significant: they can amount to as much as 20% of the value of the company.

At the same time, the safeguard proceeding has better restructuring rates (60% of restructuring agreements) and a less negative reputation. It can be assumed that these results can be extrapolated to out-of-court proceedings, which benefit both from a high survival rate (70% of restructuring agreements) and from confidentiality that ensures the protection of the company's reputation.

For a given financial situation, preventive and out-of-court proceedings are much more likely to preserve companies' chances of survival, which is why they should be favoured.

The effect of covid-19 on restructuring procedures

Given the differences in crisis exit scenarios across sectors (Lemaire et al, 2021), many measures (investment plan, crowdfunding, extension of state-guaranteed loans, etc.) aim to mitigate the risk of greater difficulties for some firms, particularly VSEs and SMEs. Among this crisis exit arsenal, restructuring procedures should not be overlooked. At the first signs of fragility, companies should be encouraged to contact the commercial courts to be guided towards the solutions best suited to their situation.

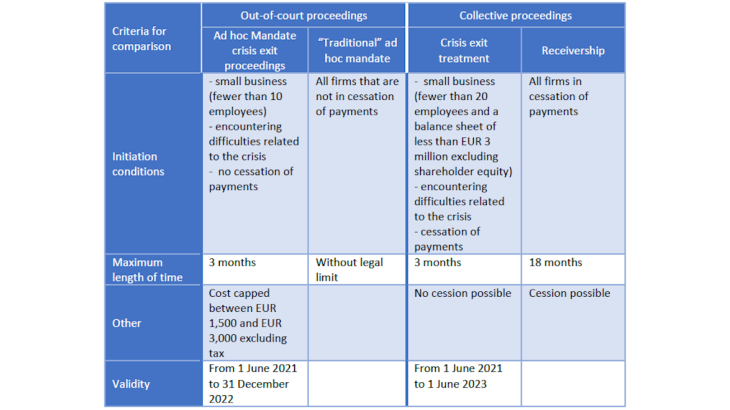

Arrangements have been put in place to facilitate their rapid restructuring (Table 1). New "crisis exit" proceedings are available to small ailing firms, alongside the traditional procedures. In particular, capping the cost of the ad hoc mandate and simplifying the declaration of claims, by a simple declaration by the director and a balance sheet analysis, make the process lighter and restructuring more accessible. Limiting observation periods to three months also reduces the indirect costs incurred by the company (Zapha, 2021).

Updated on 29 March 2024