- Home

- Publications et statistiques

- Publications

- Speed up restructuring proceedings in re...

Post n°192. Collective restructuring proceedings could be improved in order to deal effectively with ailing firms. Speeding up the process of corporate debt restructuring - starting with the safeguard procedure - could help as many firms as possible to recover.

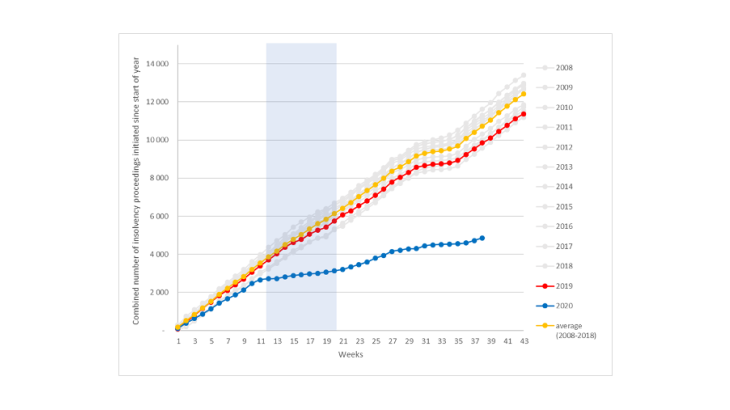

Source: France Stratégie (data from the BODACC, calculations by Cros, Epaulard and Zapha)

Note: Between 9 and 15 March 2020, fewer than 3,000 receivership proceedings had been initiated in France since the beginning of the year (3,500 in the same week in 2019). The blue area represents the lockdown period.

During lockdown, the number of businesses entering receivership was at a virtual standstill and increased little thereafter (Chart 1). This situation reflects the slowdown in the activity of the commercial and high courts, as well as regulatory changes that temporarily change the dates for filing for insolvency.

With the growth in corporate indebtedness, and against a still fragile economic backdrop, restructuring proceedings could return to their pre-crisis rate in line with the rise in insolvency filings. Effective bankruptcy law will be essential to absorb the forthcoming surge in ailing companies, to enable the successful restructuring of as many viable companies as possible and to limit losses on the loans they have taken out.

The benefits of the safeguard procedure

An effective bankruptcy law must be able to identify viable businesses among those at risk of insolvency and enable them to restructure their debts while preserving the value of their assets. To achieve this objective, French insolvency law has used the safeguard procedure since 2006.

Unlike receivership, the safeguard procedure is aimed at companies in difficulty prior to insolvency. This preventive procedure significantly increases the chances of survival of these businesses. According to Epaulard and Zapha (2019), 62% of companies under the safeguard procedure manage to restructure their debt against only 27% of those in receivership. This study also shows that the good results achieved by the safeguard procedure partly stem from its ability to protect businesses from a decline in their reputation because of receivership, which entails self-fulfilling expectations: its low restructuring rates lead to mistrust which in turn reduces its chances of success.

The safeguard procedure thus contributes to making French insolvency law more dynamic and efficient. It enables France to be exemplary by international standards, against the backdrop of a growing interest in preventive restructuring frameworks (France Stratégie, 2019). In the European Union, this led to the adoption in June 2019 of an insolvency directive requiring all Member States to have a preventive procedure in place by 2021. Among its many recommendations, it insists on the need to reduce the excessive length of insolvency proceedings.

To go further, should restructuring proceedings be speeded up?

In his Letter to the President of the Republic in 2020, the Governor of the Banque de France stressed the importance of “speeding up and simplifying collective restructuring and liquidation proceedings […]”. In France, restructuring proceedings last on average eight months, (whereas debt-restructuring plans last on average nine years).

When the safeguard or receivership procedure is initiated, the company enters a six-month observation period, renewable twice, during which the legal proceedings are suspended and a list of the company's claims is drawn up. After this period, the company obtains a debt-restructuring or divestment plan, or is liquidated.

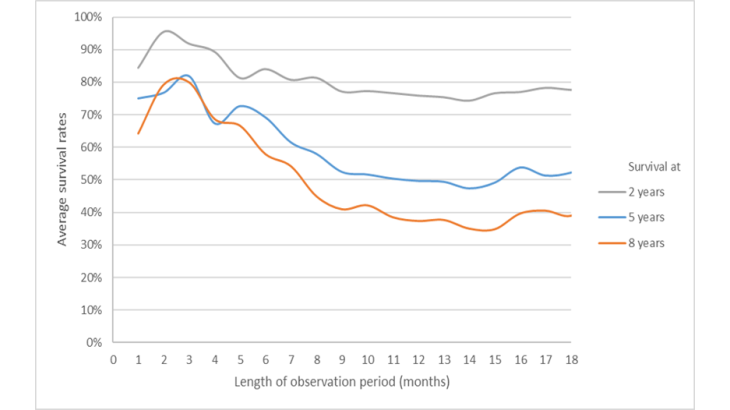

Key: 70% of companies whose proceedings lasted for 6 months survived at least 5 years, compared to 50% of companies whose proceedings lasted 12 months (blue line, safeguard or insolvency proceedings initiated between 2009 and 2015).

This observation period is necessary to examine the company's situation, but it is also a source of uncertainty for the business (decline in the value of its assets, difficulty securing new contracts, deterioration in its economic environment, etc.). These losses of opportunities and profits are part of the indirect costs associated with bankruptcy: the longer the proceedings, the greater the indirect costs (Bris, 2006). The time given to companies to replenish their cash positions must therefore be weighed against the need to limit the length of proceedings in order to minimise indirect costs and promote the chances of a successful restructuring.

Indeed, Chart 2 suggests a diminishing relationship between the length of the proceedings and the survival rate of companies undergoing debt-restructuring plans. This relationship can be interpreted in two ways:

- a viable company would require a shorter observation period, while a fragile business may need time to put in place a debt-restructuring plan (and its damaged situation would still result in lower survival rates, less than 50% especially beyond 8 years),

- an extended period of observation may lead to significant indirect costs that would weaken the chances of survival of the business.

These two interpretations are not mutually exclusive and would require further study to differentiate between them.

Supporting the idea that shorter proceedings would help businesses' chances of rebounding, the European directive advocates the introduction of preventive procedures with an initial observation period of four months and no longer than 12 months in total. The Action Plan for Business Growth and Transformation (PACTE), adopted on 22 May 2019, provides for the transposition of this directive into French law. The details of the overhaul of French bankruptcy law are not yet fully known, but several possibilities can be envisaged in this respect:

- comply with European recommendations and shorten the legal length of the safeguard procedure to four months (instead of six) without changing the legal length of the receivership procedure;

- make use of the recommendations to shorten the length of the safeguard and receivership procedures to four months;

- a compromise would be, initially, to shorten the length of the safeguard procedure to four months and, if the results are conclusive, to extend this change to the receivership procedure.

Materially, the technological progress achieved since the introduction of the receivership procedure in 1985 and the digitalisation possibilities, boosted by the weeks of lockdown, should indeed make it possible to shorten this period.

The end of the health crisis may provide an opportunity to implement these potentially beneficial measures in the short term in order to effectively help as many struggling firms as possible.

Updated on the 25th of July 2024