- Home

- Publications and statistics

- Publications

- Health crisis: what impact on SME debt?

Post n°224. An analysis of a sample of nearly 180,000 SMEs exposed to the health crisis shows that the vast majority of companies that took on debt in 2020 kept some of this money in cash. In the context of the gradual phasing out of government support, we also assess the extent to which businesses will be able to meet their debt obligations depending on their level of activity.

SMEs exposed to the health crisis have weathered the shock to activity relatively well

In order to measure the impact of the health crisis on SMEs, we analyse the situation of companies with a balance sheet as of 30 June 2020 (thus covering the first lockdown) and for which a 2019 balance sheet is available. In all, we examined 179,607 balance sheets of SMEs with a turnover of more than EUR 750,000 in the Banque de France's FIBEN database. This sample does not contain information on the smallest SMEs but nevertheless represents 47% of the value added of SMEs in 2018. It allows us to make an initial assessment of the impact of the health crisis on SMEs, based on observed data.

The turnover of these businesses fell by 5.2% between 2019 and 2020, and the value added by 5.9%. Personnel expenses were reduced (-4.9%) thanks to the short-time working scheme to which they largely adhered According to the Coeuré Committee's progress report, more than 80% of the businesses that received support of any nature have less than 250 employees. The fall in gross operating surplus (GOS) was therefore limited to 8.1%.

Overall, SMEs have held up fairly well. However, not all sectors were affected in the same way: the fall in turnover was very marked in the accommodation and catering sector (-32.2%) and, to a lesser extent, in business services (-8.7%) and in industry (-6.9%); it was more limited in the retail sector (-2.1%). Moreover, these sectoral disparities mask highly heterogeneous situations within the same sector Bureau et al., 2021).

Operating cash flow remained stable, cash flow and debt increased

Faced with this shock to activity, SMEs kept their operating flows under control, as measured against turnover. Indeed, in 2020, the GOS of businesses stood at 6.9% of turnover, a level similar to that of 2019 (see Chart 1). They also reduced their operating working capital requirements (OWCR). Investment and dividends were also adjusted downwards to remain in line with turnover as in 2019 and they consolidated their capital base. Nevertheless, we note that the cash flow of the SMEs analysed here was consolidated well beyond that which would have been possible with such operating cash flows, since it increased by 37.5% between 2019 and 2020.

Indeed, 2020 was marked by a sharp increase in gross financial debt for these SMEs: up 15.9% in 2020 after 2.1% in 2019. Before they knew the extent of the business shock they would have to face, and before the full roll-out of the support measures, SMEs made extensive use of state-guaranteed loans (SGLs) as of April 2020 (Vinas 2020). In our sample, 39% of businesses took out an SGL and for these firms, the amounts of SGL granted represented 44% of their total financial debt at the end of 2020.

Net debt: a generally favourable situation but some individual situations more difficult

Should we be concerned about this increase in debt? According to the latest macroeconomic statistics from the Banque de France, for all non-financial corporations (NFCs), i.e. including SMEs, ISEs and LEs, gross outstanding debt increased by more than EUR 200 billion year-on-year at the end of December 2020, but net debt increased by only EUR 5 billion, with this difference being mainly attributable to changes in the cash position.

For our sample of SMEs, at the aggregate level, we observe that the gross debt to equity ratio increased from 66.9% in 2019 to 74.4% in 2020. By contrast, the net debt to equity ratio fell by more than 4 percentage points, from 30.1% to 25.9%. The businesses in our sample therefore appear to have retained a large part of their financing flows in cash in 2020, like all NFCs.

But what about at the individual level? In 2020, gross debt rose for more than half (54%) of the businesses in our sample. Among this half, more than 8 out of 10 companies (i.e. almost 45% of all companies) reported an increase in their cash flow. The vast majority of businesses that took on debt during the crisis therefore kept at least part of these funds in cash. For those whose debt increased but not their cash flow, which account for 10% of all SMEs (=0.54 x (1-0.82)), potential difficulties could be expected.

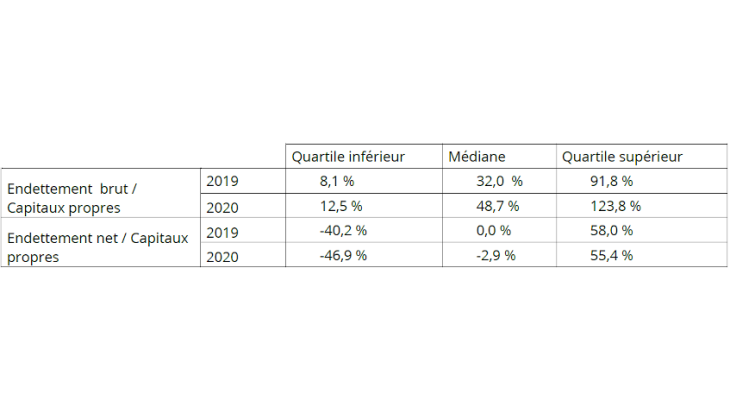

This rise in debt worsened the gross leverage ratio of the businesses in our sample: all quartiles of the gross leverage ratio distribution increased between 2019 and 2020. For instance, 25% of businesses had a gross debt to equity ratio of over 123.8% in 2020 (see Table 1). Conversely, all quartiles of the distribution of the leverage ratio net of cash improved in 2020. For example, only 25% of businesses had a net leverage ratio above 55.4%. And 50% of the SMEs in the sample had a negative net leverage ratio (less than -2.9%), which means that 50% of the SMEs had enough cash to cover the repayment of their gross debt.

Note: In 2019, 25% of businesses had a net debt to equity ratio below -40.2% (i.e. they had more cash than gross debt), 50% of businesses had a net debt to equity ratio below 0%, and 75% had a net debt to equity ratio below 58%.

To what extent can the operating cycle help to repay the financial debt incurred during the crisis?

The difference between a net debt and gross debt approach is that businesses either use their cash holdings to repay their debt or do not. In the latter case, to what extent would a company's operating cycle enable it to repay its debt?

To answer this question, we analyse changes in the ratio of stable financial debts to the firm's self-financing capacity. This ratio measures the number of years it would take to repay stable financial debts if all internal cash flow were allocated to them. Deferred tax and social security charges are excluded here because of the difficulty of isolating them in companies' balance sheets. However, thanks to the exceptional repayment mechanism, it was possible to stagger them over several years.

The ratio of debt with a maturity of more than one year to the company's self-financing capacity deteriorated in 2020, from 361% in 2019 (or 3.6 years of cash flow) to 459% (or 4.6 years of cash flow). It would therefore take about "one more year of activity" to pay off the company's long-term debt. The worsening of this ratio is due to the increase in gross debt and the decrease in activity. A less conservative and more plausible calculation hypothesis would be to assume a return to the 2019 activity level, proxied by the 2019 self-financing capacity. Indeed, according to the Banque de France's June 2021 macroeconomic projections, activity is expected to start exceeding its pre-Covid level as of the first quarter of 2022. This ratio between long-term debt at the end of 2020 and the company's 2019 cash flow also deteriorated, but to a lesser extent, to 429%. With this correction, which assumes a return to the pre-crisis level of activity, it would therefore take - with unchanged cash holdings - a little more than 8 months of 'additional' activity (0.7 years) to repay the additional gross debt contracted in 2020. This is an upper bound since the majority of companies could also use their surplus cash holdings to reduce their debt.

When examining the situation of SMEs at the individual level, this deterioration can be put into perspective. While for 25% of businesses this ratio deteriorated by more than two years of cash flow, the median increase in the ratio in 2020 of stable debt to 2020 self-financing capacity is 3 percentage points. Thus, for the majority of the companies we observe, this ratio did not deteriorate significantly.

Overall, therefore, the support measures and expenditure adjustments made by SMEs have enabled them to weather the health crisis reasonably well. However, some businesses will require close monitoring during the recovery period (Doucinet et al., 2021). This is the aim of the national support scheme for businesses emerging from the crisis, to which the Banque de France is a signatory.

Updated on 25 July 2024