Post n°324. When shocks to production costs are small, price changes are relatively rare. A shock then takes several months to be transmitted to prices and inflation. When a major shock occurs, however, prices adjust more quickly than in normal times - which helps to explain why the recent episode of high inflation may have come as a surprise.

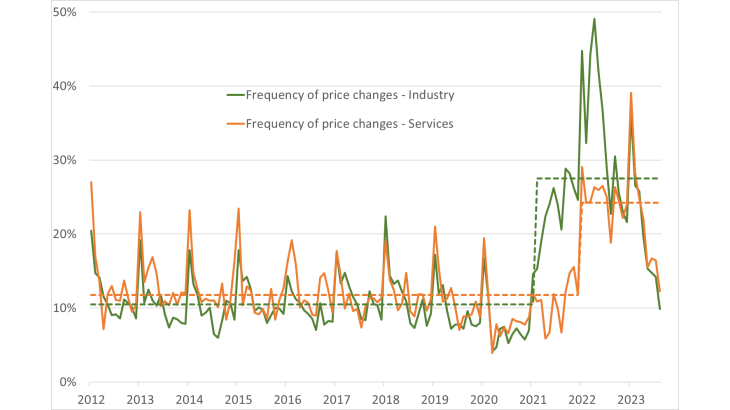

Sources: Monthly business survey (Banque de France), share of business leaders reporting a price change during the month (weighted). Last point: August 2023.

Over the period 2021-22, the French economy saw sharp rises in the cost of imported raw materials. These increases had a direct impact on the production costs of companies, which accordingly raised their prices. While this repercussion was to be expected, it was the speed at which these cost increases were transmitted to inflation that was surprising. In general, several months or even a year can elapse between two price changes, making the transmission of a shock to inflation fairly slow. Yet, as of 2022, companies have significantly increased the frequency of their price changes (Chart 1). This post looks at this change in the behaviour of businesses, which has contributed to speed up the transmission of recent shocks to inflation.

The frequency of price changes has increased with the recent inflationary shock

Inflation results from millions of decisions by companies and retailers to change their prices. However, the prices of many products do not change all the time. For instance, in periods of moderate inflation, price changes are usually infrequent: in the euro area as a whole, less than 10% of consumer prices change in any given month (Gautier et al., 2022). Typically, a price remains unchanged for a year - even if there are differences between products: prices change more often for food products than for services, for example.

The monthly share of price changes remained very stable over the period 2000-20. In France, according to the Banque de France's monthly business survey of companies producing goods or services, the share of business leaders reporting a change in their prices in a given month has remained close to 10%, with almost no change over the period 2012-20 (Chart 1). The only significant changes are within the year rather than year-on-year: the proportion of changes in producer prices is much higher in January than in the other months of the year.

Source: INSEE - Harmonised consumer price index (year-on-year % change); Imported commodity price indices in EUR (100 = January 2018); Brent crude oil price in EUR (100 = January 2018), authors' calculations.

However, since mid-2021, the frequency of price changes has risen sharply reflecting shocks to companies’ raw materials and production costs (Chart 2). The frequency of price changes in industry reached levels close to 50% per month over the course of 2022. In services, a similar phenomenon occurred, albeit with a time lag as the raw materials shock became a more general inflationary shock (Chart 1).

Prices are more flexible in response to a major shock

How can we explain the contrast between these two periods? One of the key assumptions of contemporary macroeconomics is that companies and retailers will not instantly pass on a cost shock to their prices. Prices are rigid. There are several explanations for this price rigidity. The price adjustment process can be long and costly, involving research into cost increases and price setting by competitors, communication with customers, defining a price strategy, possible errors, and the physical costs of displaying new prices. These disincentives to immediate price adjustment are generally referred to as "menu costs". This term originally referred to the cost to a restaurant of reprinting menus when changing prices. Given these costs, it is rational for a company not to change its prices immediately after a shock. Furthermore, contracts between companies can also limit price adjustments during their term (see Gautier 2009 for a summary).

This price rigidity hypothesis is confirmed by the observation that prices change infrequently and that shocks take time to be transmitted to prices. Moreover, in periods of moderate inflation and small shocks, the degree of price rigidity does not vary. The models used by macroeconomists therefore generally assume that the frequency of price changes is a fixed and exogenous parameter (insensitive to shocks). This can be corroborated by the observation that some companies systematically revise their prices once a year, often in January (Chart 1). This is known as a “time-dependent” price adjustment model. One of the implications of this model is that a shock will take several months to be transmitted, irrespective of its magnitude.

How can we explain the fact that the frequency of price changes becomes more sensitive to economic shocks when they are of greater magnitude? Following an increase in their production costs, companies have to choose between not changing their prices and thus incurring a temporary reduction in profits (due to the fact that their price is too low relative to the "desired" price), or paying the "cost" of adjusting their prices. If production costs rise sharply, many more companies risk major losses if they do not change their prices. They would rather change their prices immediately (and incur the associated costs) than suffer these losses. This explains why the frequency of price changes increases so suddenly: many companies immediately pass on the shock to their prices. In this case, the frequency of changes depends on the size of the shock. This is known as a "state-dependent" price adjustment. Gautier and Le Bihan, 2022empirically confirm that a significant state-dependent component is at play in the adjustment of consumer prices in France.

One of the implications of this "state-dependent" component is that there is non-linearity in the lag in transmitting an economic shock to inflation: it is slow for a small shock and fast for a very large shock (Cavallo, Lippi and Miyahara, 2023, Chart 3).

Source: Cavallo, Lippi and Miyahara, 2023. Note: horizontal axis: number of months after the shock; vertical axis: predicted response of inflation in the simulation of the "state-dependent" model (in blue), in the "time-dependent" model. (In red).

Several factors could contribute to slowing the decline in inflation

While the transmission of a shock to inflation is faster in the case of a large shock, the state-dependent behaviour of companies also implies that inflation could fall rapidly once production costs have stabilised (or if there is a counter-shock to costs). Indeed, inflation will initially be very high, rapidly reflecting the magnitude of the production cost shock. After a few months, it will be much less marked, since the vast majority of companies will already have passed on the shock to their prices, and inflation will then fall more quickly than in the case of time-dependent behaviour (Chart 3).

However, a number of additional factors could contribute to slowing the decline in inflation in the current environment. Firstly, anticipating moderate but positive inflation in the future (Banque de France, 2023), companies may not lower their prices immediately, even if their costs fall, in order to avoid raising them again in the future. In addition, as labour costs are partly indexed to past inflation and are downwardly rigid, their development could contribute to slowing the decline in inflation (Baudry et al. 2023). Furthermore, companies may have less to lose in terms of profits by selling at a higher price than their 'desired' price than at a price that is too low. They will therefore respond more quickly to an upward shock than to a downward one (Cavallo, Lippi and Miyahara, 2023). As a result of these mechanisms, the frequency of price cuts will increase only slightly over the coming months, price rises will become rarer and the time between two price changes will increase. The results of the Banque de France survey over recent months seem to bear out this scenario, with a decline in the frequency of price rises (Chart 4). Inflation should then decrease more gradually than it has increased, while converging towards the 2% target in 2025.

a) Industry

Sources: Monthly business survey (Banque de France), weighted percentage of business leaders reporting a price change over the month. Last point: August 2023.

b) Services

Sources: Monthly business survey (Banque de France), weighted percentage of business leaders reporting a price change over the month. Last point: August 2023.

Download the PDF version of the publication

Updated on 11 April 2024