1 Measuring firms’ inflation expectations in France

Since the 1990s, central banks have improved their communication to make their monetary policy more transparent and predictable. Communication has thus become an additional monetary policy tool. Thanks to this clear communication, it is possible to anchor economic agents’ expectations to the monetary policy objective and make monetary policy decisions more

effective (Barthélémy et al., 2019). In particular, a key challenge for these communication policies is to stabilize economic agents’ inflation expectations at a level close to the inflation target (Blinder et al., 2008).

Monitoring household and corporate inflation expectations is crucial for monetary policy

For a long time, traditional indicators for monitoring expectations were primarily based on market information (e.g. ILS – Inflation Linked Securities) or on information collected directly from professional forecasters (e.g. SPF – Survey of Professional Forecasters). A number of studies use this type of data to show that central bank communication, including the adoption of an explicit inflation target, has contributed to lowering and stabilizing inflation expectations (Ehrmann, 2021). However, financial market participants and professionals have a fine understanding of macroeconomic mechanisms and are distinguished from the general public by their higher level of information and attention to monetary policy. It therefore seems difficult to extrapolate the expectations of forecasters and financial market participants to deduce what all economic agents, and in particular firms and households, think.

Monitoring the expectations of a wider population than just experts has thus become a crucial issue today as central banks have adapted their communication to address firms and households more directly (Draghi, 2014; Haldane and McMahon, 2018). Central bank communication can indeed help to influence the inflation expectations of firms and households and thus improve the effectiveness of monetary policy (Binder, 2017).

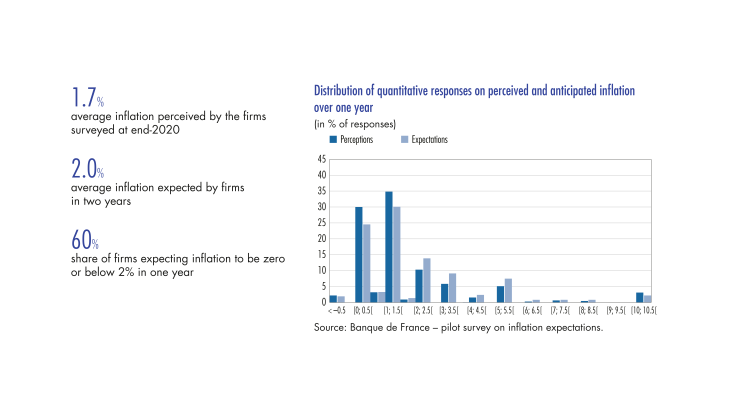

The aim of this communication is to anchor household and corporate inflation expectations to the inflation target. In the case of the euro area, the inflation target was revised in July 2021 (following the strategy review conducted by the ECB and the national central banks) to “2% over the medium term”. The ECB’s credibility in fulfilling its mandate depends on its ability to keep firms’ and households’ expectations close to this target. Firms are the economic agents that set the prices of goods and services produced and consumed in the euro area, and also play an important role in setting wages. In the presence of large scale economic shocks, keeping their expectations.

[to read more, please download the article]