Wage negotiations in a context of rising inflation

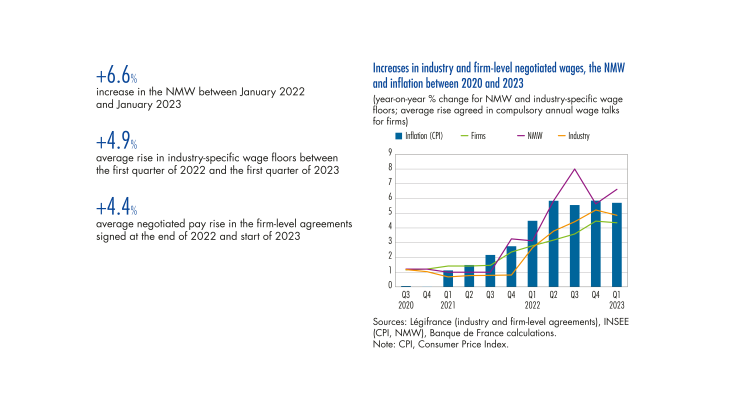

Bulletin n°245, article 6. The resurgence of inflation has changed the context in which wage talks are being conducted within industries and firms. The pass-through of price rises to wages (and vice-versa) is a key challenge for monetary policy and is being closely monitored. An analysis of thousands of industry and firm-level wage agreements in France shows a significant rise in negotiated wages between the end of 2020 and start of 2023. At the industry level, the rises have been fuelled by the upward revisions to the national minimum wage (NMW) in 2022. At the individual firm level, the negotiated pay rises for 2023 average 4.4% (compared with 2.8% in 2022 and 1.4% in 2021), which in many cases will be boosted by the prime de partage de la valeur (PPV – value-sharing bonus). These results are not indicative of a wage-price spiral, and are in line with the Banque de France’s projections for a gradual decline in inflation in 2023 and a return towards the Eurosystem’s 2% target by end-2024 to end-2025.