- Home

- Publications and statistics

- Publications

- Monthly Business Survey – Start of May 2...

The Banque de France publishes a range of monthly and quarterly economic surveys that provide a snapshot of the French economy in the form of business climate indicators and short-term forecasts.

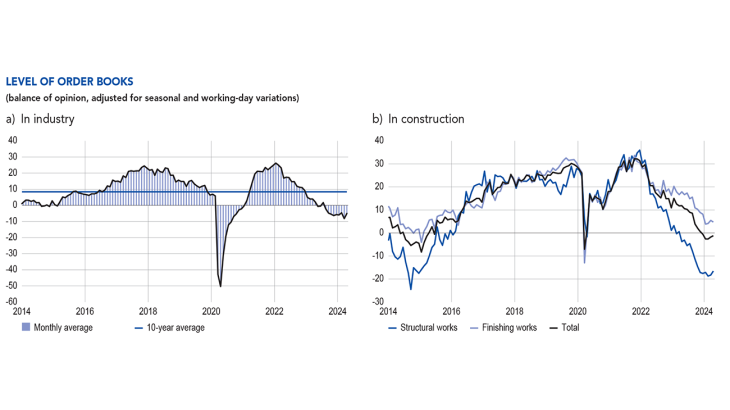

According to the business leaders surveyed (approximately 8,500 companies and establishments questioned between 26 April and 6 May), activity rose in April in market services, and more markedly than expected last month in industry and construction. This helped businesses catch up after a sluggish March and prepare for the prospect of a leaner May due to holidays and closures associated with the number and timing of public holidays. The business forecasts for May indicate that activity should decline in industry and construction, while little change is expected in services. However, these expectations should viewed with a degree of caution given the calendar effects during the month. Order books are still deemed weak in almost all industrial sectors, with the notable exception of aeronautics. In the structural works sector, orders remain well down on pre‑Covid levels due to stagnation in the construction of new builds.

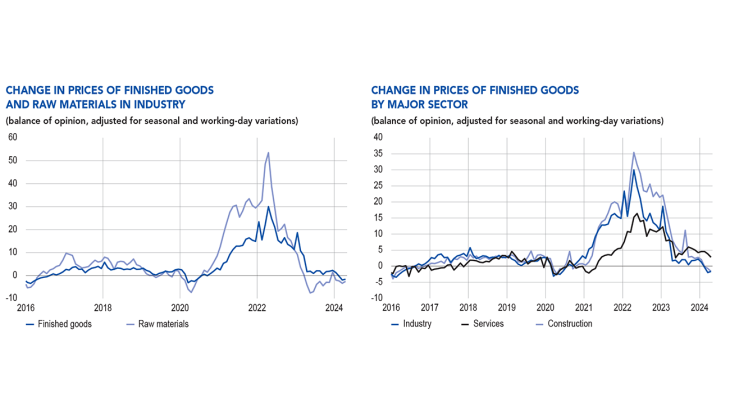

Price moderation continued. According to business leaders in industry, raw material prices continued to decline though at a slower pace. In April, the proportion of businesses increasing their prices in industry and construction (6% and 2%, respectively), was a little below pre‑Covid April levels. At the same time, the proportion of businesses reporting a drop in their prices (5% and 8%, respectively, in industry and construction) exceeded pre‑Covid levels. In services, the proportion of businesses reporting a rise in their prices (12%) has not yet completely returned to normal.

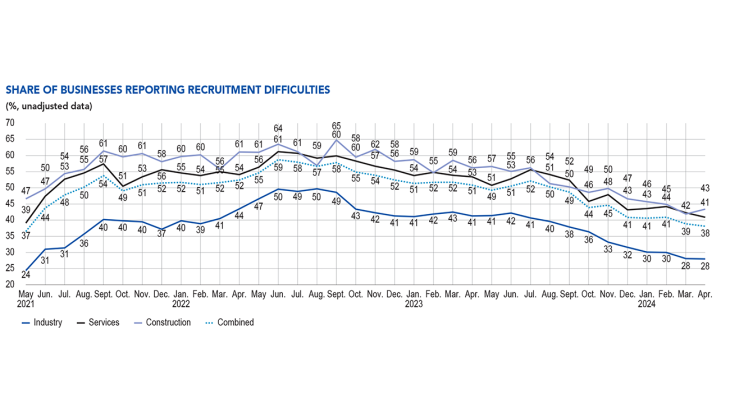

Recruitment difficulties continued to trend slowly downwards, but remained high: they were cited by 38% of businesses in April, compared with 39% in March.

Based on the survey results as well as other indicators, we estimate that GDP should increase slightly during the second quarter of 2024 after a 0.2% increase in the first quarter.

However, this forecast is still very provisional, due to the unusual nature of the calendar in May 2024 and the forthcoming change in benchmark (on 31 May) for the national accounts published by INSEE.

1. In April, activity increased in industry, market services and construction

In April, activity increased in industry, at a significantly faster pace than business leaders had expected the previous month. Business leaders pointed to a catch‑up effect in March and the prospect of lower activity in May due to holidays and closures associated with the number and timing of public holidays. The improvement in April was driven by the agri‑food, capital goods and transport equipment sectors, and more specifically by computer, electronic and optical products, electrical equipment, aeronautics, chemicals and other industrial goods. In contrast, activity in rubber and plastic products was down, continuing the trend observed in March.

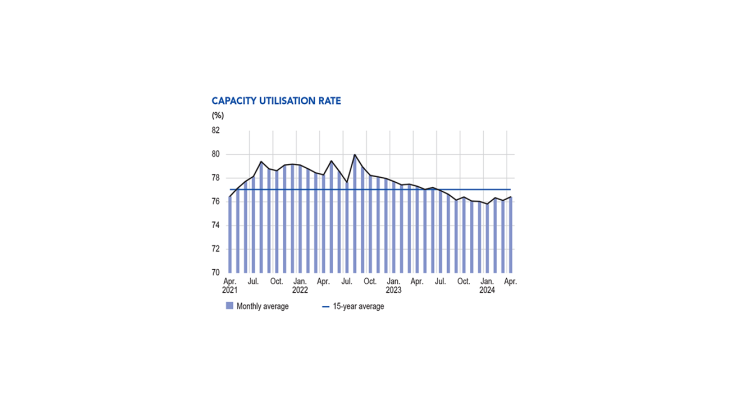

The capacity utilisation rate (CUR) for industry as a whole rose slightly to 76.4%, remaining close to its 15‑year average of 77%. CUR increased in the wearing apparel, textiles and footwear, and automotive sectors, in particular (up 2%).

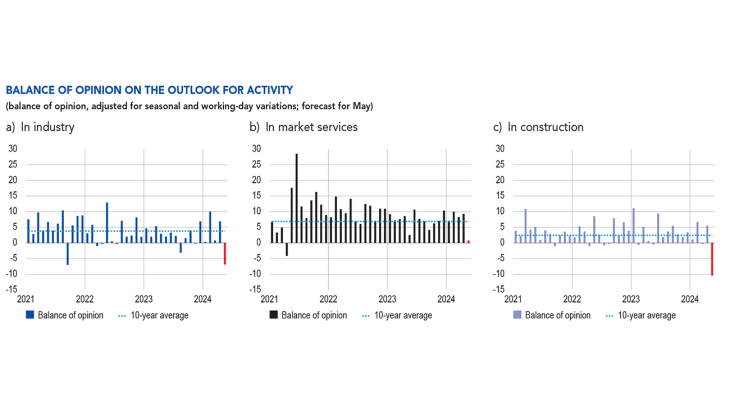

the past month) stood at 7 percentage points for April in industry. For May (red bar), business leaders in industry expect activity to fall by 7 percentage points.

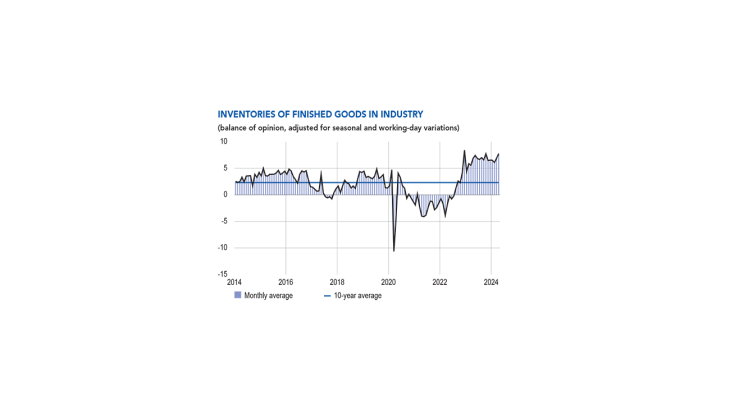

Inventories of finished goods were up slightly in April, partly in anticipation of the lower production expected in May, and were notably higher in aeronautics, machinery and equipment and wearing apparel, textiles and footwear. Levels continue to be deemed high and above their long‑term average in most sectors, including the aeronautics, pharmaceutical and machinery and equipment industries.

In market services, activity continued to grow in April, and at a faster pace than business leaders had expected the previous month. This growth was reported in all business services, in particular publishing, legal and accounting activities, management consultancy, advertising and market research, but activity declined in consumer services (leisure activities, personal services and accommodation and food services), largely due to unfavourable weather conditions. Activity improved in temporary employment.

In construction, activity rose in April (and here again more than had been expected the previous month) in both structural and finishing works, in preparation for a far leaner May.

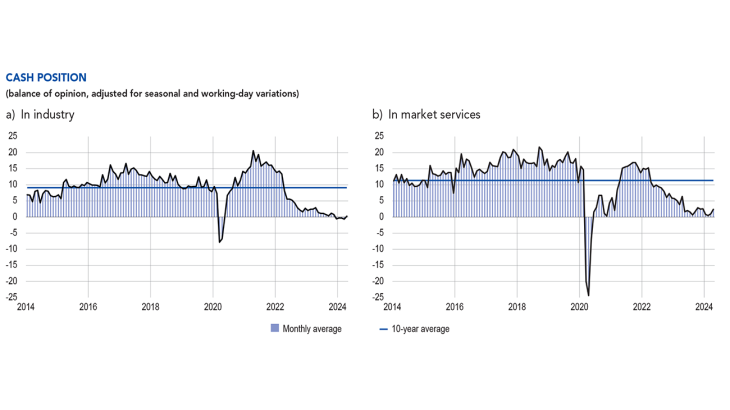

The balance of opinion on cash positions remained little changed overall in industry. Business leaders felt that cash positions were satisfactory in the pharmaceuticals, agri‑food and chemicals sectors, but that they were particularly low in rubber and plastic products, the automotive industry, wearing apparel, textiles and footwear, metal and metal products manufacturing, and wood, paper and printing.

There was a slight improvement in the balance of opinion on cash positions in market services. It was felt that cash positions were satisfactory in engineering, publishing, IT services and legal and accounting activities, but that they remained low in the advertising, market research and food services sectors

2. In May, business leaders expect little change in market services activity, and a decline in industry and construction, mainly due to calendar effects

Business leaders in industry expect activity to fall sharply in May, due to long weekends and holidays associated with the number and timing of public holidays. Although balances of opinion reported in the survey are working‑day adjusted, this does not take account of the timing of public holidays, which can affect the number of days that are effectively worked. Activity in the machinery and equipment, wearing apparel, textiles and footwear, metal and metal products manufacturing and wood, paper and printing sectors is thus expected to decline sharply in May. The sole exception is expected to be the aeronautics sector, which should see growth.

In services, activity is expected to change little overall, but trends will differ depending on the sector. With the public holidays in May, growth is expected in accommodation, food services and motor vehicle rental activities, as well as certain business services (publishing, legal and accounting activities and management consultancy), but activity in motor vehicle repair, personal services, temporary employment, and computer programming and consultancy is set to decline.

Lastly, in construction, activity is expected to contract sharply in both the structural and finishing works sectors. Apart from May, which is a very unusual month, business leaders in the finishing works sector said that they were generally pessimistic about the year as a whole, echoing the structural works sector.

The balance of opinion on industry order books for all sectors except machinery and equipment is not quite as bad as that reported in March. It is deemed below its long‑term average in all sectors apart from aeronautics and computer, electronic and optical products.

Dans le bâtiment, le jugement sur les carnets de commandes baisse de nouveau dans le second œuvre et reste très dégradé dans le gros œuvre, malgré une légère inflexion.

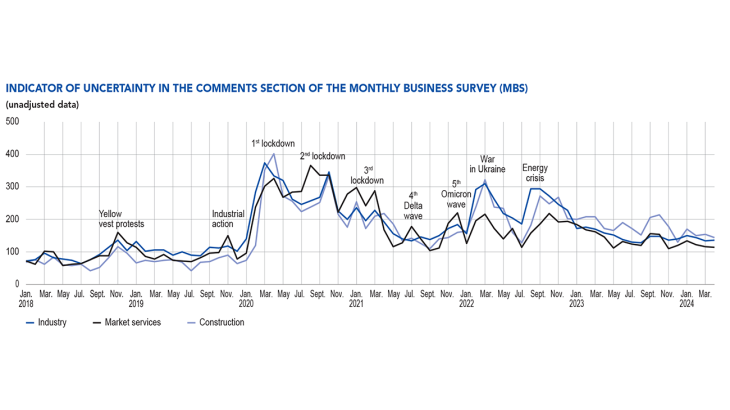

Notre indicateur mensuel d’incertitude, construit à partir d’une analyse textuelle des commentaires des entreprises interrogées, évolue peu par rapport à mars, quel que soit le secteur considéré.

3. Price moderation continued

In April, supply difficulties were increasingly isolated in industry, with 10% of businesses mentioning them (down 2 percentage points on March). However, in the transport equipment sectors (the automotive and aerospace industries), a quarter of business leaders reported difficulties with regard to certain components such as microprocessors, connected to shipping problems in the Red Sea. Nonetheless, these difficulties were far less severe than the record high levels reported in 2022: 28% and 26%, respectively, in April, compared with 87% and 77% in April 2022. Supply difficulties were rarely encountered in construction (6%, down from 7% in March).

In industry, business leaders continued to see a decline in raw materials prices, although to a lesser extent than in March, and the balance of opinion on finished goods prices1 in April remained negative for the second consecutive month. Equally, quote prices were again deemed to be down by business leaders in construction in April. However, in services, the balance of opinion was still a little above pre‑Covid levels, even though it had fallen slightly since March.

At a more detailed level, 6% of business leaders in industry reported that they had raised their selling prices in April, marginally below pre‑Covid April levels and well below the levels reported in April 2022 and 2023. Conversely, 5% of business leaders in industry reported lowering their selling prices in April. Decreases in finished goods prices were reported in chemicals (17%), agri‑foods (8%), and machinery and equipment manufacturing (7%).

In construction, only 2% of business leaders reported increasing their quote prices, which is less than the level observed in April during the pre‑Covid period. Moreover, 8% of business leaders said that they had reduced their prices in April, compared with 11% in March (when the highest percentage in five years was reported).

In services, price dynamics have not yet completely returned to normal. The proportion of businesses reporting price rises was 12% (compared to around 7% for pre‑Covid April figures), while the proportion reporting a cut in their prices remained low at 3%. Service price increases were mainly reported in advertising and market research, and cleaning services.

For May, 6% of business leaders expect to raise their prices in industry, and 7% and 2% of business leaders expect to do so in market services and construction, respectively.

Business leaders were also asked about their recruitment difficulties, which continued to slowly decline in April: 38% of the businesses surveyed reported difficulties, down from 39% in March.

Change in prices of finished goods by major sector

4. Our estimates suggest a slight increase

in activity in the second quarter

The quarterly account first estimates published by INSEE at the end of April put GDP growth at 0.2% for the first quarter of 2024. This is in line with the forecast in our last update on business conditions. The downturn in activity in the construction and energy sectors was offset by higher value added in market services, while activity in industry stabilised compared with fourth‑quarter 2023.

Based on the results of the Banque de France monthly business survey (MBS), as well as other available data (INSEE production indices and surveys and high‑frequency data), we estimate that real GDP will rise slightly in the second quarter of 2024.

It should be boosted this quarter by market services, particularly wholesale and retail trade, business services and information and communication.

Value added in manufacturing industries is expected to be stable over the quarter, reflecting an anticipated decline in production in May following an increase in April. A modest rebound in activity is expected in the energy sector after a sharp fall at the beginning of the year. Lastly, construction activity is seen continuing to decline, in line with the significant drop in single‑family housing starts and deteriorating order books.

It is important to note that even greater uncertainty than usual surrounds the forecast for second‑quarter GDP growth due to the number and timing of public holidays in May. Furthermore, we do not yet have the national accounts, rebased to take into account the change of benchmark. These will be published on 31 May by INSEE, and the quarterly accounts (including for first‑quarter 2024) will be adjusted accordingly.

1 The balance of opinion is the difference between the proportion of business leaders reporting increases or decreases, weighted by the intensity of the variation (with three possible grades in the monthly business survey: low, normal and high). A business leader indicating a “high” increase in prices will, all other things being equal, influence the balance of opinion more than a business leader indicating a “low” increase.

Download the full PDF version

Updated on 20 June 2024