Banking sectors in Sub-Saharan Africa have been growing rapidly during the last two decades in the wake of the super-cycle of commodity prices and high growth on the continent. Regional or pan African bank conglomerates have emerged and contributed to higher, albeit still limited, financial integration. The concerns about financial stability have grown accordingly, notably as a result of the Nigerian banking crisis of 2009-10. Whereas considerable attention has been devoted to financial stability in developed countries affected by the global financial crisis, few empirical studies have focused on Sub-Saharan Africa (SSA) so far. With credit risk being relatively high and rising since the drop in commodity prices and the ensuing African economic slowdown in 2014, analyzing the determinants of credit risk seems both relevant and timely.

A growing strand of theoretical and empirical research highlights the importance of financial deepening and inclusion to spur economic growth in Sub-Saharan African countries. In such countries characterized by high levels of economic growth, the reliance on banking sectors to ensure adequate financing is increasing, however, at the same time there are high risks of macroeconomic instability which is often spurred by external shocks. In this context, the linkages between growing competition in SSA banking sectors and credit risk have become salient: even if they have remained in SSA countries with weak and isolated financial systems, banking crises arising from credit booms may become an increasing source of concern for regulatory and supervisory authorities, to the extent that the interactions between credit and economic cycles become stronger, similar to the trends observed in the advanced economies.

The relationship between bank competition and credit risk is less than straightforward. Bank competition may spur efficiency gains (lower credit costs, improved operational and risk management practices, better allocation of capital, economies of scale), and thus contribute to higher potential growth and translate into sounder bank credit portfolios. However, it may also encourage additional risk taking by financial intermediaries, making banks more fragile in the face of economic fluctuations and deterioration of the quality of their credit books. Shedding light on the bank competition/credit risk nexus, a large body of theoretical and empirical literature produced mixed conclusions.

In addition to extending the focus on the recent experience in Sub-Saharan Africa, the main contribution of our research is to provide new empirical insight on how bank competition has affected credit risk in SSA countries, controlling for macroeconomic determinants, bank-specific indicators, and the regulatory environment. Our study also seeks to contribute to the ongoing discussion about whether and to what extent regulatory and policy design should be adapted to the determinants of credit risk that are specific to developing countries.

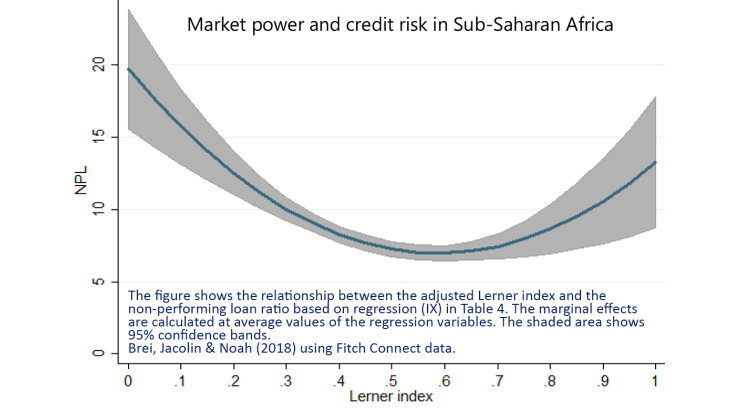

Using data on the financial statements of 221 commercial banks (of which 140 are foreign-owned) from 33 countries in SSA over the period 2000–15, we find evidence that the relationship between non-performing loans and bank competition, as measured by market power, is non-linear and U-shaped, suggesting that beyond a certain threshold the efficiency gains of more bank competition may be outweighed by financial instability effects. Our study also highlights the importance of macroeconomic variables in determining credit risks, such as growth, financial deepening and economic concentration, as well as bank portfolios and the regulatory environment. More specifically, we find that credit risks have been lower in countries where there operate more branches, credit registry coverage is higher, and the tenure of supervisors is shorter. Finally, we show that public indebtedness may have an impact on bank credit risk in these countries, where government and public enterprises make up a significant portion of the formal economy.