1 Higher prices boosted the property wealth of affluent households to an extent in France, and even more so in Germany

A low interest rate environment conducive to increased debt and property wealth

Property assets are far and away the largest component of household wealth (Garbinti and Savignac, 2018). In 2021, they made up 80% of gross household wealth in the euro area.

House prices exhibited fairly different trends in the euro area’s four largest economies over the 2010 2021 period. In Germany, prices rose steadily from the mid 2000s onwards, but elsewhere, after increasing in the early 2000s, they fell following the 2008 2009 financial crisis, sharply in Spain and Italy but only slightly in France, before climbing again through to mid 2022 (see Chart 1).

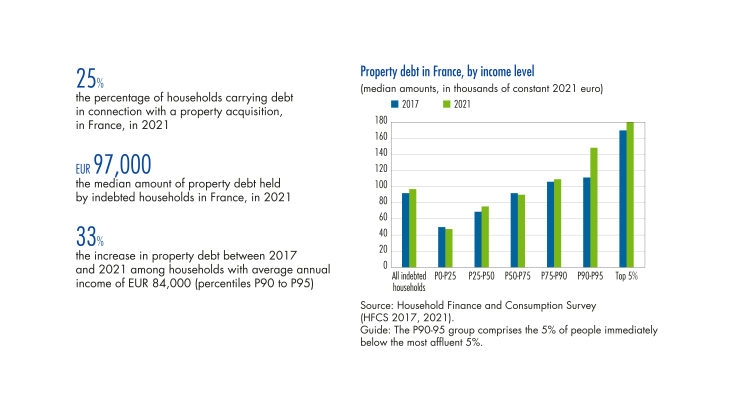

More recently, between 2017 and 2021, house prices went up across the board, rising strongly in Germany (35% increase), to a more measured extent in France and Spain (19%), and much less in Italy (4%). Financing costs decreased significantly for euro area households over the same period (although only from 2020 in Spain), bottoming out in 2021 (see Chart 2). Since then, with inflation picking up again, lending rates have risen everywhere, staying lowest in France.

Throughout that period, firming house prices boosted the wealth of property owning households while simultaneously pushing up acquisition costs for buyers. Having said that, buyers benefited from the decline in interest rates until 2021.

The share of homeowners remained steady in France and Germany, while shrinking in Spain

According to the HFCS (see box below), the percentage of households who own their main residence varies considerably among the four large countries of the euro area. In 2021, it was over 70% in Italy (77%) and Spain (73%), 58% in France and just 44% in Germany. These shares themselves are the result of contrasting trends across the four countries.

In Spain, the percentage of homeowner households has fallen steadily since 2010, shrinking from 83% to 73% in 2021, with households aged below 45 years especially affected: between 2010 and 2021, the proportion of households aged 35 44 years owning their own home contracted from 21% to 16.5%. …