Open-end investment funds engage in a liquidity transformation as they offer shares that are generally more liquid than the assets held. Share redemptions can lead to a decrease in the share price, the net asset value (NAV), due to liquidity costs associated with the sale of assets needed to meet share redemptions. This liquidity cost is usually passed to investors remaining in the funds, inducing an incentive to redeem shares first (“first-mover advantage”). This incentive becomes particularly acute in periods of market stress and can lead to fire sales and runs, jeopardizing financial stability.

Swing pricing is a tool aiming at reallocating the liquidity cost from remaining to transacting investors to mitigate the first-mover advantage. It relies on a NAV adjustment based on the portfolio liquidity and fund flows. If the fund is experiencing outflows, it adjusts the NAV downward to transfer the liquidity cost associated with asset sales to redeeming investors. Similarly, if the fund is experiencing inflows, it adjusts the NAV upward to transfer the cost of asset purchase. The strength of the adjustment decreases with the liquidity of the portfolio and is captured by the swing factor. Swing pricing can be applied for any level of flows (full swing pricing) or only if flows exceed a threshold (partial swing pricing). Second, the swing factor can be capped to assure investors that the NAV will not be too distorted by the mechanism

This paper focuses on the empirical impact of swing pricing on flow dynamics during market stress. More precisely, we study how, in France, swing pricing has affected flows during the acute market stress situation induced by the Covid-19 crisis. In addition, we study how using a cap on the swing factor influences its efficiency to inform on optimal swing pricing design. To lead this analysis, we rely on the same information that is available to investors: fund prospectuses. Indeed, to use a swing pricing mechanism French funds must disclose it in this document. We extract this information using a text-mining algorithm.

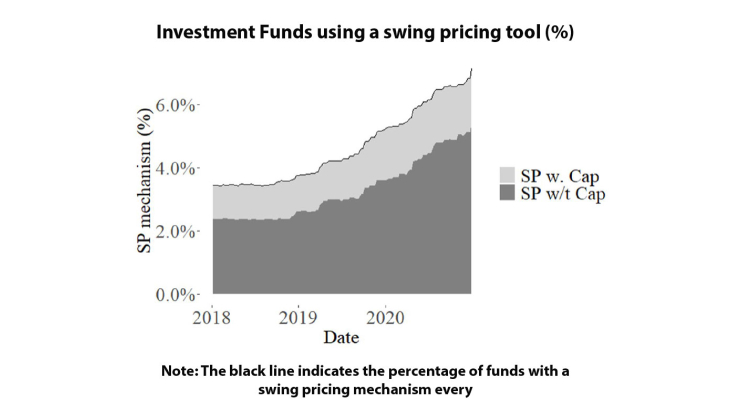

Swing pricing has gained in popularity in France: at the beginning of 2018, 3.4% of investment funds were using swing pricing, they were 7.2% at the end of 2020. 27% of them use a swing factor cap and all of them use partial swing pricing (minimum adjustment value triggering the activation of the swing pricing). We study the endogenous decision of fund managers to use swing pricing and find that the strength of the liquidity mismatch increases the likelihood to implement swing pricing: the tool is thus used by funds that need it the most.

Then, we turn to the analysis of flow dynamics during the Covid-19 crisis. We find that swing pricing only had a limited impact on the financial stability of funds during this period. Indeed, this tool did not decrease volatility and funds with swing pricing suffered additional outflows. One reason highlighted is the existence of a “stigma” effect: some investors are reluctant to invest in funds using swing pricing, especially during market stress. The other reason lies in the type of swing pricing currently used in France. Indeed, when focusing only on funds without a swing factor cap, we find that swing pricing stabilizes flow dynamics during systemic stress: volatility is reduced as well as outflows.

Our study thus informs on the detrimental effects of having capped swing pricing. It may be explained by the gap created between actual and unconstrained swing factors when the swing factor is capped, preventing accurate internalization of reorganization costs and thus increasing the risk of dilution. Furthermore, the higher the cost of reorganization the larger the gap, mitigating the stabilizing impact when it is the most needed. Complementing the analysis based on systemic stress, we focus on the impact of swing pricing during idiosyncratic stress—situations of large past outflows and liquidity strain. Idiosyncratic stress is particularly relevant to study the swing impact as it is expected to induce large swing factors (and to exceed swing activation threshold for partial swing pricing) and thus large NAV corrections. Contrasting with systemic stress, we find that swing pricing increases flows. In addition, we observe that the stabilizing impact of swing pricing vanishes also during idiosyncratic stress for funds with a swing factor cap. We conclude that the swing pricing is efficient if the price impact is substantial enough to offset the stigma effect highlighted previously.

To conclude, we find that swing pricing has the ability to reduce the exposition of investment funds to risks of fire sales. However, the swing pricing calibration is of paramount importance to achieve the intended objective.