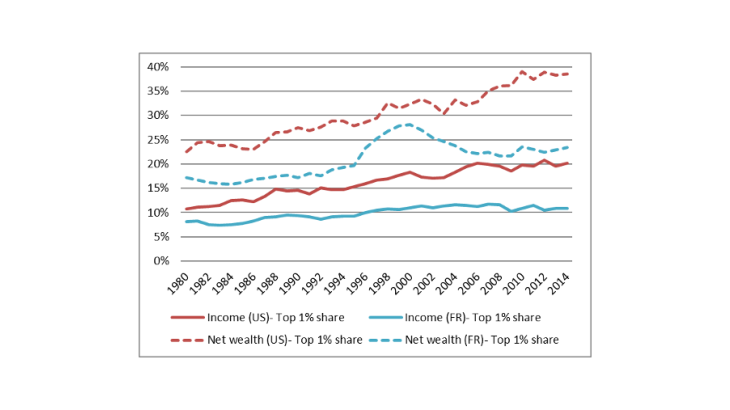

In the aftermath of the Great Recession, historically low levels of interest rates and large-scale unconventional monetary policies have led to an intense discussion on the potential distributional effects of central bank interventions (Brookings, 2015, for example). Does monetary policy systematically benefit specific groups of households? And has it contributed to the rise in inequalities over the past forty years (Chart 1)?

In the long run, monetary policy only affects inequality through inflation

In the long run, the only variable influenced by monetary policy, conventional or unconventional, is the average level and volatility of inflation. But changes to either the level or volatility of inflation can have redistributive effects.

Inflation is a regressive tax because poorer households tend to hold a higher proportion of their wealth in cash or deposits and carry out more transactions using cash than richer households, which tend to have greater access to credit and own more real assets (houses, land and businesses). Unanticipated inflation can have these temporary redistributive effects because contracts are commonly written in nominal terms and because households’ assets and debt differ along many dimensions (type of assets, wealth level, indebtedness, etc.). The biggest losers from unexpected inflation are individuals without real assets (poorer and younger households) and those who rely on nominal income (workers who cannot renegotiate their nominal wage or who do not benefit from an automatic indexation of their wage to inflation).

These adverse redistributive effects are larger and more persistent the bigger the inflation shock. Episodes of hyperinflation have historically been particularly devastating for wage earners and those with wealth in nominal assets (and there are still cases of this in parts of the world today). Avoiding these types of risks is an important motivation for price stability mandates.

Inflation shocks can also be attenuated by monetary policy frameworks through the anticipation of future policy actions. For instance, inflation targeting frameworks have generally been credited in helping to reduce inflation volatility. As long as average inflation and inflation expectations are close to the inflation target, monetary policy cannot be a first-order driver of inequality developments in the long run.

Over the business cycle, monetary policy may have distributional effects through income and employment

Monetary policy cannot account for the long-term movements in inequality but may play a role in some cyclical fluctuations of income and wealth inequality. The effects of monetary policy on income and wealth distributions work through a direct channel and an indirect one.

- The direct effect can be defined as the immediate consequence of monetary policy on income and wealth distribution. A reduction in policy interest rates will lead to a reduction in interest payments for households with variable rate loans or those taking out new fixed rate loans, and a reduction in interest on savers’ deposits (implying some redistribution of income from savers to borrowers). Since borrowers are generally younger and savers generally older, there will be an implicit transfer between generations. But lower interest rates will also boost asset prices such as housing and equities. Higher housing prices would benefit homeowners whereas higher equity prices would most benefit the top end of the wealth distribution. By contrast, savers with few real assets would be the most adversely affected.

- Indirect effects consist of the effect of monetary policy on labour market conditions through general equilibrium adjustments. A reduction in interest rates will boost aggregate consumption and investment, which will then exert positive pressures on employment and wages. This will generate a positive effect on average household income but this effect might differ along the income distribution. For instance, low-skilled worker employment might be more sensitive to aggregate demand than high-skilled worker employment.

The difficulty in judging the overall effect on redistribution is that the direct and indirect effects of monetary policy tend to work in opposite directions. Besides, it is hard to disentangle the effects of monetary policy from the effects of the factors motivating the monetary policy intervention in the first place. A lot depends on what one assumes would have happened if there had been no monetary policy adjustment at all. For the United States, Coibion et al. (2014), for example, show that an unexpected expansionary monetary policy can temporarily reduce income inequality whereas an unexpected contractionary monetary policy would tend to increase inequality.

For the euro area, Lenza and Slacalek (2018) find that the “unexpected” monetary policy measures undertaken by the ECB through its Asset Purchase Programme produced a temporary overall reduction in income inequality because it reduced the unemployment rate among households in the bottom of the income distribution. Ampudia et al. (2018) also find that the indirect effects through employment and labour income are quantitatively larger than the direct effects leading to an overall reduction in income inequality.

Inequality trends depend on other factors than monetary policy

However, overall monetary policy effects on inequality are rather modest and other long-term factors have contributed more decisively to the rise in wealth inequalities we have observed over recent decades. Intergenerational transfers are well-known as one of the major sources of wealth inequality (Alvaredo et al., 2017). It is also of considerable concern that the next generation’s prospects may be increasingly determined by parental economic resources. Globalisation and technological change have also been important driving forces of the rise in inequalities within and across countries. Fiscal policy or structural policies related to education or labour markets are the most appropriate and legitimate ways to counteract these effects.