The decline in cognitive functions may render some people particularly vulnerable and give rise to a set of risks to which senior customers are more frequently exposed in their financial affairs (gradual decline in financial understanding, overlooking necessary products, ill-timed decrease in risk aversion, etc.). In addition to the aspects related to decision-making, other age-related parameters come into account, such as health problems, social isolation and misfortunes (widowhood or separation, loss of income, etc.) or difficulties adapting to new forms of communication, particularly in a context of digital transformation of the financial sector.

Furthermore, the ACPR and the AMF, in the context of their activity of monitoring and supervising commercial practices, have noted that the elderly could more particularly be the target of unfair practices and scams.

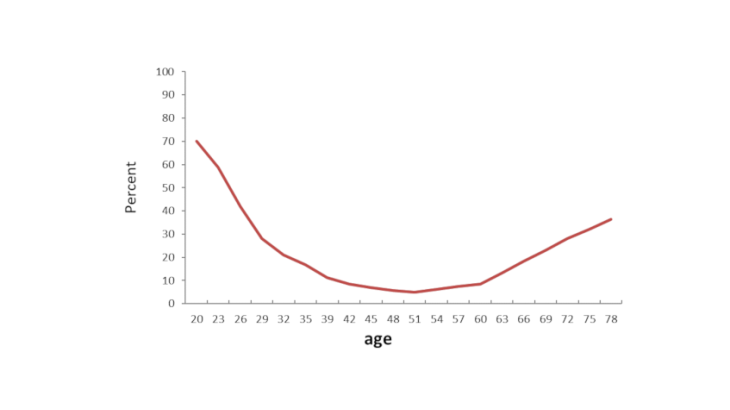

In view of all these elements, a joint study of marketing practices vis-à-vis senior customers, particularly when they become vulnerable, was conducted. One of the intermediate conclusions of the study is that the decline in abilities does not affect each individual in the same way and at the same time of his/her life. Thus, age is not, as such, an adequate indicator of a person's vulnerability: a 70-year-old person may already be very fragile and dependent, while a 85-year old person may still possess full physical and intellectual capacity.

This work led to the publication of a report in December 2018 and the opening of a public consultation on the subject.

A financial sector already aware of the issue

The bilateral meetings conducted with a number of institutions and the public consultation organised in early 2019 brought to light the fact that the financial sector was already examining the issue of elderly customers’ protection. Various measures exist within financial institutions: marketing restrictions for certain complex or risky products according to age, automatically set meetings with the customers upon reaching a certain age, and training and support for banking advisers. Professionals admitted to encountering difficulties in the presence of older people whose cognitive abilities may have declined, but whose vulnerability had not resulted in a measure of judicial protection – i.e. those who are in what may be called a “grey area". Talking directly with a customer about his/her level of cognitive abilities is indeed a delicate, if not inappropriate, exercise for an adviser.

Also, most existing measures are solely based on an age criterion, which is not fully satisfactory because of their potentially discriminatory nature.

Towards a more precise identification of the vulnerability of senior customers?

In order to better identify vulnerable elderly people, it may therefore be necessary to consider other objective criteria, which would enable sales advisers to adopt a more targeted vigilance during the marketing process.

In order to identify these other objective vulnerability criteria, a research partnership was concluded with the Risk Foundation of the Université Paris-Dauphine with the objective of working on the SHARE database (Survey on Health, Ageing and Retirement in Europe). It brought to light some of the factors that may increase or testify to the vulnerability of the elderly. A low level of education or income, a short financial planning horizon and a low risk tolerance are generally associated with a lower level of "numeracy", i.e. a person’s ability to master the basic concepts of mathematics and probabilities, a skill necessary for the sound management of one's financial affairs.

A predictive vulnerability model, developed on the basis of these criteria, could provide an estimate of a customer's numeracy level. Such information could signal the need for greater support, or at least encourage the adviser to check that the customer understands the information provided.

In 2019, the ambition is to test the viability of this theoretical model using anonymised real data supplied by voluntary institutions. Financial products providers, when assessing their customers' investment knowledge, may collect data that are likely to reflect a level of numeracy. This research work aims to demonstrate the possibility of setting up operational tools to be used for the early detection of signs of vulnerability, in addition to the fundamental human relationship between the adviser and his/her customer.