- Home

- Publications and statistics

- Publications

- Climate data: time to act!

Post n°262. Financial stakeholders report numerous data gaps that hinder their consideration of climate-related risks. While the lack of reliable, comparable, granular and forward-looking data is a challenge, some temporary solutions may help overcome it. Furthermore, recent efforts should allow to gradually bridge those persistent gaps.

Significant data are required to assess climate-related risks

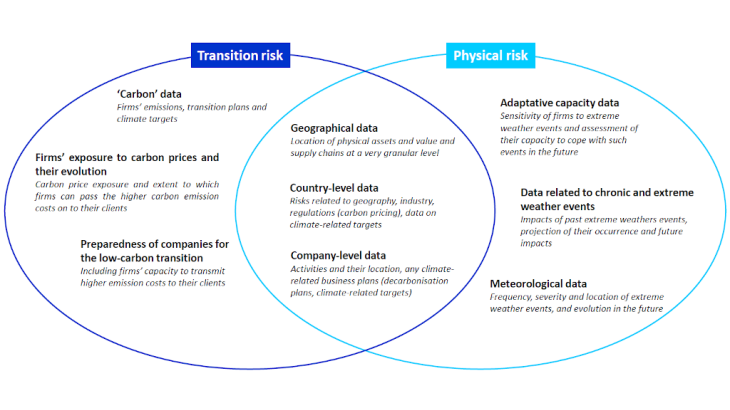

The Progress report on bridging data gaps published by the Network for Greening the Financial System (NGFS) in 2021 identified six main use cases for the data needs of financial stakeholders: (i) exposure quantification; (ii) investment and lending decisions; (iii) scenario analysis and stress testing; (iv) climate-related disclosures; (v) financial stability monitoring; and (vi) macroeconomic modelling. These use cases often rely on analysis and quantification methodologies and on the calculation of metrics (carbon footprint, alignment scores, etc.). For example, assessing exposure to physical risks requires measuring the impact related to assets’ exposure and vulnerability to climatic hazards, and their capacity to adapt. Exposure to transition risks requires measuring the impact of a transition to a low-carbon economic model on the assets. Taking climate-related risks into consideration for all use cases requires specific data (see Chart 2) that have to be reliable, granular and forward-looking (10 to 15 years horizon or more, compared with the 3 years horizon generally considered in financial stakeholders’ models) despite the fact that available data provide a backward-looking perspective. Data should also allow for international comparisons of financial stakeholders’ exposures.

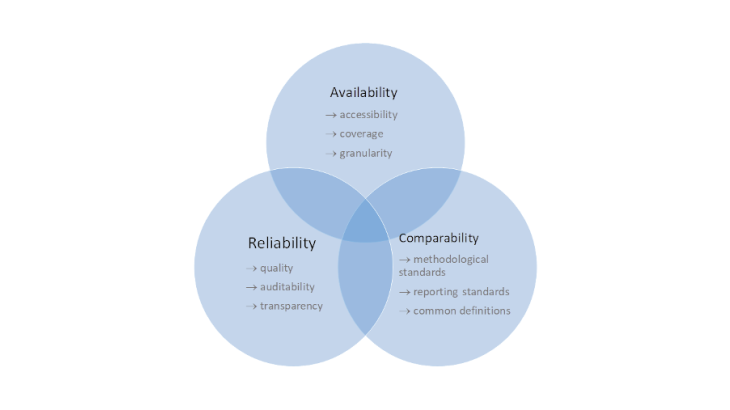

Availability, reliability and comparability

The lack of forward-looking data (firms’ emissions pathways, for example) is problematic as climate-related risks are extremely non-linear. Furthermore, some “carbon” data, such as those on Scope 3 emissions (those indirectly produced as a result of a company’s activities), are only rarely available. In some cases, data exist but are difficult to access as they are scattered across different sources and/or only available via private data providers. Lastly, available data do not always have the required granularity or geographical and sectoral coverage.

Furthermore, the data available are not always reliable, as they are rarely audited. The non-transparency of methodology providers is also a cause for concern insomuch as they sometimes rely on the use of estimated data and/or calculation methods and assumptions that vary between providers. Results can thus be variable or inconsistent.

Lastly, differences in the design and focus of existing frameworks for climate-related disclosures, alongside a lack of consistency between them, make comparing reported data difficult.

In the short-term, we have to make the most of existing solutions and tools

As the sphere of climate-related data is still evolving, it could take some time before high-quality data are available globally. Financial stakeholders should therefore look beyond this, and start taking climate-related risks into consideration by using existing data and tools, which have proved to be a useful means of bridging the gaps in the short term (NGFS, 2021).

First, it is important to ensure that existing data, which are sometimes available but not easily exploited by financial stakeholders or well known outside the scientific community, are better disseminated. This is particularly true of physical risk-related data, such as geospatial and meteorological data provided by public platforms like the World Resources Institute’s Global Forest Watch or the European Space Agency’s Climate Data Dashboard.

Second, using proxies, estimates and modelled data to make up for the absence of raw data, or qualitative approaches aimed at improving resilience and reducing the need for data (engagement with clients, for example) are also good alternatives.

Lastly, digital tools such as machine learning facilitate access to data by gathering scattered data or by exploiting data that are in an unusable format, for example. This field of activity is well known and has already prompted initiatives aimed at promoting innovation. Open data initiatives have also been launched: approaches similar to the French government’s Etalab have placed a great deal of relevant data in the public domain, while the European Commission has presented its proposal for a Regulation establishing a European single access point to financial and non-financial information disclosed by companies. Open source platforms such as OS-Climate and the collaborative ESA-NASA platform have also been recently created.

Expertise on the use of available data and tools must still be shared if we are to make the most of them.

Efforts underway to bridge the persistent gaps

As identifying available data continues to be challenging, the creation of public repositories pointing to existing data and informing users on how best to access relevant data sources is a significant step forward. The repository of the NGFS (2022) will allow the generation of a detailed list of the data needed to assess climate-related risks and their sources. Relevant but missing data will thus be systematically identified, and data gaps will be more easily bridged.

In addition, recent reports have looked into the data needs of financial stakeholders (Financial Stability Board, 2021; Bank for International Settlements, 2021), and issued recommendations to bridgethe persistent data gaps. The NGFS report groups them into three “building blocks”: (i) convergence towards global disclosure standards; (ii) efforts towards a global taxonomy; and (iii) development of more transparent methodological standards and metrics. Several initiatives are underway on the first two of these building blocks, notably from the European Financial Reporting Advisory Group and the International Financial Reporting Standards Foundation (development of disclosure standards), and the International Platform on Sustainable Finance (work on a common ground taxonomy). As for the third block, the European System of Central Banks is coordinating efforts to develop methodologies and benchmark indicators to estimate the carbon footprint of financial institutions' portfolios and their exposure to physical risks. Lastly, on the data side, a working group within the BIS Innovation Network is conducting an initiative aimed at increasing their use in the financial sector, while the third phase of the G20 Data Gaps Initiative focuses heavily on climate change, and central banks and national statistical institutes are working together through the Committee on Monetary, Financial and Balance of Payments Statistics to improve existing environmental databases and develop a European data catalogue.

In conclusion, while the gaps in climate-related data are real, they are not an unassailable obstacle stopping financial stakeholders from taking climate-related risks into consideration. They do not appear to be insurmountable.

Updated on 25 March 2024