- Home

- Publications and statistics

- Publications

- Negotiated wage rises for 2022: the resu...

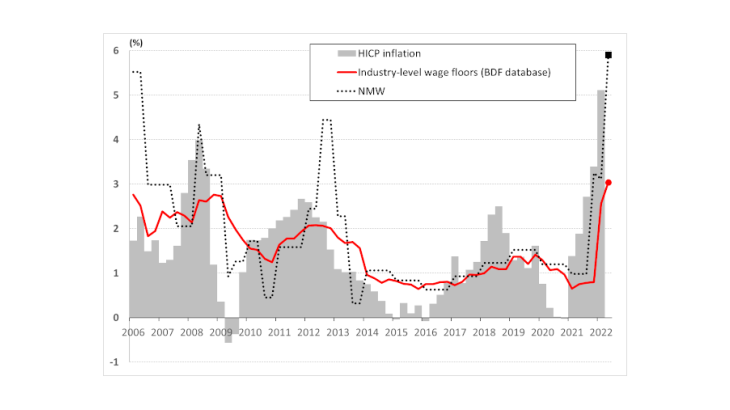

Post n°269. So far in 2022, industry-level wage bargaining has generally resulted in wage increases of around 3% compared with rises of close to 1% in recent years. Inflation, which has been higher since the end of 2021, and the recent hike in the national minimum wage (NMW) are contributing to this stronger growth in negotiated wages.

Inflation has been accelerating in France since the end of 2021: according to the European Harmonised Index of Consumer Prices, it reached 5.4% in April 2022 compared with close to 1% in the same period in 2021. The strength in consumer prices is largely attributable to surging energy prices. Aside from the uncertainty over how long this shock to imported prices will last, one of the principal factors that will shape medium-term price dynamics is the wage-price spiral: higher inflation leads workers to demand bigger pay rises, which in turn can drive prices upwards over the medium term. Central banks are therefore paying close attention to wage discussions as they are a key variable in determining whether or not inflation will prove persistent.

Using data on collective wage agreements for more than 200 industries in France, this blog post examines the changes in negotiated wages between the end of 2021 and the first quarter of 2022. So far, negotiated pay rises for 2022 have averaged 3% (Chart 1). This is higher than in the period 2014-20, when pay rises were closer to 1%, reflecting low inflation and annual growth of less than 1% in the NMW (Gautier 2018).

Industry-level wage floors are key for wage setting

As in many European countries, wage dynamics in France are strongly influenced by collective bargaining institutions. A large majority of private sector workers are covered by an industry-level collective wage agreement. Each industry defines a classification of representative jobs and sets a minimum wage, or wage floor, for each one. Compulsory talks are then held each year on this wage floor scale, which may lead to a new wage agreement between trade unions and employer federations (Gautier 2017).

The French Labour Laws enacted in 2017 stipulate that industry-level wage floor agreements have primacy over firm-level agreements: in other words, firms in a given industry may not pay a worker less than the wage floor agreed by the industry for that specific job category (or less than the NMW). The Ministry of Labour generally extends industry-level agreements to all firms belonging to that industry. In practice, a third of firms say their wages are bargained at industry level (Luciani, 2014). Industry-level agreements therefore set an observable “reference” for firms’ wage policies.

Wage bargaining discussions are clustered over a few months each year, generally between the end of the year and start of the following year. Over the past few months, the vast majority of industries have signed a new wage agreement for 2022. This rise in the number of agreements compared with the much lower frequency observed in previous years can be explained by stronger growth in prices and in the NMW, hiring difficulties in some industries and the Ministry of Labour’s support for wage talks.

Negotiated wages are rising more sharply in 2022

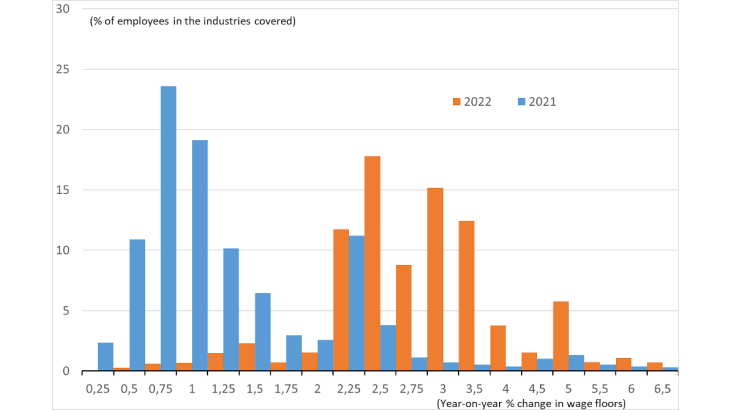

In many industries, the negotiated wage rises for 2022 range between 2.5% and 3.5%, whereas in 2021 they were frequently below 1% (Chart 2).

For example, the plastics industry, DIY stores, the non-food wholesale sector and managers in the metalworking industry have all negotiated wage rises of around 3%. For regional construction and public works industries, and for departmental metalworking industries, the rises are also close to 3% on average. In other industries, many of which signed agreements at an earlier date, the agreed wage rises are around 2.5% or even lower (e.g. chemicals, pharmaceuticals, furniture trade, wholesale meat trade, security services).

The agreements for 2022 also more frequently contain inflation clauses stipulating that in the case of higher inflation, industries may have to restart discussions over the course of year, outside the usual wage-bargaining timetable. The car services industry, for example, has revised its wage floors for 2022 twice since July 2021: the initial rise of 1.5% was revised to 2.5% in October 2021, and then again to 4.5% in April 2022.

The NMW influences industry-level wage bargaining

In several industries (notably hotels-cafés-restaurants, hairdressing, road transport), negotiated wage rises have been higher (5% or more), but this is due to a catch-up effect as a portion of their wage floor scale was previously below the NMW and has now been brought in line with the latter.

If an industry does not sign a wage agreement in a given year, then the upward revision of the NMW will mean that the lowest wage floors in that industry fall below the NMW; all workers in those jobs will then have to be paid the NMW. Unlike industry-level wage floors, the NMW adjusts automatically each year according to a formula set by law: on 1 January it increases in line with the inflation rate (excluding tobacco) for households in the first income quintile and half of the real change in the blue-collar hourly base wage. If, over the course of the year, inflation exceeds 2% following the previous adjustment, the NMW is also immediately and automatically revised upwards. As a result of the pick-up in inflation in 2021-22, the NMW has been revised upwards three times in the last eight months (by 2.2% in October 2021, by 0.9% in January 2022 and by 2.65% in May 2022). In total, the NMW has increased by 5.9% in the past 12 months, meaning that many industries have had to renegotiate their wages since the start of 2022 to bring their lowest wage floors in line with the NMW.

Increases in the NMW also tend to feed through to the rest of the wage scale in order to keep pay differentials between job categories constant. Industry-level wage floors are therefore a channel for the transmission of past inflation and NMW rises to all wages (Fougère et al. 2018). The renewed rise in the NMW on 1 May could force some industries to reopen wage talks over the coming months, especially as, for nearly 75% of industries (in terms of employee numbers), the first level of the wage floor scale is below the NMW, including for those industries that recently signed an agreement.

The spillover effects of wage-floor adjustments on base wages

Whereas the annual rise in the index of base wages (i.e. paid wages excluding bonuses and overtime) was close to 1.5% at end-2021, the increase in industry-level wage floors should help to boost growth in base wages over 2022. A 1% rise in industry-level wage floors pushes up base wages by around 0.2% (Gautier et al. 2021). This compares with a 0.1% rise in base wages for every 1% rise in the NMW. In addition, while the direct impact of an increase in the NMW is concentrated on those wages close to the NMW, rises in industry-level wage floors are transmitted more evenly across the wage distribution.

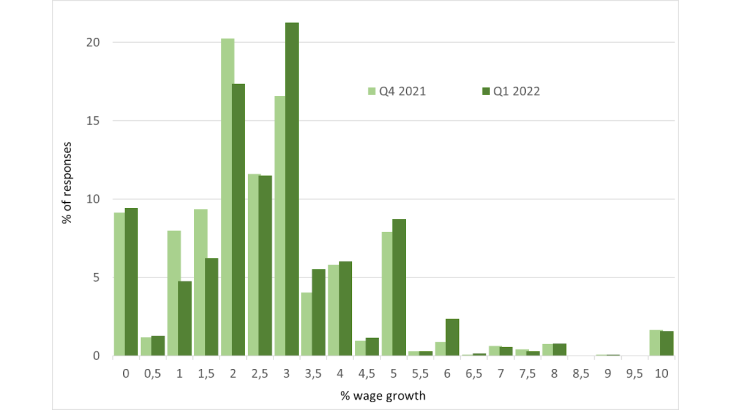

Since the end of 2021, the Banque de France has conducted a new quarterly survey (soon to be published regularly) of some 3,000 business leaders, questioning them on how they expect base wages to change at their company over the next 12 months (Chart 3). On average, the anticipated rise in wages for the next 12 months was 2.5% in the fourth quarter of 2021 and around 2.8% in the first quarter 2022 (compared with around 1% in 2020-21, see Bouche et al. 2021).

Updated on 28 September 2023