Accounting for Intergenerational Wealth Mobility in France over the 20th Century: Method and Estimations

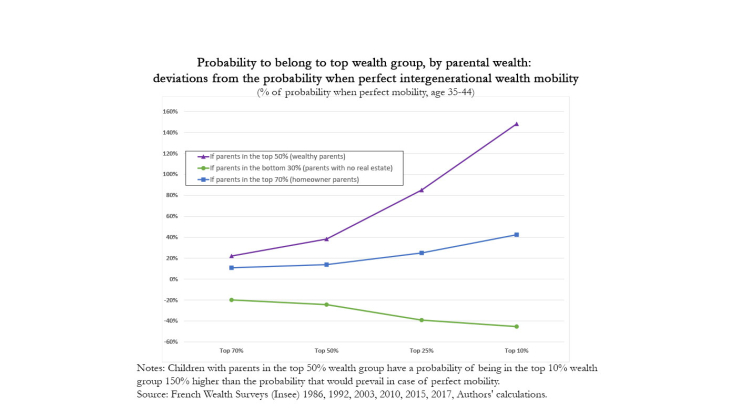

Working Paper Series no. 776. We propose a new and simple method to study intergenerational wealth correlation between two generations, which is easy to implement in wealth (and housing) surveys and aims at overcoming the strong data limitation faced in most of the countries. We show that the ownership of housing assets can be used to proxy for three wealth groups for all cohorts. Misclassification induces a low and downward bias in the estimate of the intergenerational correlation. Using France as an example, we estimate intergenerational wealth correlation for cohorts covering the 20th century and focus on the wealth positions measured at the mid-life cycle of both children and parents. First, probabilities to belong to top wealth groups are increasing with the wealth of the parents. This intergenerational correlation has increased over time for most of the top wealth groups. Second, the higher we move up along the children’s wealth distribution, the larger the role of parental wealth: the persistence in the top 50% is 38% higher than under perfect mobility and the deviations from perfect mobility are larger in higher top wealth groups. Third, 50 to 60% of the correlation is accounted for by a mix of intergenerational wealth transfers, fathers’ occupation and children’s education. Fourth, gifts and bequests explain a larger share of the link between parental wealth and the probability to belong to the top 10% compared to larger top wealth groups. We also find evidence of persistence of the effect of parental wealth over the life-cycle.