In July 2020, the Banque de France and the AMF published a joint study on the liquidity management tools (LMTs) of French funds. The primary objective was to describe as precisely as possible the regulatory framework applicable to the various LMTs and to explain how they work. Secondly, the study presented an original method for automated reading of fund prospectuses aimed at identifying, via a textual search (a.k.a. text-mining), the funds that were equipped with LMTs. The program had been run on an exhaustive database of prospectuses of French funds that were live on 31 December 2019. Extraction of classification and net asset data based on regulatory reports had made it possible to refine the analysis (i.e. provide an analysis by volume and a detailed analysis according to the main asset classes in the portfolio). In June 2021, a fresh study combined the results of the identification of LMTs with data from the French insurance sector supervisor to illustrate the existence of a potential lower rate of adoption of LMTs in funds mainly serving in unit-linked life insurance policies.

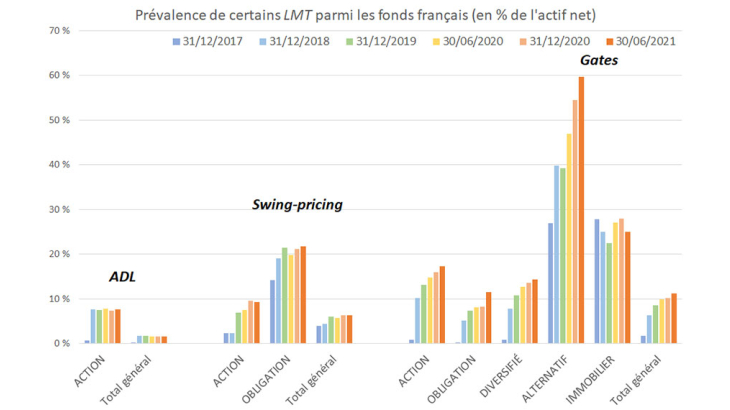

This follow-up analysis’s contribution offers a dynamic view of the adoption of LMTs by fund managers. After extensive work to optimize the computer code (which helped to significantly improve computation time), the program was applied to the historical prospectus databases corresponding to funds outstanding as of 31/12/2017, 31/12/2018, 31/12/2019 (this date corresponds to the calculation date in the of the previous study published in July 2020), as well as 30/06/2020, 31/12/2020 and 30/06/2021. The mid-year calculation date for 2020 aims to identify a possible sharp pickup in adoption in the wake of the financial crisis in March. The results obtained were combined with another extraction from the AMF regulatory reports (by a uniform method between the six calculation dates). This new study supplements the previous one in several ways. First, from a dynamic viewpoint, it highlights the fact that, despite the continuing adoption of LMTs by the fund managers, substantial efforts are still needed. It also makes it possible to refine the initial observations by comparing the degree of adoption of the various LMTs according to certain fund characteristics (ETFs, employee savings scheme funds, funds used by unit-linked insurance products, legal nature).

The findings are therefore as follows:

- Anti-dilution levies (ADLs) are used especially in equity and "other" funds, whereas swing-pricing is found mainly in bond funds (and to a lesser extent in equity and diversified funds). Gates, meanwhile, are provided for chiefly in alternative funds (31% of fund classes and 60% of net assets at end-June 2021) and real estate funds (31% of fund classes and 25% of net assets at end-June 2021). However, they still concern around 10% of the fund classes of equity, bond and diversified funds.

- The equity, bond and diversified funds which are predominantly used for unit-linked insurance products (i.e. serving as units for unit-linked products) are generally characterised by a lower rate of adoption of ADLs, swing-pricing and gates than funds in which unit-linked policies are less predominant.

- Employee savings scheme funds have less liquid liabilities, to the extent that these products are marketed via employee savings plans (PEEs) or employee retirement savings plans (PERCOs), respectively locked up in theory for five years (except in the case of early release of funds) and until retirement. The rate of adoption of various LMTs (including complete suspension) is very much lower where these are concerned.

- Conversely, ADLs and gates are far more common to equity ETFs than to other equity funds. Equity ETFs offer redemption in kind less often and they do not resort to swing-pricing.

- Lastly, the rate of adoption of the various LMTs differs depending on the nature of the funds. UCITS (and especially VaR UCITS) generally make more use of swing-pricing and gates than AIFs.

In the near future, the national regulatory reporting framework (BIO) will be enriched to collect, directly from fund managers, the information relating to the introduction of liquidity management tools in the regulatory documentation of their funds, thus relieving reliance on textual analysis. The new reporting system will also make it possible to monitor precisely the effective activation and deactivation of the various LMTs. Inherently, automated reading based on non-standardised prospectuses implies that the findings of this study are only estimates. However, the application of the same method at various dates indeed makes it possible to consider the evolution of LMT deployment over time.