- Home

- Publications and statistics

- Publications

- Macroeconomic projections – June 2022

In order to contribute to the national and European economic debate, the Banque de France periodically publishes macroeconomic forecasts for France, constructed as part of the Eurosystem projection exercise and covering the current and two forthcoming years. Each publication comprises a summary of the projections. Some also include an in-depth analysis of the results, along with focus articles on topics of interest.

Introduction

• The war in Ukraine and the strong tensions in commodity markets and global value chains are creating a difficult environment. These shocks have led us to revise inflation upwards and activity downwards, to a greater extent than in March.

• As a result, French inflation is expected to be elevated in 2022 and 2023. The main driver should be soaring energy prices, especially as we are conventionally assuming that the price shield will not be extended beyond the end of this year. Inflation should also be fuelled by food and manufactured goods over the coming quarters. Under our baseline scenario, headline inflation and inflation excluding energy and food are then seen coming back to around 2% over 2024, which is the Eurosystem target and similar to the rates seen in 2002-07.

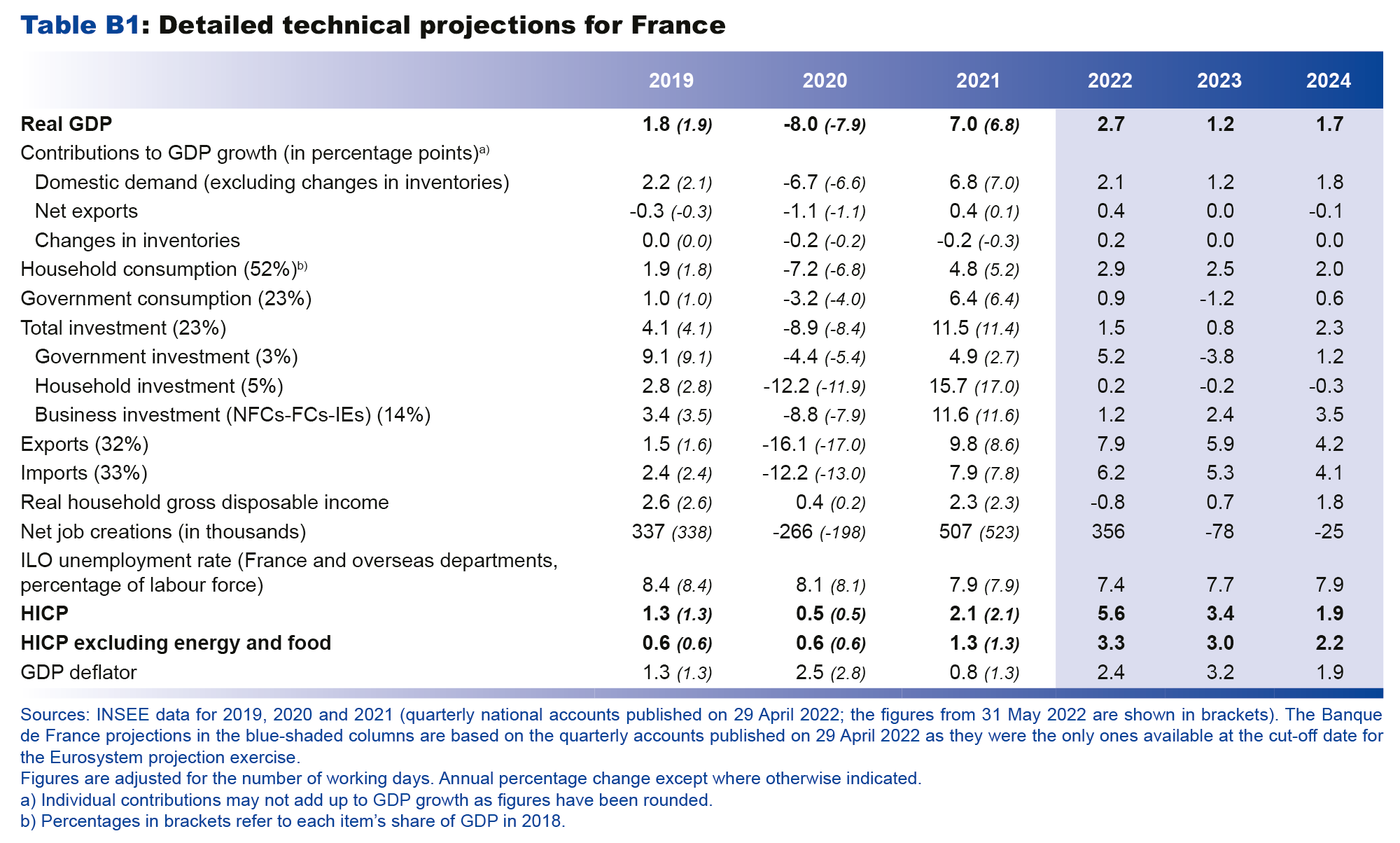

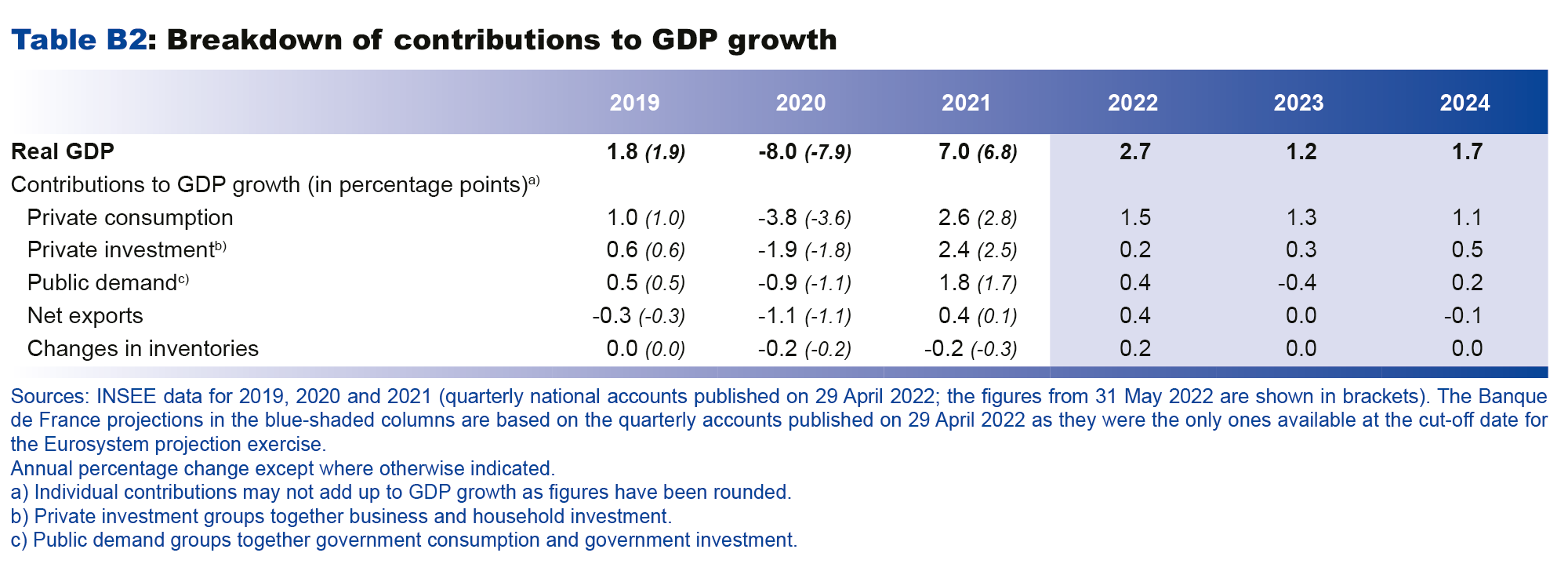

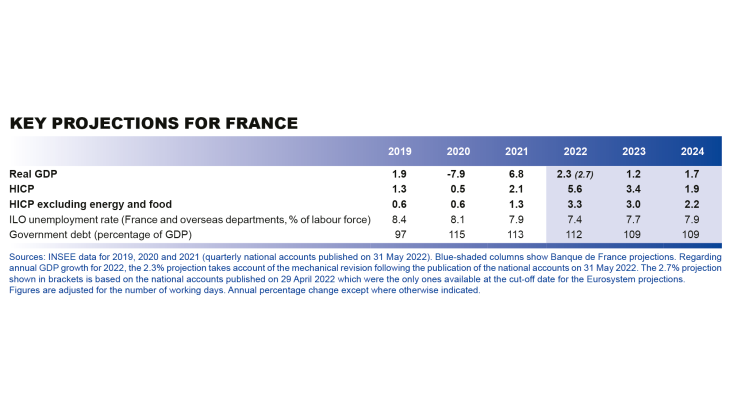

• In 2022, growth in French activity is expected to slow to 2.3% if we mechanically incorporate the revision to the past quarterly national accounts published by INSEE on 31 May (and to 2.7% without this revision). Growth should be dampened by the current level of inflation which is weighing on purchasing power. It should also be affected by the deterioration in the global economic environment and by the strong geopolitical uncertainty that is denting confidence for all economic agents. In the near term, our baseline scenario is for a sharp slowdown in activity over the four quarters of 2022, even though the decline in GDP in the first quarter is not expected to continue. In 2023, GDP growth is expected to average 1.2% owing to some persistent effects of the shocks being felt today and, under our conventional assumptions, the withdrawal of the temporary part of the economic support introduced during the crisis. In 2024, however, once the shocks have dissipated, growth should return to a stronger average rate of 1.7%, buoyed by fairly robust domestic demand. Against this backdrop, employment should hold up well overall, with the unemployment rate remaining historically favourable and showing only a moderate rise.

• The government deficit is expected to be impacted by economic activity, but also in 2022 by the measures to support purchasing power. Under our current assumptions, the deficit should narrow but will still slightly exceed the threshold of 3% of GDP in 2024. As a result, the reduction in government debt that began in 2021 is expected to stall at the end of the projection horizon.

• Given the high degree of uncertainty, we have also provided a downside scenario where additional risks materialise, including much stronger inflationary pressures on energy and food prices. Whereas in March we made no comment on the respective probabilities of the conventional and degraded scenarios, this time our downside scenario should be seen as a risk to our baseline scenario, with the latter remaining more likely at this stage. Growth under the downside scenario would be sharply curtailed in 2022, and GDP would decline by 1.3% in 2023 before returning partially to growth in 2024 with an expansion of 1.3%. The shocks to commodity prices would also push inflation to over 6% in 2022 and 2023 but this would be followed by a sharper reduction in inflation in 2024 owing to the significantly impaired economic environment under this downside scenario. Government debt would undergo a sharp upward shock, even assuming fiscal policy remains unchanged.

Projections macroéconomiques (Juin 2022) | Banque de France

After the marked rebound in activity in 2021, the economic consequences of the war in Ukraine are expected to weaken the post-Covid recovery

With the lifting of the public health restrictions that weighed on the economy in 2020, 2021 was marked by a robust pace of activity from spring onwards, resulting in strong annual growth. In the second half, however, with all economies experiencing a strong economic recovery after the end of the pandemic-related lockdowns, tensions gradually emerged in commodity prices, combined with increasing supply disruptions. These difficulties intensified significantly at the start of 2022 with the outbreak of the Ukraine conflict and the reintroduction of lockdown measures in some areas of China.

In the first quarter of 2022, according to the detailed quarterly national accounts published by INSEE on 31 May, GDP inched down by 0.2% (see Box 1), reflecting a marked 1.5% decline in household consumption and weaker than expected exports. In the second quarter, according to short-term data from the Banque de France business surveys, GDP is expected to grow by around a quarter of a percentage point: certain services sectors (especially accommodation and food services) are benefiting from the lifting of the last pandemic-related restrictions and the recovery of tourism, including foreign tourism; in contrast, industrial activity and construction are being adversely affected by supply disruptions and rising production costs.

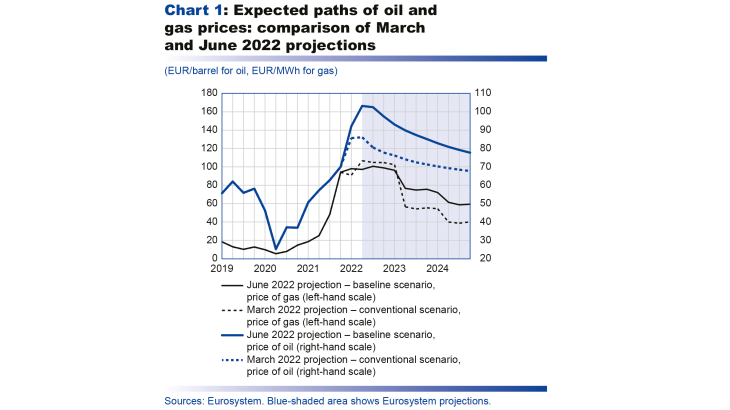

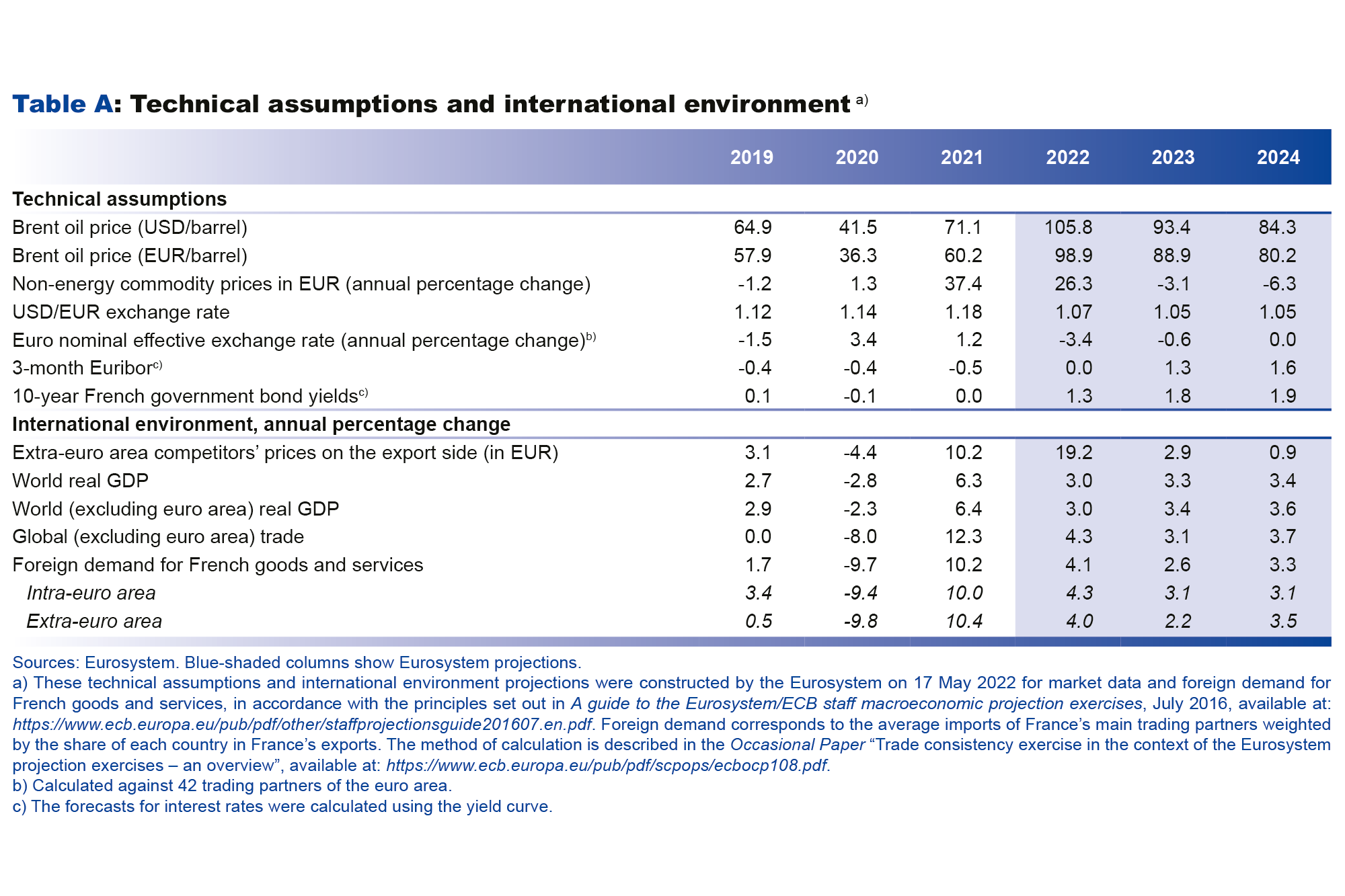

Activity is expected to remain moderate over the second half of 2022, reflecting the adverse effects of higher energy and food commodity prices and developments in the global economy. The Eurosystem assumptions regarding commodity prices and the international environment, for which the cut-off date is 17 May 2022, are for Brent crude oil to average USD 105.8 per barrel over 2022, which represents a sharp upward revision compared with the price of USD 93 underlying our conventional scenario for March (see Chart 1). This assumption of a rise in the price of Brent takes into account market expectations that the European Union will impose a gradual embargo on Russian oil; however, our baseline scenario does not see this causing any significant increase in energy supply disruptions given the alternative sources available for oil. In addition to higher crude prices, we have also taken into account the recent rise in margins on refining and distribution, especially on diesel which is primarily imported from Russia. Demand from France’s trading partners is also expected to deteriorate sharply: growth in foreign demand for French goods and services has been revised down by between 1 and 1½ percentage points for 2022 and 2023 compared with our conventional scenario in March.

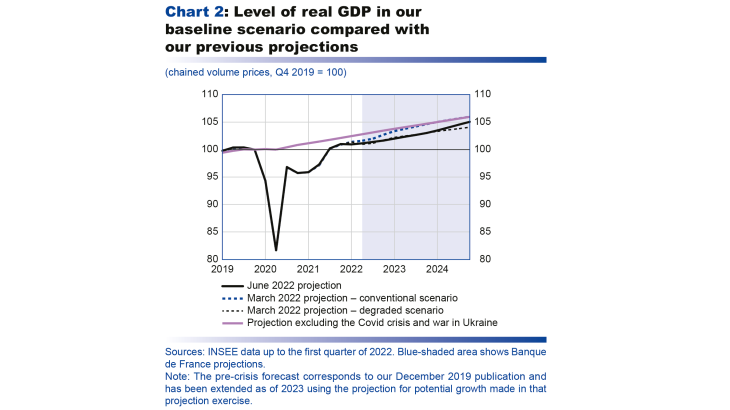

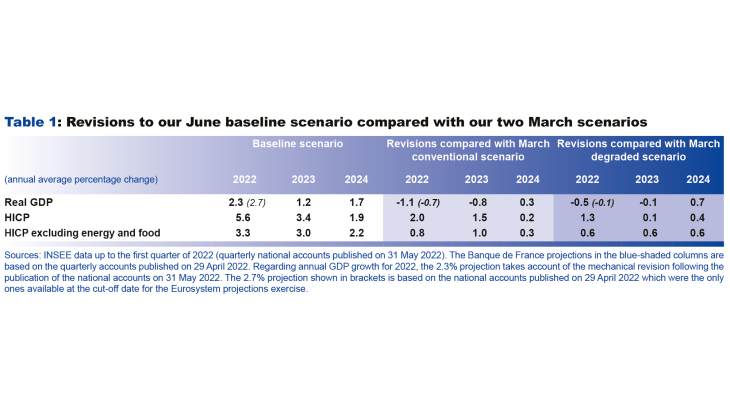

These headwinds, combined with the strong uncertainty weighing on household and investor confidence, are expected to curtail annual growth in 2022. GDP is seen expanding by an average of 2.3% if we mechanically incorporate the detailed results published by INSEE on 31 May. Growth has therefore been revised downwards sharply compared with our March conventional scenario, and is more in line with the degraded scenario published at that time. This resilient pace of growth in annual average terms essentially reflects a positive carry-over effect from the strong recovery seen in the second half of 2021. By contrast, the quarters in the current year should contribute very little to growth in 2022, and GDP at the end of the year is only expected to be around half a percentage point higher than a year earlier.

GDP growth for 2023, at an average of 1.2%, is expected to be more in line with our March degraded scenario (see Table 1). The recovery should be hampered by persistently high inflation which will continue to weigh on household purchasing power, and there should be less support from fiscal measures due to the withdrawal (under the conventional assumptions used here) of those intended to remain temporary – for example the measures linked to the public health crisis – and the assumed lifting of the price shield at the start of 2023. That said, assuming the Ukraine conflict eases from the start of next year, the recovery in global trade and gradual fading of supply bottlenecks should buoy French exports.

In 2024, after the dissipation of the shocks to energy and food prices, which are driving imported inflation, activity is foreseen gaining momentum, with average growth of 1.7% over the year, supported notably by domestic demand. If we mechanically incorporate the detailed results published by INSEE on 31 May, GDP is seen returning to a level similar to that projected in our March degraded scenario in 2024. Based on the national accounts published on 29 April 2022, it should be around half a percentage point higher than in our previous degraded scenario (see Chart 2).

The total cost of the war in Ukraine for the French economy, based on the revisions made since our December 2021 projections, should be a cumulative loss of 2 percentage points of GDP over the period 2022-24.

Box 1 : According to the most recent national accounts published at the end of May after the close of the Eurosystem’s broad macroeconomic projection exercise, the growth carry-over for 2022 is revised downwards

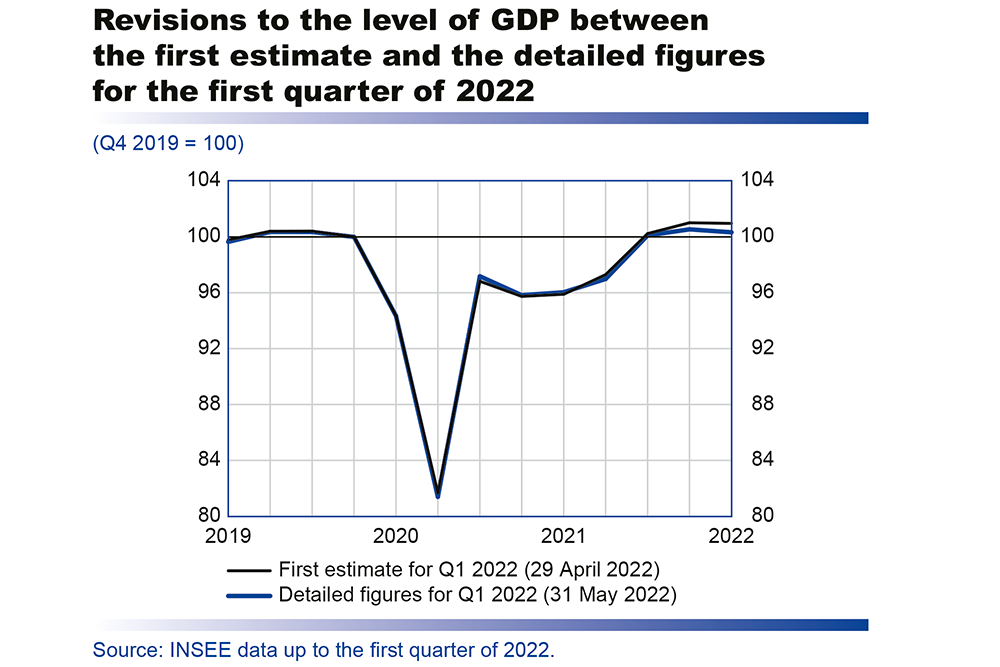

Our macroeconomic projections are based on information available at the time of their finalisation: in this case, the first estimate of the national accounts for the first quarter of 2022 published by INSEE on 29 April 2022. However, on 31 May 2022, INSEE published its second estimate of the quarterly national accounts for the first quarter of 2022 (referred to as “detailed figures”) together with the revised annual accounts for 2019 to 2021. In this second estimate, GDP growth is revised downwards to -0.2% for the first quarter of 2022 from the previous estimate of 0.0%. Annual growth for 2021 is also scaled down to 6.8%, from the previously estimated 7.0%. Annual growth for 2020, on the other hand, is revised upwards by 0.1 percentage point to -7.9%. Overall, the growth carry-over for 2022 at the end of the first quarter is reduced from 2.4% to 1.9%.

Using revised data up to the first quarter of 2022 and applying the quarterly growth rate for our June macroeconomic projections over the rest of the year, we have mechanically adjusted our growth forecast for 2022 from 2.7%, which was estimated when these projections were finalised with the other members of the Eurosystem, to 2.3%.

The French economy thus started 2022 with a little less momentum than had been reported in the national accounts until now. However, given that the trends in the main macroeconomic aggregates (GDP, consumption, employment, household and corporate incomes, etc.) have not, in general, been subject to significant revision, this new information does not call into question our overall assessment for the projections in 2023 and 2024.

Furthermore, on 15 June, INSEE also published its final inflation results for May 2022. Year-on-year, headline HICP (Harmonised Index of Consumer Prices) inflation is expected to rise to 5.8% and HICP inflation excluding energy and food is expected to increase to 3.4%. In both cases, these figures are close to our baseline scenario and do not call into question our forecasts for the remainder of the projection horizon.

Inflation should remain high in 2022 and 2023, before easing back to around 2% in 2024

Inflation as measured by the Harmonised Index of Consumer Prices (HICP) has continued to strengthen over recent months, rising from an annual rate of 5.1% in March to 5.4% in April and then 5.8% in May. Inflation as measured by the Consumer Price Index (CPI) is projected to reach 5.2% in May 2022, after 4.8% in April and 4.5% in March. The difference between the two measures, which is unusually high at the moment and should narrow in the future, essentially stems from the higher weighting of energy in the HICP basket of goods. The consequences of the war in Ukraine along with pre-existing supply chain pressures are fuelling this high inflation via the strong contribution of energy prices (linked to high oil prices). In addition, the price of refined diesel, which had already risen throughout 2021 amid the post-Covid recovery, has appreciated sharply since February 2022. The Ukraine conflict has triggered a sharp drop in Russian diesel exports (France imports around 20% of its diesel from Russia), leading to a rise in refining margins which is ultimately being passed through to pump prices. In addition, as already indicated, we are basing our forecasts on the conventional assumption that the measures taken to limit energy price rises (such as the price shield) will not be extended beyond the end of 2022.

The upward trend in inflation is not solely related to energy prices, however. In May, food inflation rose to 3.8%, reflecting the higher food commodity prices observed over recent months. Manufactured goods prices are also increasing (3.8% growth year-on-year), supported by the rise in production costs observed since the second half of 2021 (sharp recovery in post-Covid demand). Services inflation is also high (3.2% year-on-year).

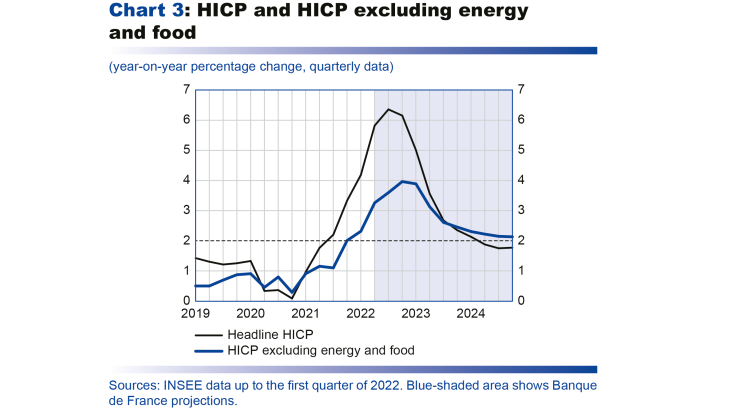

In March, under our degraded scenario, we were expecting headline HICP inflation to reach an annual average rate of 4.4% in 2022. Although oil prices are now expected to be lower than under this scenario for 2022, at USD 105.8 per barrel compared with USD 119 previously, food commodity prices and refining margins have since surged to beyond the levels expected under the March degraded scenario, and pandemic-related restrictions in Asia are exacerbating supply constraints. As a result, we are now forecasting an inflation rate of 5.6% under our new baseline scenario. Headline inflation is expected to prove more persistent and to subside only very gradually in 2023; it should decrease to below 2% in 2024, assuming global oil and agricultural prices gradually normalise (see Chart 3).

That said, inflation in France should remain well below the rate for the broader euro area in 2022 (Eurosystem forecast of 6.8% for the euro area). This difference of 1.2 percentage points is largely attributable to the price shield on gas and electricity prices which we assume will be maintained throughout 2022. Indeed, gas and electricity prices explain around three-quarters of the gap between French and euro area inflation in 2022. In contrast, oil products should make little contribution to the gap, as many euro area countries have taken similar measures to the French rebate on fuel prices to limit the surge in pump prices. The rest of the difference in inflation rates can be attributed to food inflation, which has been weaker in France over the first half. However, the reopening of negotiations between producers and distributors under the EGalim 2 Law since mid-March could lead to further cost rises for distributors from the second half, which should be passed on at least partially to consumers, reducing the gap versus the euro area on this item. In addition, inflation excluding energy and food is expected to reach a similar rate in France as in the rest of the euro area (3.3% in 2022).

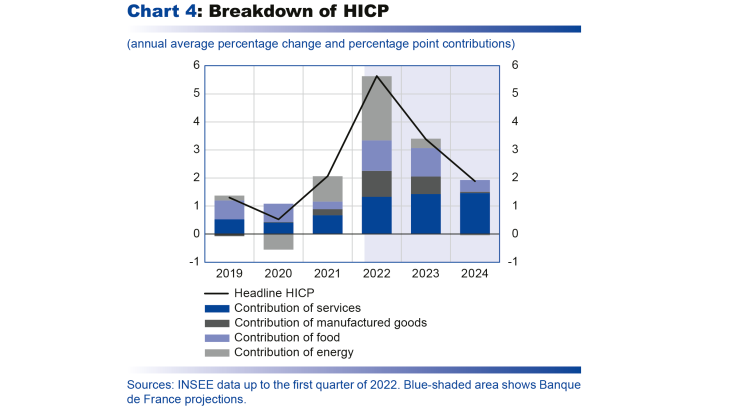

With futures contracts currently factoring in a fall in oil prices, energy inflation is expected to start receding towards the end of 2022, and this should continue gradually over 2023 (see Chart 4). After peaking at the end of 2022, food and manufactured goods inflation are only expected to normalise very gradually, reflecting the persistent effects of supply constraints and the commodity price shock. Services inflation is projected to remain strong, buoyed by wage rises. Headline inflation is seen averaging 3.3% over the year.

In 2024, headline inflation is projected to stand at an annual average rate of 1.9%, which is well above the too-low average annual rate observed over the last decade, and more in line with that seen in the 2000s. The main driver will be inflation excluding energy and food, which is expected to stand at 2.2% in annual average terms. More specifically, manufactured goods inflation is projected to return towards its long-term average, while services inflation is seen remaining robust, reflecting further strong wage growth and higher rent inflation linked to the indexation of rent prices to past inflation via the rent reference index.

The external drain on finances caused by higher imported prices should affect both households and firms

The consequences of the war in Ukraine combined with existing pressures in global supply chains and commodity markets, are driving sharp rises in consumer prices as well as in firms’ production costs.

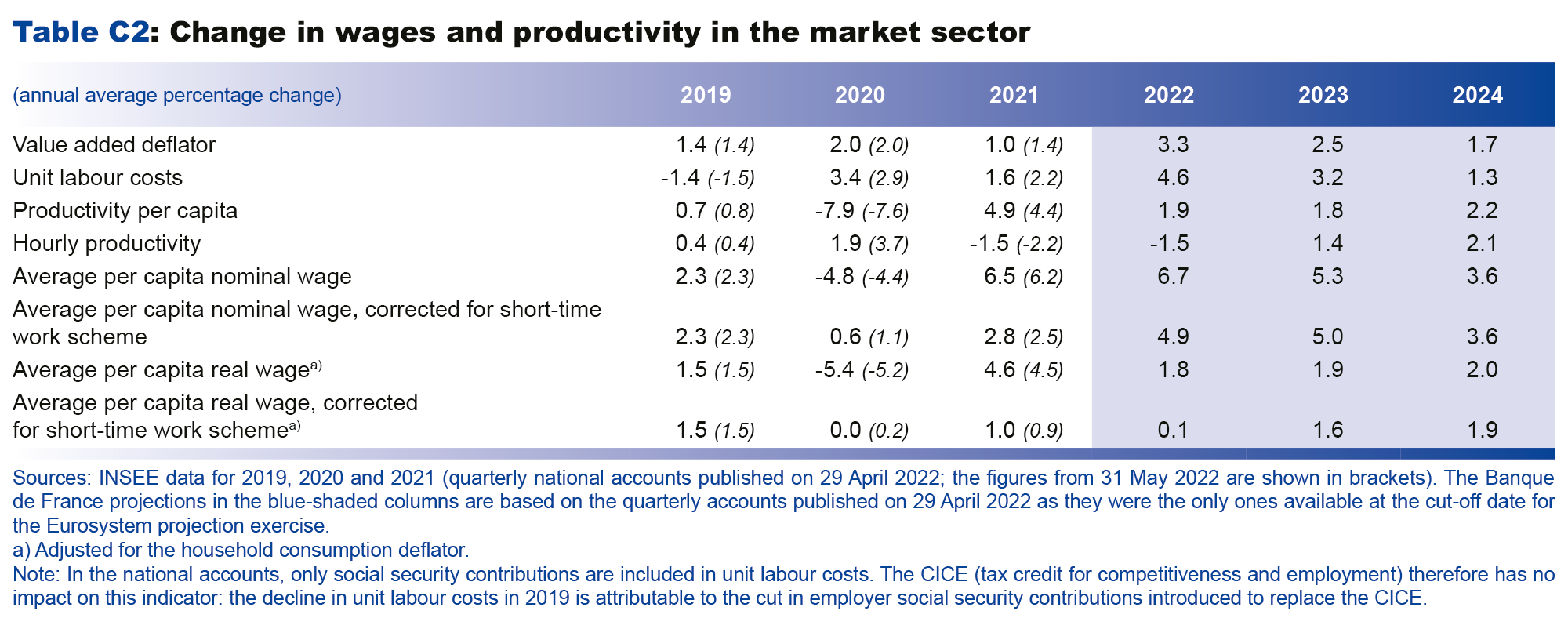

These price rises are naturally expected to affect nominal wages. The Salaire minimum interprofessionnel de croissance (SMIC – the French minimum wage), which is automatically inflation indexed, was revised upwards three times between October 2021 and May 2022, resulting in a rise of nearly 6% over the past 12 months, exceeding the rate of inflation at end-May (CPI of 5.2%). Under the terms of the indexation rule, we expect two further hikes in October 2022 and October 2023 on top of the usual annual rise which takes place in January. These increases should then feed partially through to the rest of the wage scale, notably via industry-level wage bargaining agreements: for 2022, the wage talks held at the start of the year have resulted in average pay rises of around 3%, compared with rises more in the region of 1% in recent years. After the upward revision of the SMIC in May this year, a number of industries have found that their industry-level wage floor is now below the minimum wage, meaning they will be forced to restart pay talks. In addition, many industry-level agreements contain inflation clauses stipulating that discussions have to be reopened if inflation proves to be higher than anticipated.

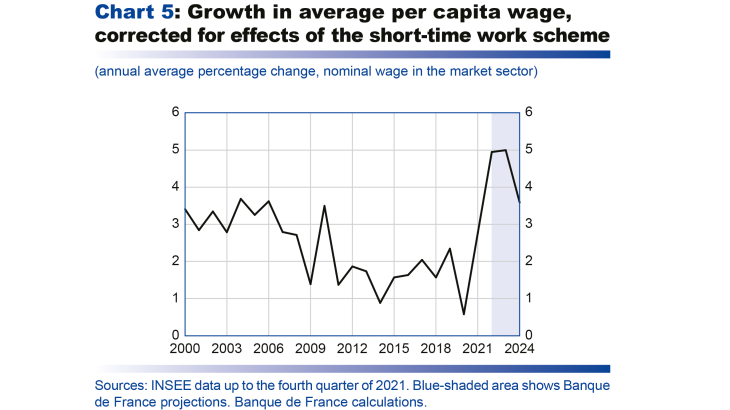

As a result, nominal wages, which should also be supported by hiring difficulties and the strength of the labour market at the start of 2022, are expected to be especially dynamic in 2022 and 2023, with the average per capita wage in the market sector growing at an annual rate of 5% (excluding the mechanical effects linked to short-time work schemes). In 2024, however, the annual growth rate should come back down to around 3%, which is similar to that seen in the 2000s (see Chart 5). Historical trends generally show that wage increases have only partially offset the rise in consumer prices since the end of wage indexation in the 1980s (conversely, these historical trends also explain a portion of the temporary purchasing power gains when inflation is too low). Real wages (corrected for short-time work schemes) should therefore remain stable in 2022, but should then start rising again in 2023 and 2024 at a similar rate to productivity.

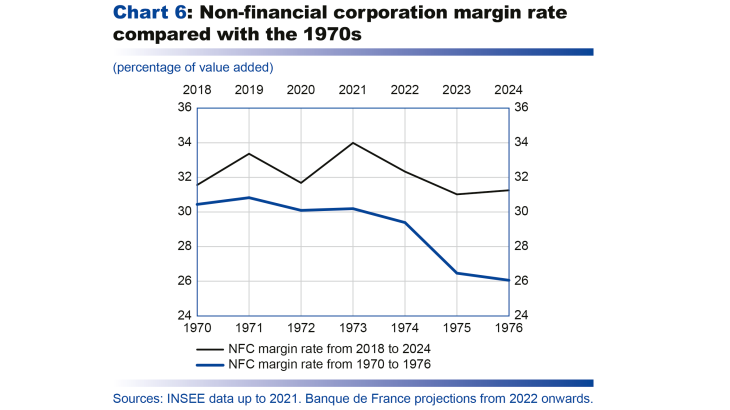

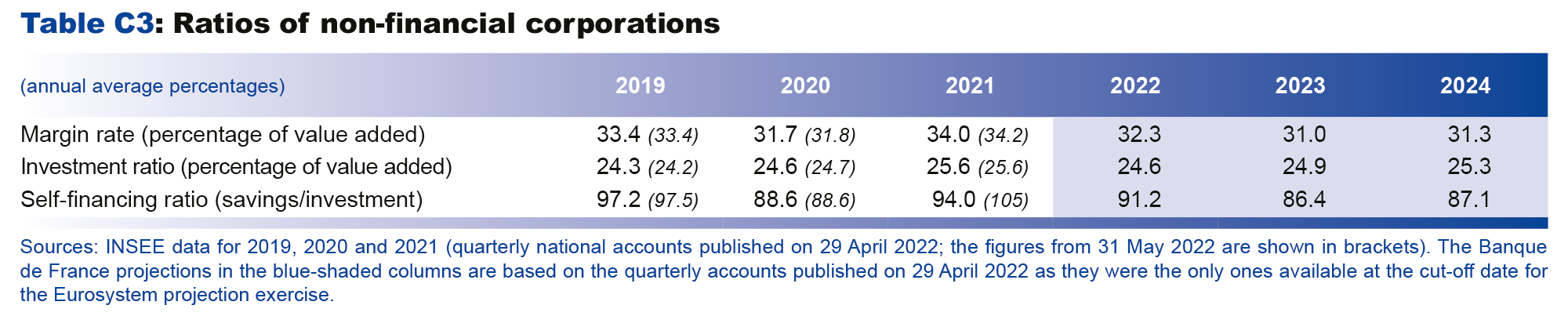

This trend in nominal wages, against a backdrop of sharp price rises for commodities and intermediate goods, should push up costs slightly for businesses. The non-financial corporation (NFC) margin rate, which was artificially inflated in 2019 by the double-counting of the Crédit d’impôt pour la compétitivité et l’emploi (CICE – Tax Credit for Competitiveness and Employment) and then supported in 2020 and 2021 by the measures to tackle the Covid crisis, should shrink by around 2½ percentage points between 2021 and 2024, although this is much smaller than the drop of around 4 percentage points during the 1970s oil shocks (see Chart 6). In 2024, the NFC margin rate is projected to come back to near its pre-crisis level (around 32% in 2018), helped by the cuts to production taxes in 2021. However, this average figure masks significant disparities across sectors: margin rates in manufacturing sectors (excluding the manufacture of coke and refined petroleum products) are projected to be badly hit by higher commodity prices, whereas market services should be less severely affected and energy-related sectors should see their margin rates rise.

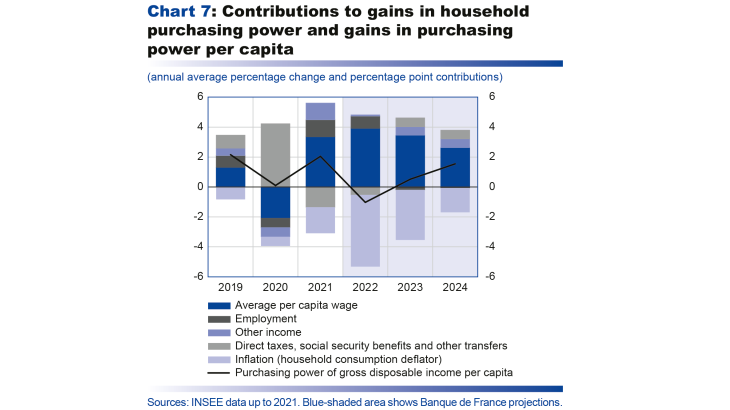

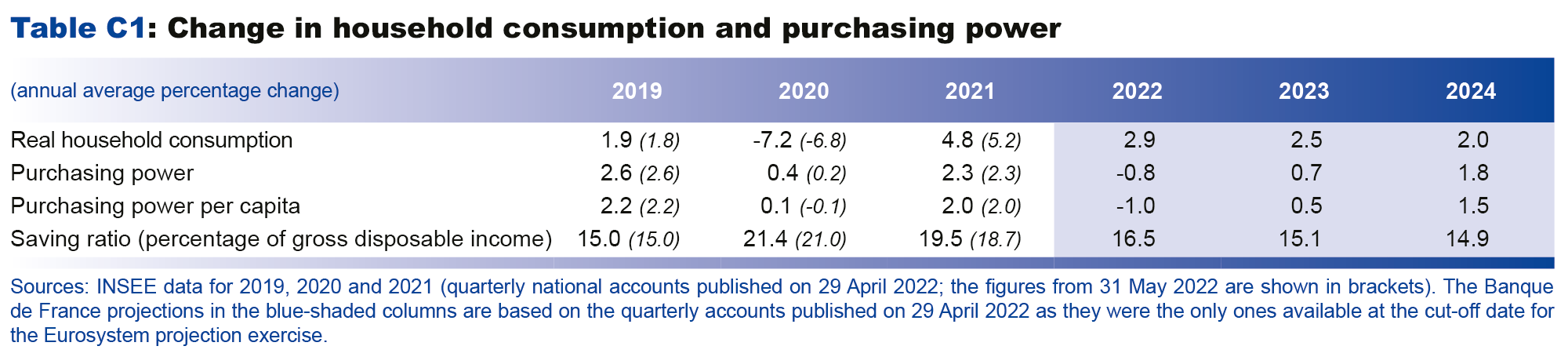

After rising sharply in 2021, household purchasing power should fall temporarily in 2022, weighing on consumption

Despite the strong growth in nominal wages, household purchasing power is expected to decline in 2022 after the rise seen in 2021 (see Chart 7). The impact of higher consumer prices on real wages should nonetheless be cushioned by the measures already introduced to support purchasing power (price shield, rebate on pump prices, increase in tax relief for car travel) or proposed under the amended budget law (increase in the index points in the public sector wage grid, increase in welfare benefits, abolishment of the television licence fee). After being preserved at the height of the Covid crisis and rising sharply by 2.0% in 2021, purchasing power per capita is now anticipated to fall by an average of 1.0% in 2022. It should then recover gradually in 2023, with growth of 0.5%, and subsequently rise more sharply in 2024 (growth of 1.5%) as the price shock fades.

This loss of purchasing power, albeit moderate in average terms, is projected to slow household consumption. There should be a slight rebound in consumption in the second quarter of 2022, especially in transport services and accommodation and food services which were hard-hit in the first quarter by the resurgence of the pandemic with the Omicron variant. However, over the rest of the year consumption is expected to be adversely affected by precautionary savings behaviour linked to concerns over the global geopolitical situation. Supply shortages could also dampen household consumption over the coming quarters, especially in the automobile sector. As a result, in 2022, household consumption is projected to rise by just 2.9%, which is essentially due to a positive carry-over effect and well below the growth rates seen in our March projections under both the conventional and degraded scenarios. In 2023 and 2024, consumption should rise at a rate of over 2% per year.

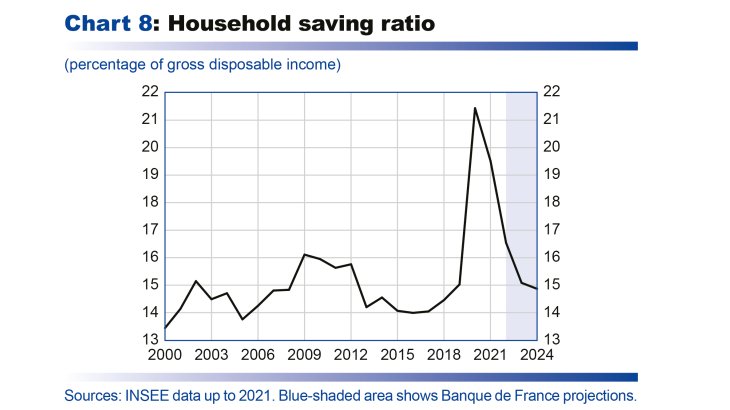

Against this backdrop of uncertainty, households should continue to save more than they did before 2020, especially in 2022 when the saving ratio is expected to be particularly high at 16.5% of gross disposable income (see Chart 8). It should then ease back again to 15%, which is similar to that seen in 2019. At the aggregate level, therefore, the excess financial savings accumulated in 2020-21 should only be spent to a limited extent up to 2024. This aggregate picture masks significant differences between individual households, however: better-off households that have accumulated significant excess financial savings are not necessarily the worst affected by rising energy and food prices and are also using their savings to increase their investments. Conversely, poorer households, who spend a higher proportion of their income on food and energy, are being forced to draw on any excess savings they

might have.

The deterioration in the macroeconomic situation should weigh slightly on private investment

The excess financial savings accumulated during the Covid crisis fuelled a sharp rebound in household investment in 2021. It now appears to be stagnating, however, due to a rise in construction costs linked to shortages of building materials and structural hiring difficulties in the construction sector. The household investment ratio is anticipated to decline by 2024 but should remain above its long-term trend.

Business investment recovered rapidly after the public health crisis and remained dynamic over the first quarter of 2022, buoyed by continued spending on digital technology. It should stabilise over the rest of the year, owing to the decline in profit margins and the adoption of a wait-and-see approach amid the uncertainty. The NFC investment ratio is thus projected to decline to 24.6% of value added in 2022 after reaching a historical high of 25.6% in 2021. It should then grow at a similar rate to that observed since 2015 (see Table C3 in the appendix).

French exports are expected to be hampered by developments in the global economy

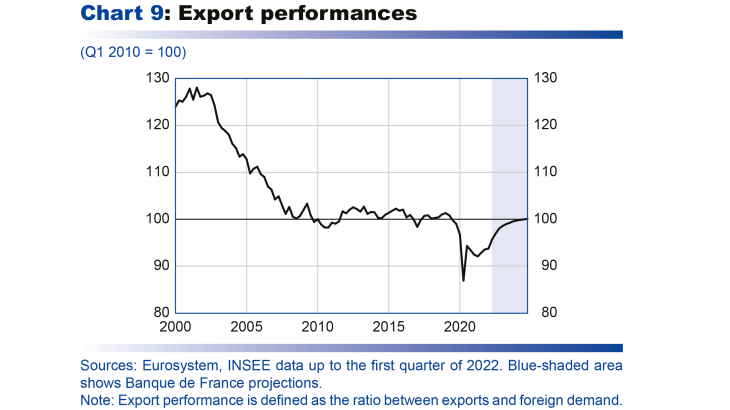

Tensions in global energy and commodity markets, together with the deterioration in the public health situation in China, are all expected to weigh on global trade and hence on foreign demand for French goods and services. The Eurosystem’s projections for global demand have been revised downwards for the full projection horizon compared with the conventional scenario in March. In 2023, foreign demand for French goods and services should only rise by 2.6%. Exports should nonetheless be helped by the gradual recovery in France’s export performances to near pre-crisis levels by 2024 (see Chart 9); they were still weak at the start of 2022, but there should be a gradual normalisation in those stronghold export sectors that were hard-hit by the Covid crisis – notably tourism and aeronautics. Overall, France’s exports are projected to be hampered by lower foreign demand, but should still prove dynamic over the projection horizon, growing by nearly 8% in annual average terms in 2022 and then easing to slightly over 4% growth in 2024.

The slowdown in domestic demand is expected to lead to a deceleration in imports in 2022. However, they should subsequently accelerate again as global supply chains improve. Overall, net trade should contribute little to GDP growth over the full projection horizon.

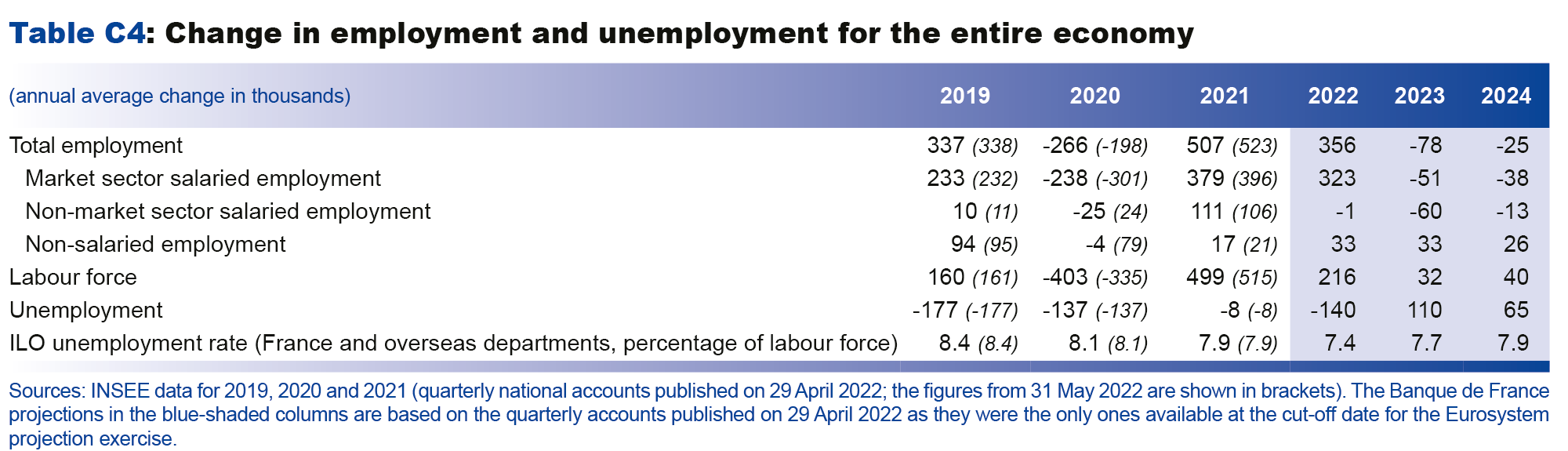

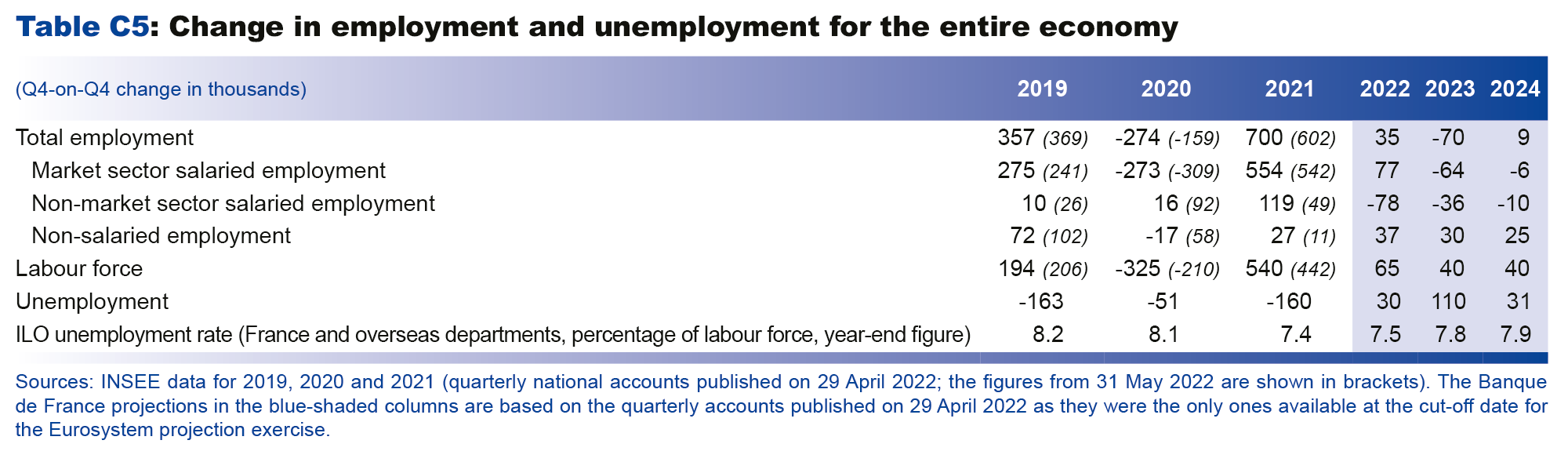

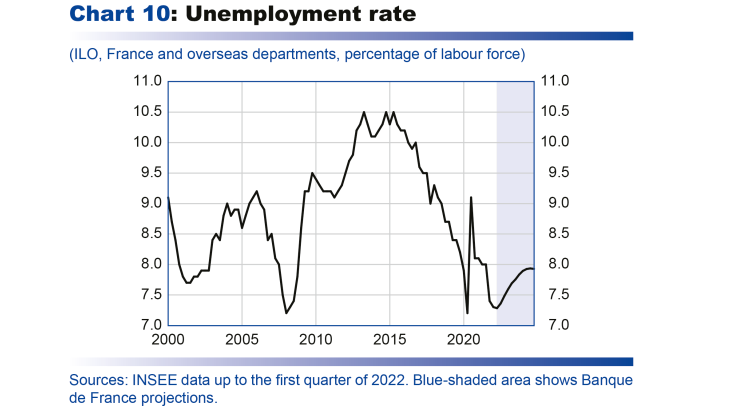

The slowdown in activity is expected to push the unemployment rate up slightly to just below 8% in 2023-24, but this is still below the rate seen in 2019 before the crises

Although the unemployment rate is currently close to a historical low at 7.3% (see Chart 10), the first signs emerged of a slowdown in employment at the start of 2022, after the strong rise in 2021. This slowdown is projected to continue over the rest of the year and the market sector should only have added 77,000 net new jobs over the four quarters to end-2022 compared with the same period a year earlier. The public sector should also make a negative contribution to the change in non-market employment, owing to the non-renewal of the temporary healthcare and education jobs that were created during the public health crisis.

In the medium term, the marked slowdown in activity should translate into a lagged stagnation in market sector employment and gradually push the unemployment rate up to just below 8% in 2024 – although this is still below the levels seen in 2019, before the crises. Employment is thus expected to remain almost stable over the projection horizon, with the total number of jobs rising by around 400,000 compared with end-2019, thanks to the strong gains of the past two years.

The resilience of the labour market in the face of the historically large shocks to activity in 2020 has pushed productivity growth down to well below its pre-crisis trend (growth of around 0.7% per year for the period 2010-19). In our projection, the slowdown in employment is accompanied by a gradual rise in productivity per capita to near its pre-crisis trend by the end of the projection horizon.

The economic context as well as the recovery measures and support for purchasing power are expected to weigh on the government deficit and government debt

Our projection for government finances is based on the macroeconomic scenario described above and takes into account the most recent government announcements up to the end of May, where they can be sufficiently quantified. It does not incorporate the precise details of the economic and fiscal measures that should be adopted in the coming weeks.

In 2022, despite the strong economic rebound and receipt of funds from the European Recovery and Resilience Facility (RRF), the government budget balance is expected to remain firmly negative (-5.0% of GDP after -6.5% of GDP in 2021) owing to further massive measures to tackle the public health crisis, support for household purchasing power and the continuing roll-out of the economic recovery plan, combined with a slight fall in the tax-to-GDP ratio. This decline in the tax-to-GDP ratio will result from the measures already introduced some time ago (gradual abolition of housing tax, lowering of the corporation tax rate) and the new tax cuts (notably the temporary EUR 8 billion cut in the TICFE (domestic tax on electricity) for 2022). It will come despite stronger growth in the nominal tax base than in GDP.

Government expenditure growth should remain robust in 2022 owing to continued high spending on health care to tackle the pandemic and the continuing roll-out of the France Relance recovery plan. Added to this will be the measures to support household purchasing power to help offset soaring energy prices (expenditure of around EUR 15 billion in 2022, taking the total support since 2021 to EUR 20 billion), including the “energy cheque” and the price shield. These measures, some of which came into force at the end of 2021, have been reinforced with the adoption of the resilience plan in March 2022.

At constant legislation, the government budget balance is projected to improve in 2023-24 – although without reaching the threshold of -3% of GDP – thanks to the end of most of the temporary measures and to still strong economic growth.

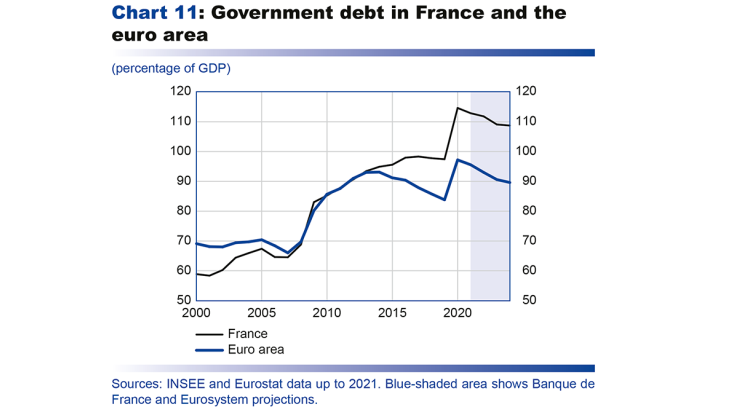

The government debt-to-GDP ratio is projected to decline progressively in 2022 and 2023, helped by the use of the EUR 75 billion of cash reserves accumulated in 2020 and not reabsorbed in 2021. Based on the measures that we are able to quantify at this stage, government debt should stabilise at just under 110% of GDP in 2023-24 (see Chart 11).

The war in Ukraine is creating considerable uncertainty and could lead to further pressures on energy prices and supplies

The geopolitical situation surrounding the war in Ukraine remains highly uncertain, and we are therefore complementing our baseline scenario with a downside scenario (see Box 2). This latter scenario assumes a complete and immediate stoppage of European imports of Russian gas and additional upward pressures on gas and oil prices.

Conversely, the baseline and downside scenarios do not take into account the economic policy responses that could be implemented at the national and European levels to cushion the macroeconomic impact of the shocks. In particular, they do not incorporate the measures that could be adopted at the European level to help finance investments in the energy transition or in industrial sovereignty. More specifically, in France’s case, there is still some uncertainty over a number of fiscal measures to support purchasing power, and these should be set out in more detail in the next amended budget law.

A number of other risks not directly related to the war in Ukraine could also affect our forecasts, both positively and negatively. The “zero Covid” policy in China could have a greater impact on global value chains and disrupt global trade, while a deterioration in China’s macroeconomic situation could alleviate some of the inflationary pressures on commodity prices.

There are also significant risks surrounding the outlook for prices. Downward shocks to activity linked to additional supply disruptions could also be accompanied by upward shocks to inflation, especially in the near term. In the second part of our projection horizon, a deterioration in activity and employment could have disinflationary effects. Conversely, stronger second-round effects via the wage-price spiral could increase inflation, and it will be important to pay close attention to the anchoring of long-term inflation expectations.

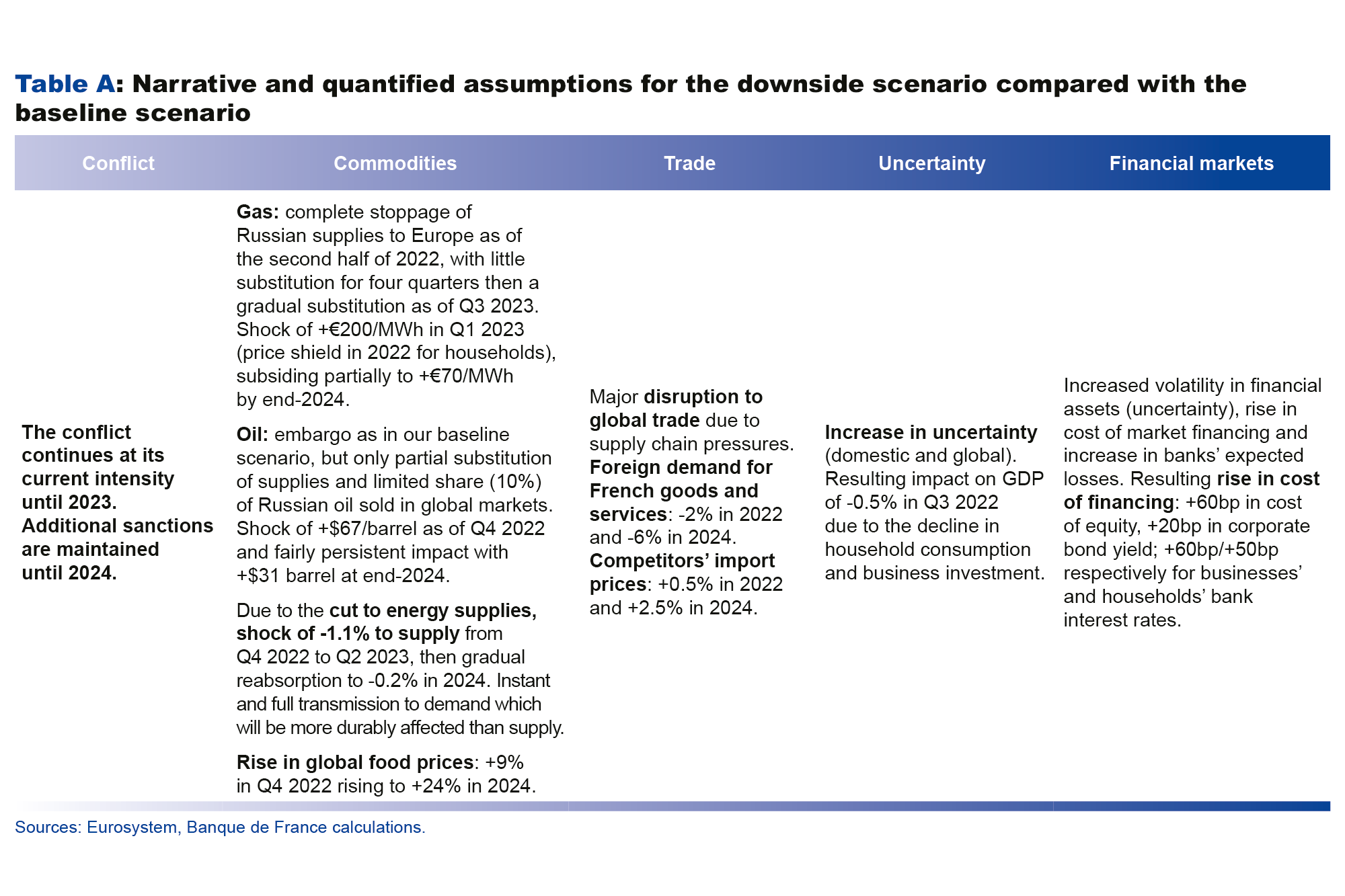

Box 2 : In a downside scenario notably characterised by additional pressures on energy prices, France would slip into recession and inflation would hit 7% in 2023 before improving in 2024

The risk of a prolongation of the war waged by Russia in Ukraine and the greater and more durable uncertainty and new economic sanctions that it would imply, has prompted us, in conjunction with all other Eurosystem national central banks, to set out the consequences of a particularly unfavourable scenario (although this is less likely than our baseline scenario).

This downside scenario is based on a series of shocks. While our baseline scenario includes a full embargo on Russian coal and an embargo on Russian oil, with possible substitute sources available (via the assumptions for oil prices derived from futures contracts at the cut-off date) and already high gas prices, this downside scenario assumes that all European imports of Russian oil and gas would be brought to a complete halt as from the third quarter of 2022, and additional, exceptionally strong pressures on oil and gas prices (see below). Furthermore, the prolongation of the conflict and its effects on uncertainty would also weigh on domestic demand as well as on international trade, financial conditions and food prices. Lastly, we also assume that policies will not change and do not take into account any additional measures that could be introduced by governments (aside from automatic stabilisers).

The narrative of this downside scenario and its associated assumptions are detailed and quantified in Table A.

In contrast to our baseline scenario, which we currently consider to be more likely, this scenario is deliberately based on severely adverse assumptions in order to illustrate the downside risks that could undermine our baseline scenario. We assume there will be a more limited substitution of energy sources. In addition, although in our baseline scenario we use oil and gas prices taken from the futures markets, which reflect the assumption the markets make about the future path of prices, our downside scenario incorporates price peaks that are well above the upper quartiles of the future distributions of these prices (distribution taken from data for oil price options or taken from past forecasting errors for gas

price futures).

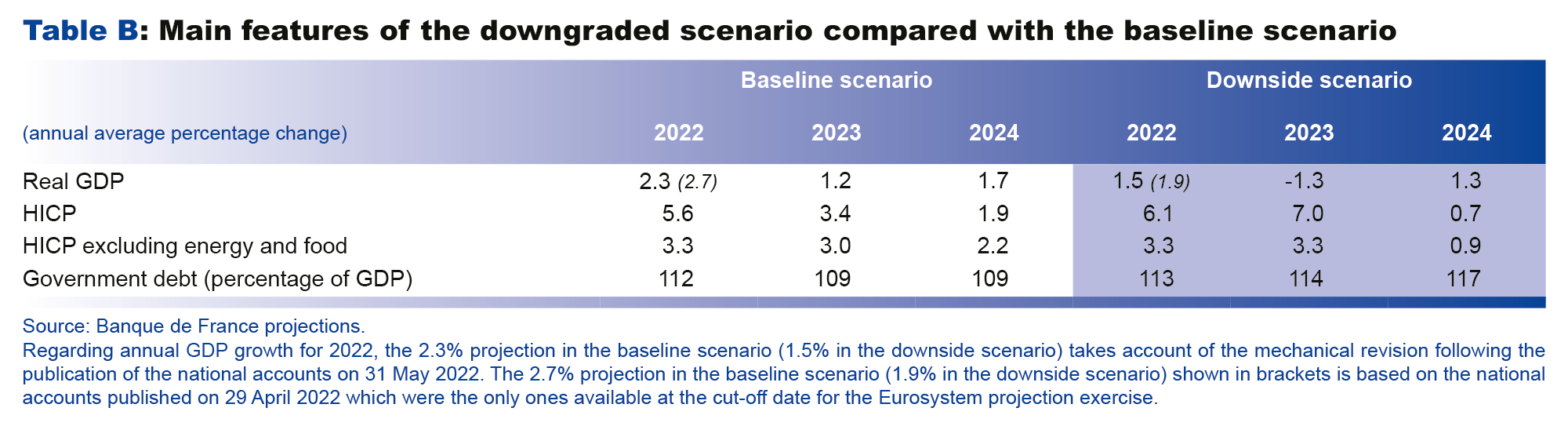

In this downside scenario, the shock to growth as well as to inflation would be concentrated in 2023. The French economy would suffer a recession of -1.3% in 2023 (see Table B). It would subsequently return to positive growth of 1.3% in 2024. Inflation would hit 6.1% in 2022 and would increase further to 7.0% in 2023, compared with 5.6% in 2022 and 3.4% in 2023 in our baseline scenario. However, it would then drop sharply to 0.7% in 2024, driven by the more marked decline in energy prices and the disinflationary effects of the recession of 2023, compared with a rate of inflation close to 2% in the baseline scenario.

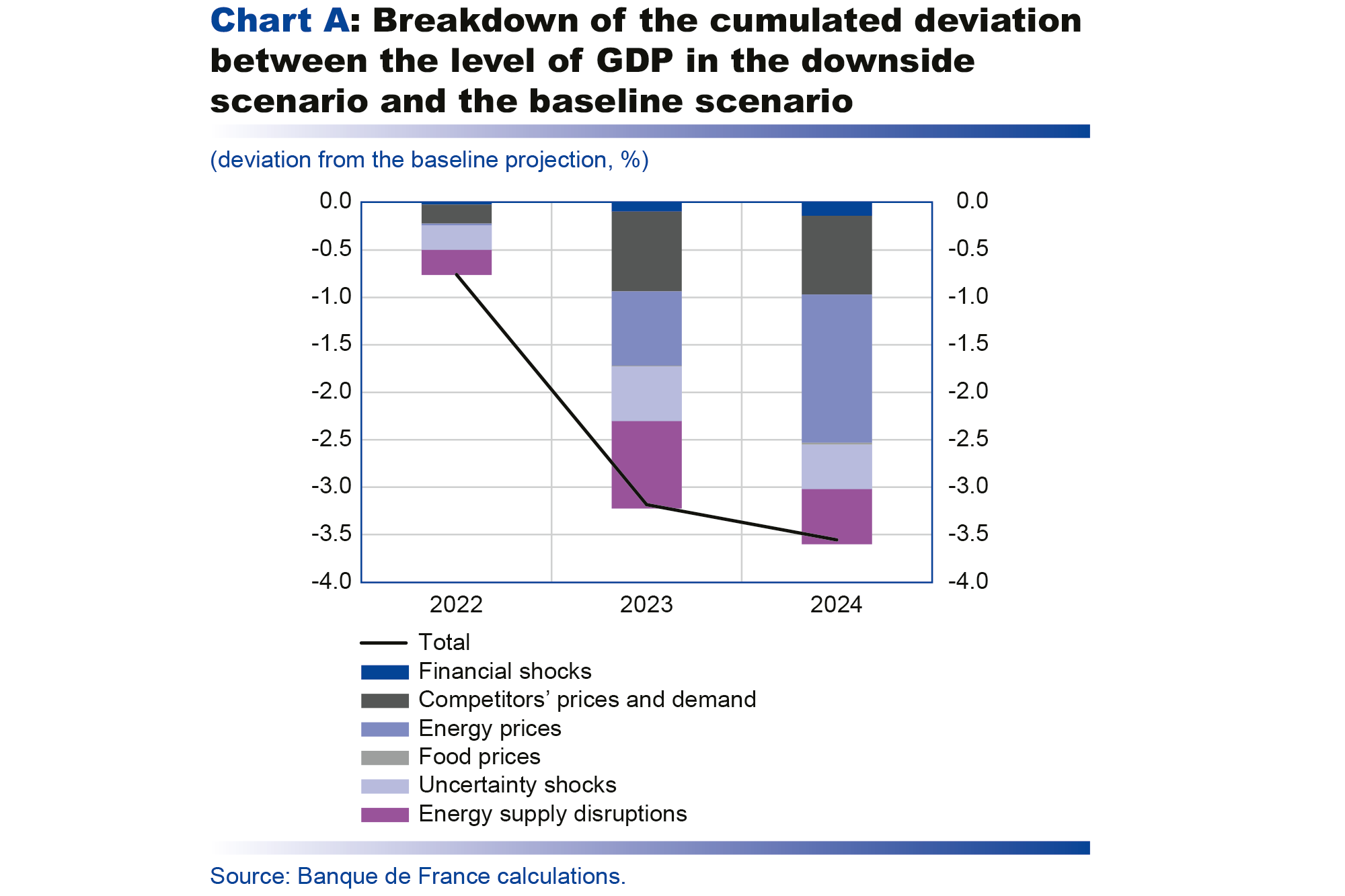

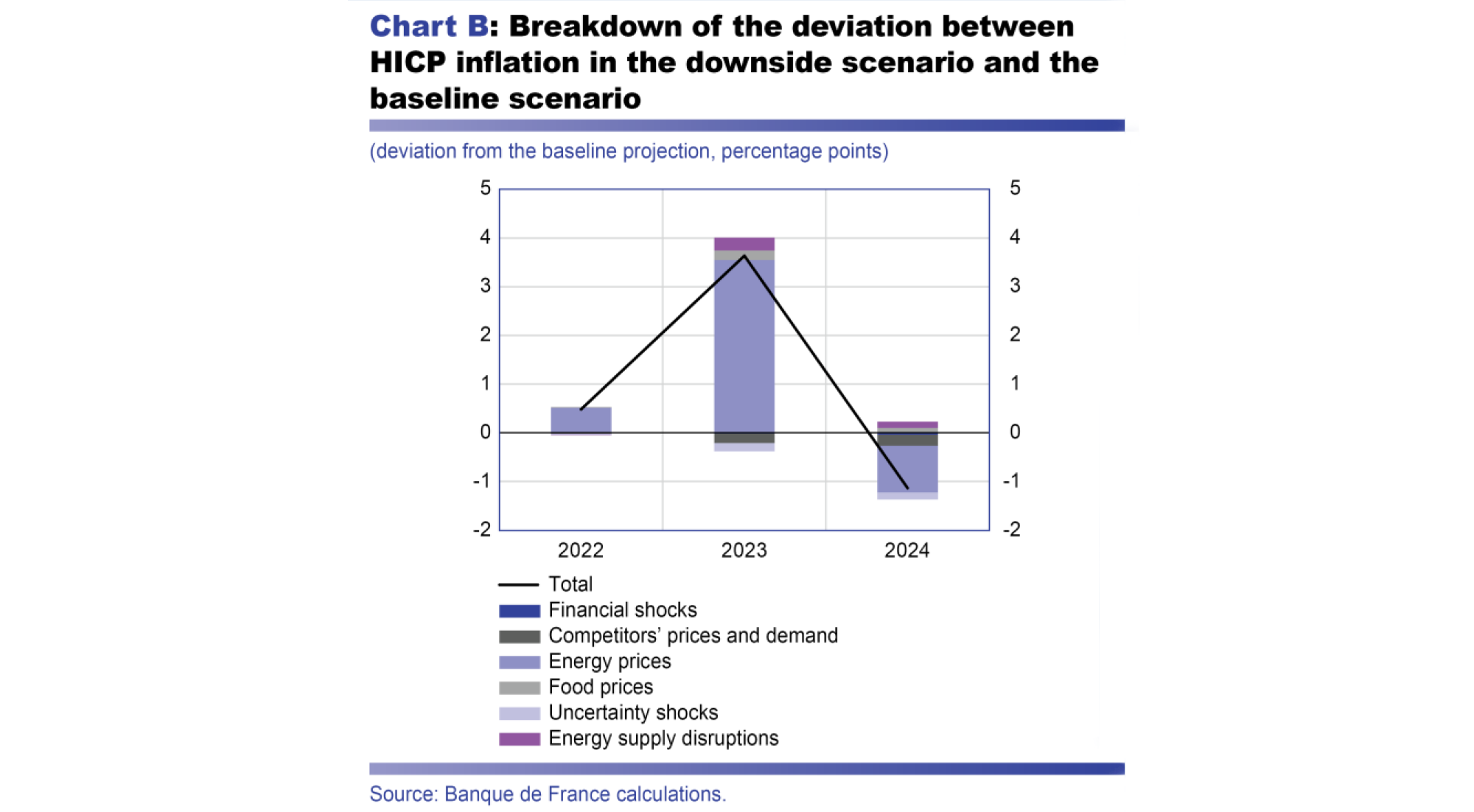

Nearly 60% of the negative impact on GDP in 2023 would be due to the effects of energy shocks (disruptions to supply and prices), including through their repercussions on household purchasing power, which would drag on household consumption and investment (see Chart A). The decline in foreign demand addressed to French exporters would also play a non-negligible role in 2023 and 2024. Almost all of the inflation shock would be due to the hike in hydrocarbon prices (see Chart B).

In terms of public finances, the government deficit would widen compared with the baseline scenario by around 2 percentage points to reach 5% of GDP in 2024. Government debt should rise by almost 8 percentage points of GDP compared with the baseline scenario to 117% of GDP.

Updated on 25 March 2024