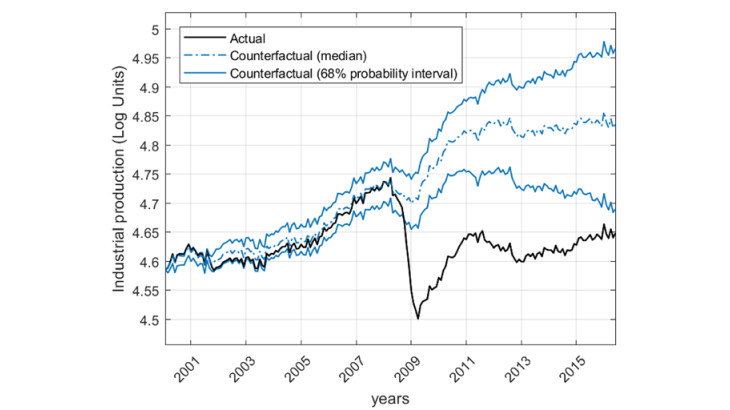

Beginning in the first quarter of 2008, the European economy started to experience a severe and long-lasting double-dip recession from which it only recently recovered. The figures speak for themselves: real euro area Gross Domestic Product dropped by 5.5% and 1.2% year-on-year during the first and second dips in first-quarter 2009 and first-quarter 2013 respectively, while job losses, amounting to nearly 5.3 million, occurred in most sectors of the economy.

The trigger events of these deep recessions are well-known and both dips have their origins in the financial sector. The first dip was attributable to the bursting of the US housing bubble. Following the introduction of mortgage securitisation as a new type of financial innovation, and with low interest rates and a global savings glut, US home prices collapsed in 2007, with massive repercussions in the euro area. The second dip, this time emerging from within the euro area, stemmed from a major sovereign debt crisis that originated in Greece, Ireland, Italy, Portugal and Spain. Here, the reasons cited by economists include important fiscal deficits, a loss of competitiveness and the rapid expansion of lending in the early 2000s.

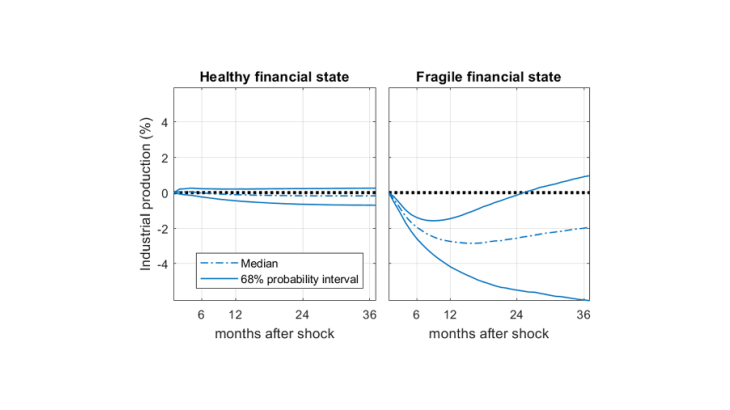

By contrast, other financial events such as the bursting of the Dot-com bubble in March 2000, which triggered massive wealth destruction, had small effects on aggregate activity. Euro area economic growth increased at an annual rate of 3.9% in the third quarter of 2000, compared with 4.5% in the previous quarter. Hence, disturbances that originate in the financial sector sometimes seem to have little impact on aggregate activity, but sometimes have just the opposite. The reason behind these all-or-nothing effects is amplification, a mechanism in which changes in financial and credit conditions play a key role in the transmission and propagation of business cycles. Such a mechanism, better known as the “financial accelerator”, was introduced by Bernanke and Gertler (1989).

Understanding the amplification mechanism theory

The starting point to understanding this mechanism lies in asymmetric information and agency problems. In the lending process, a key task of financial intermediaries is to screen and monitor potential borrowers. They charge borrowers a premium to cover the resulting agency costs. This premium, referred to as the “external finance premium” represents the difference between the cost to a borrower of raising funds externally and the opportunity cost of using internal funds, such as cash or equity. Fundamentally, the strength of the borrower’s financial position influences his or her incentives to make good decisions, and thus the premium. The higher their net worth, the more borrowers are encouraged to make well-informed investment choices as they can finance an investment project with a significant amount of their own funds and thus rely relatively little on external finance. As a consequence, banks would charge a lower external finance premium for borrowers in a healthy financial situation. Conversely, worsening financial conditions raises the cost of borrowing.

Most importantly, the strength of the negative relationship between a borrower’s net worth and the premium depends crucially on the overall health of the financial sector, both on the borrower’s side and on the lender’s side. In the case of the Dot-com bubble, financial intermediaries had relatively little exposure to Internet-related assets, while in the case of the European debt crisis they were exposed to European government debt, making them much more vulnerable. When the financial system is fragile – with more generalised maturity or liquidity mismatches, bank runs, liquidity spirals, heightened uncertainty, etc. – financial intermediaries’ attitude to risk changes. They become more reluctant to lend because they may not be reimbursed later. During such times, economic agents are thus more sensitive to changes in financial conditions, and the premium reacts more strongly to borrowers’ net worth. Consequently, losses to net worth lead banks to charge a higher premium than they would usually do under normal circumstances, which dramatically reduces new investment projects, weakens profits and has more severe and longer-lasting effects on economic activity.