- Home

- Publications and statistics

- Publications

- Health crisis: (very) heterogeneous cash...

Post n°225. Without support measures, the cash flow shocks (on a constant funding basis) experienced by French companies in 2020 would have been generally negative but above all very heterogeneous, including within a single sector of activity. The support measures brought the share of negative (and positive) shocks back to the level of a normal year and reduced their dispersion, although major shocks at both distribution tails were less rare than usual.

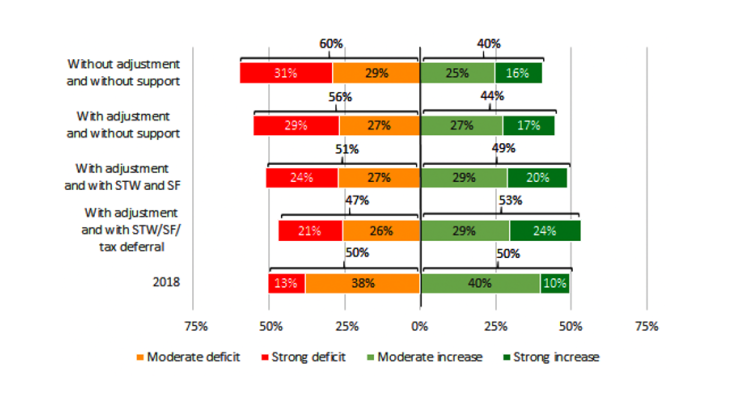

Source: Bureau et al. (2021a).

Notes: % of companies, weighted by employment, with a strong (> 30 days of sales) or moderate (< 30 days of sales) deficit (or increase) in cash flow in 2020. Shocks calculated at a constant funding basis relative to the previous year. “Without adjustment”: the possibility of reductions in investments or dividends is temporarily excluded. “ST”: short-time work; “SF”: solidarity fund.

The French economy experienced an unprecedented shock in 2020. The 7.9% contraction in GDP was the largest ever recorded in France’s national accounts (Insee, 2021). This shock led in particular to an extremely sharp increase in the gross debt of non-financial corporations (NFCs), which rose by 12.2% (EUR 217 billion), although the increase in liquidity holdings was equally strong (28.6% or EUR 200 billion). As a result, the increase in net debt was relatively modest: 0.8% or EUR 17 billion, compared with an increase of EUR 51.5 billion in 2019 (Banque de France, 2021). In other words, at the aggregate level, at end-2020, the impact of the crisis on NFC net debt was relatively limited. This observation only applies to financial debt, i.e. not taking into account deferral of corporate taxes and social security contributions.

A micro-simulation model to assess the impact of the health crisis

The trends identified using macroeconomic approaches can nevertheless mask very different individual situations, which may be worse or better than this snapshot might suggest. That is why INSEE and the Banque de France developed a micro-simulation model to assess, on a company-by-company basis, the impact of the health crisis on the financial situation of more than 645,000 companies in France in 2020 (Bureau et al., 2021a). The aim of this research was to go beyond the aggregate macroeconomic analysis and examine the dispersion of this impact among companies, focusing particularly on the impact of government support measures. To this end, we used a particularly broad range of individual company data (monthly 2020 VAT returns, use of short-time work in 2020, deferred social security contributions in 2020, company financial statements in 2018, pre-crisis Banque de France rating).

The main indicator used in this analysis is “cash flow shock” (before or after support measures). It corresponds to cash flow from operations after taking into account investments, dividends and interest payments but before any increase in debt. At constant equity and excluding asset disposals, the pre-financing cash flow therefore corresponds to a change in net financial debt. It should not be confused with the actual change in liquidity holdings: a negative cash flow shock will not result in a decrease in liquidity holdings if it is accompanied by an at least equivalent increase in gross financial debt. Indeed, an initial analysis of just over 200,000 balance sheets already received by the Banque de France shows that only a quarter of companies recorded a decrease in liquidity holdings in 2020 (Doucenet et al., 2021; Lemaire et al., 2021)

Cash flow shocks experienced by non-financial companies were very heterogeneous

The almost stable net debt at the aggregate level masks strong disparities at the individual level. In our simulations, companies experiencing a negative cash flow shock saw their total net debt increase by around EUR 200 billion, whereas those recording a positive shock saw their total net debt decrease by about the same amount.

The heterogeneity of cash flow shocks was particularly marked between sectors (before and after public support measures) as well as within each sector. For example, even within accommodation and catering, the hardest-hit sector during the crisis, nearly 20% of NFCs saw an increase in liquidity holdings in 2020 after support measures (see Chart 2). The non-negligible share of companies recording a positive cash flow shock in each sector can be attributed primarily to the ability of some companies to adapt, for example by using distance selling or developing their online presence. In a given sector, therefore, the profile (more or less subdued) of companies’ activity in 2020 was highly correlated to their organisational adaptation (Bureau et al., 2021b). These findings may be useful in public policy approaches, as the sector cannot be the sole criterion for defining policies to exit the crisis.

Moreover, the occurrence and intensity of negative cash flow shocks at end-2020 were correlated to the company’s pre-crisis credit risk (measured by the Banque de France rating). Lower-rated companies not only experienced a greater number of negative cash flow shocks but also “larger” ones (more than one month of turnover).

A company’s size, however, appeared to be a secondary determinant of negative cash flow shocks. Nevertheless, in terms of amounts, intermediate-sized enterprises (ISEs) and large companies – which represented 1.5% of the companies in our sample but nearly 60% of salaried employees – recorded (after support measures) the bulk of the overall increase in NFC net debt at end-2020.

Support measures reduce negative cash flow shocks… but without a return to normal

In 2018, the distribution of companies experiencing negative or positive liquidity shocks was evenly balanced (50% vs. 50%), which reflects the “normal” life of companies. Net financial debt increases or decreases as a function of the company’s business activity or asset purchases and disposals without necessarily determining its financial situation. The crisis altered this distribution (Chart 1). Some 60% of the shocks were negative and 40% positive before support measures and adjustments to investment spending and dividends. This adjustment in the behaviour of companies was nevertheless insufficient on its own to absorb the shock. Once the necessary support measures were implemented, the relative share of companies recording a positive cash flow shock no longer differed significantly from a normal year (53% in 2020 vs. 50% in 2018). However, the dispersion of these shocks was greater. While, in 2018, 13% of companies experienced a “strong” increase in net debt (more than one month of turnover), this figure reached 21% in 2020. Conversely, whereas only 10% of companies saw a “strong” reduction in their net debt in 2018, this figure reached almost 25% at end-2020.

Skewing of the distribution tails were even more pronounced for companies that were the most fragile at the start of the crisis (Banque de France rating of 4 to P). The share of these companies experiencing an increase in net debt thus reached 28% at end-2020, compared with 15% in 2018, suggesting that the situation of vulnerable companies became even more precarious. Meanwhile, the highest-rated companies (Banque de France ratings of 3++ to 4+), which represented only 10% of the companies in the study sample, accounted for nearly 50% of all negative cash flow shocks at end-2020. This was due to the fact that the highest-rated companies are generally larger than the others.

Lastly, while it appears that companies that were particularly fragile before the crisis benefited from public support measures in 2020, we cannot say based on our findings that they benefited more from these support measures than did the other companies.

Source: Bureau et al. (2021a).

Updated on 8 April 2024