- Home

- Publications et statistiques

- Publications

- Are bancassurers more resilient? A Frenc...

Post n°304. The French bancassurance model stems from the growth of the life insurance market. Based on the results of a model of 800 French banks on a non-consolidated basis over the 1993-2021 period, being part of a financial conglomerate enhances the resilience of groups due to the fact that they are exposed to certain external shocks in an asymmetric manner.

Source: ACPR

Note: The Z-score is constructed as the ratio of the sum of the mean return on assets (ROA) and equity-to-assets ratio, divided by the standard deviation of the ROA, calculated over a rolling 3-year period. The Z-score indicates the number of standard deviations the bank's ROA has to drop before it becomes insolvent: the higher the Z-score, the lower the probability of the bank defaulting.

The bancassurance model: a feature specific to France

The French financial landscape is characterised by the presence of financial conglomerates combining banking and insurance activities, with the term “bancassurer” applying more specifically to an insurance subsidiary.

Historically, the development of such groups stemmed from the growth of the life insurance market and the search for economies of scale in the banking networks. There is no consensus in the economic literature as to the costs and benefits of belonging to such conglomerates in terms of their resilience, nor on whether the concept of a “conglomerate discount” developed in corporate theory can be applied to financial conglomerates. The expected benefits from a group's point of view include economies of scale and scope, risk diversification (Baele et al., 2007), and the complementarity of financing structures between banks and insurers. The costs to the group are associated with a higher volatility of new activities when the group seeks to diversify (Stiroh and Rumble, 2006; Meslier-Crouzille et al., 2016). From a supervisor's point of view, there are additional concerns regarding financial stability resulting from possible increased risk-taking by the banking entities making up a financial conglomerate which could feel protected by being part of a large group (moral hazard) and increased risks of interconnection between the banking and insurance sectors.

The rules applicable to the supervision of financial conglomerates at European level and the criteria for their identification are defined by the Financial Conglomerates Directive (FICOD), published in 2002. It establishes three criteria for identifying financial conglomerates, including (i) a parent company that is a regulated entity; (ii) at least one entity of the group must belong to the insurance sector and at least one other to the banking and investment services sector; (iii) a significant proportion of the group's consolidated or aggregated activities must be in the insurance, banking or investment services sectors. In practice, total financial sector activities must exceed 40% of the group's total balance sheet.

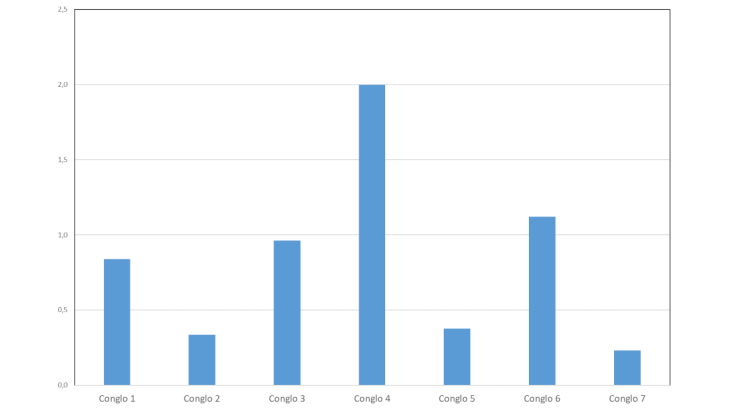

A descriptive statistical analysis based on two prudential databases used by the Autorité de contrôle prudentiel et de résolution (ACPR) shows that the seven groups producing "Conglomer" reports (BNP Paribas, Groupe BPCE, Groupe Crédit Agricole, Groupe Crédit Mutuel, HSBC-Continental Europe, La Banque Postale, Société Générale) are fairly heterogeneous in terms of their financing structure. First, the cross-exposures between the banking and insurance activities in the total liabilities of the groups' consolidated accounts vary tenfold, ranging from 0.2% to 2% depending on the group under consideration, a relatively small share (Chart 2). Furthermore, the share of the insurance business in the total net profits of these groups varies from 6% to 30%. Lastly, the relative share of intra-group refinancing of banking activities in relation to insurance activities varies from one group to another, since in three groups the banking sector is a net debtor to the insurance part, whereas the opposite is true in the other four groups.

Comparative resilience of banking entities in a financial conglomerate and other banking entities

In a recent research paper (Pouvelle, 2022), we attempt to shed light on the impact for an entity of belonging to a financial conglomerate in terms of profitability (measured by Return on Assets - ROA), risk-taking (volatility of ROA), default risk (Z-score) and resilience of intra-group financing (volatility of the growth of this form of financing), particularly in times of financial stress. To do this, we estimate a panel model for each of these four variables of interest. The data, from the SURFI prudential database, cover 114,000 observations on almost 2,000 banks on a non-consolidated basis, with a quarterly frequency over the 1993-2021 period. The models include various macroeconomic, financial and individual bank control variables, including the size of the entity, the risk density of its assets and the share of loans to the non-financial sector in its balance sheet total. Our variable of interest is an interaction term between a variable of belonging to a financial conglomerate and periods of financial stress, i.e. we create a new variable corresponding to the product of these two variables. Periods of financial stress are defined as periods in which the VIX index, an indicator of financial volatility reflecting the risk aversion of international investors, exceeds the 75th percentile of its distribution (value of 23.2).

It should be noted that the banking entities belonging to a financial conglomerate represent a predominant share of the French banking sector in aggregate terms, with a share of 77% of total banking assets, which underscores the concentration of the French banking sector. However, the number of non-conglomerate banks is higher: 380 compared to 300 at the most recent observation date.

Our results indicate, first of all, that belonging to a financial conglomerate has a stabilising impact from the banking entity's perspective on the volatility of return on assets (ROA), measured as the standard deviation of the annualised net profits to total assets ratio over a rolling 3-year period. The impact on the growth of intra-group financing is similar. This impact is even greater in times of financial stress. Furthermore, belonging to a financial conglomerate reduces banks' default risk, as it has a positive impact on their Z-score, which is constructed as the ratio of the sum of the mean ROA and leverage ratio, divided by the standard deviation of the ROA, calculated over a rolling 3-year period (Chart 1). In contrast, as regards the impact on the bank's profitability, belonging to a financial conglomerate does not affect the level of ROA. Overall, these results seem to rule out the assumption of moral hazard, i.e. less prudent behaviour or excessive risk-taking, associated with belonging to a financial conglomerate. Instead, they illustrate the benefits in terms of risk diversification at the group level in times of market stress, without highlighting any increased risks to financial stability.

Prudential implications

The cross-financial relationships, concentration risks and interactions between banking and insurance entities within conglomerates call for close cooperation between sector supervisors (banking, insurance and financial markets). This highlights the importance of having an integrated supervisor covering several sectors, such as the ACPR in France. While the advantages for banking entities of belonging to a financial conglomerate seem clear, the management of insurance entities must depend on their primary purpose, namely to serve the interests of policyholders. At the same time, shareholders must be able to provide support to their subsidiary in the event of equity problems.

Updated on the 25th of July 2024