- Home

- Governor's speeches

- Venturing into open waters to unlock Eur...

Venturing into open waters to unlock Europe’s innovative potential

François Villeroy de Galhau, Governor of the Banque de France

Published on the 18th of March 2025

Euronext Paris – Building the Savings and Investments Union for real

Paris, 18 March 2025

Speech by François Villeroy de Galhau, Governor of the Banque de France

Ladies and Gentlemen, dear Stéphane,

I am pleased to attend this birthday celebration: Euronext is 25 years old, only one year younger than the euro. And both are remarkable examples of European success and pride. Yet, to deliver fully, both need to be complemented with greater economic and financial integration. I cannot agree more with what Commissioner Albuquerque just said.

A decade ago, when the Capital Markets Union appeared, macroeconomic stabilisation was its foremost priority. Today, the overriding objective for our rebranded Savings and Investments Union (SIU) is to ensure an efficient capital allocation, to fund our investment needs. This story has been going on for so long that it often raises doubts: why would the project take off now? I suggest three reasons for hope. First, it has gained political ownership since last year, and in particular since the Letta report. Second, today, Europe may be coming into its own. D. Trump seemingly aspires to break it, but he may be achieving the opposite. And there can be no strategic and military autonomy without economic and financial sovereignty. Finally, we are beginning to focus on a limited number of strong actions rather than the long list of small items (36 !) in the 2020 action plan. As I am at Euronext’s annual conference, I will focus on corporate equity for building a stronger economy. I will first elaborate on our “Schumpeterian gapi ” and its twin deficits (I). I will then suggest three milestones to scale up European equity and innovation financing (II).

1. The twin deficits of our “Schumpeterian” gap: innovation and equity

1.1. Don’t forget Draghi

Let me first remind the obvious. Europe lags behind on growth, productivity and innovation. Cumulative GDP growth per capita in the United States between 1999 and 2023 reached 39%, against 26% in the euro area. European companies invest, as a share of GDP, only half as much in research and development (R&D) as their American counterparts. In the meantime, our investment needs have hardly ever been greater: if we add “Rearm Europe” to the famous Draghi figures, EU would have to invest an additional EUR 900 billion yearly to remain competitive in key sectors, such as the environmental and digital transitions, defence and innovation.

This effort would account for more than 5% of our GDP. Yet, public resources are scarce and we cannot ramp up fiscal spending indefinitely.

Only four global Top 50 tech companies are European.ii. However, during the last decade in Europe, total tech industry workforce has increased sevenfold compared to the previous decade and total capital invested rose tenfold iii, showcasing a positive dynamic.

So much for a clear-headed diagnosis. Now, what is the therapy? Before coming to its financial aspects, I want to stress the importance of economic remedies and structural reforms I see with some concern the “D” of Defence eclipsing and even crushing the “D” of Draghi in our public debate today. The Letta and Draghi reports and the Commission's “competitiveness compass” last February call for three imperatives – three “Is” – that cost nothing in fiscal terms: (i) ‘Integrate more’ the single market, particularly in services; (ii) ‘Invest better’, particularly in energy and technology; and (iii) ‘Innovate faster’, by cutting red tape. If we don't do this together, quickly and decisively, Europe's strategic autonomy would once again be lost in the sands of economic decline.

1.2. Equity, our new frontier

But there is a financial component to the treatment. I won't deal this evening with public funding, which is the only option for defence: the German shift is welcome. The Bundestag vote today is a game changer for Europe, a historical breakthrough. The French challenge is more difficult, because we have squandered too much of the ‘peace dividends’ in the past on spending on everyday comforts. Private funding is more promising: the European challenge is not a lack of it, but its misallocation.

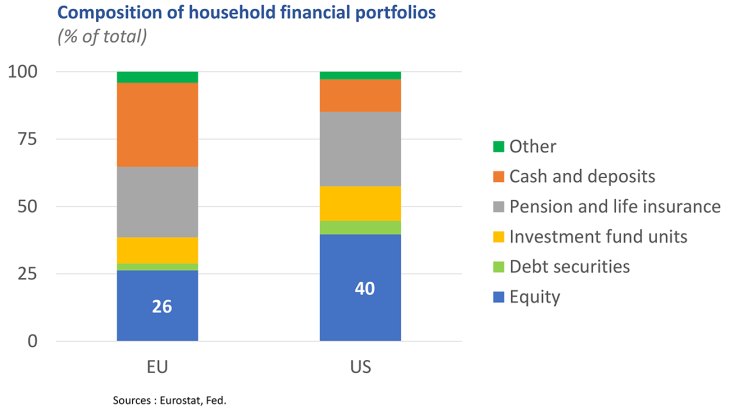

The EU has considerable private savings, amounting to 5,5% of GDP yearly, against 3,4% in the US.iv. However, the structure of European households’ financial portfolios reveals a predominance of low-risk assets.

US households allocate more than 50% of their portfolios to riskier assets, whereas these account for only a third of the assets of European households. Moreover, European private savings surplus (around 300 billion in 2023) are channelled across the Atlantic to fund US corporates or public debt, rather than European companies.

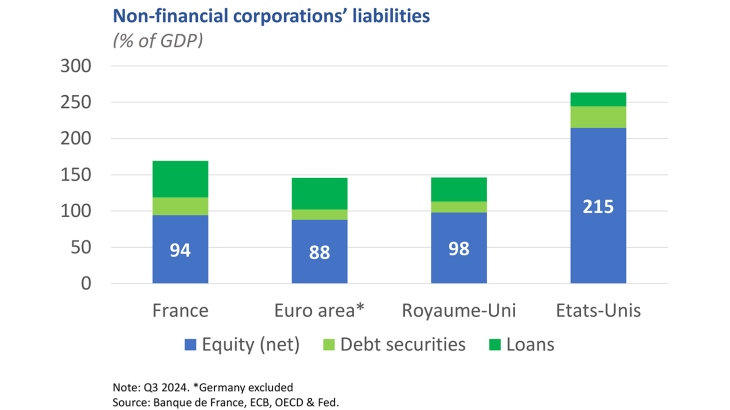

Europe’s economy does not lack credit financing; it lacks equity funding. We can pride ourselves on having a robust banking sector. Banking assets weight 300% of GDP in the EU, against only 85% of GDP in the US. Debt market-based financing is relatively less developed in the euro area than in the US, and used predominantly by larger companies. But the real gap lies in equity: equity financing of non-financial corporations amount to 215% of GDP in the US, compared to 88% in the euro zone.

Equity capital financing allows for longer-term horizons, greater flexibility and higher risk tolerance, which are necessary in frontier technologies. This aspect is key, as the bulk of the productivity growth gap between France and the United States over the period 2000–2019 stems from IT-intensive sectors.v.

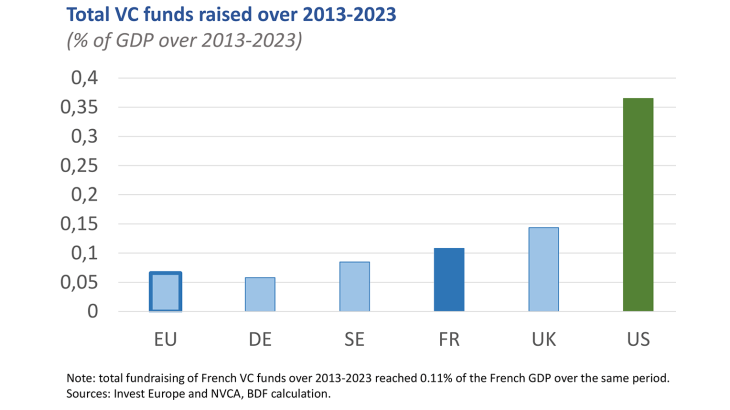

We all know that total market capitalisation is about four times lower in Europe. European venture capital remains underdeveloped in comparison with the United States in all segments, from early to late stage funding. VC funds raised from 2013 to 2023 amounted to 0,36% of GDP in the US, while it represented a mere 0,07% of GDP in the EU, with some heterogeneity between European countries.

Furthermore, we remain reliant on foreign VC to fund European innovation, for more than 50% of late-stage investments in European tech.

2. Three milestones to scale up European equity and innovation financing

Let me now set out three milestones to scale up European equity and innovation financing. We should be taking the best from America, and leaving the rest. Let us become more simple, more innovative, more risk-friendly.

2.1 Harmonisation and simplification over deregulation to unlock growth

When it comes to regulation, we need less and more: less rules, more harmonisation. Contrary to a strong wind blowing from across the Atlantic, I have argued that “simplification is not deregulation” vii . We stick to the objectives of financial stability and climate, but we reduce complexity. In this regard, the EU Commission’s first proposed Omnibus directive is welcome as it alleviates the regulatory burden on European SMEs and intermediate-sized entities, but its balance will have to be fine-tuned. We could possibly streamline somewhat MIFID, and keep the Retail Investment Strategy simple.

Additionally, greater harmonisation brings clarity. Euronext’s pioneering spirit in launching the single prospectus initiative - S1 - is commendable — a concrete step towards reducing market fragmentation. We welcome the emergence of "coalitions of the willing" among private actors, who are moving forward within the existing regulatory framework. But we should seek ingenious workarounds to accelerate the process, such as a 28th regime viii creating an optional, harmonised legal framework in key areas such as corporate law, labour, and taxation. We should always seek to reduce the European market fragmentation that limits our effective market size, hindering firms’ ability to scale up. ix. And we need a greater harmonisation of supervision. ESMA’s direct supervision of crypto-asset services providers x and cross border systemic market infrastructures such as CCPs and CSDs would be a significant step towards a unified capital market.

2.2. More innovative: boosting European venture capital

A well-functioning equity financing ecosystem is a prerequisite for scaling companies; from venture capital allowing start-ups to develop breakthrough technologies, to private equity for growth and to listed markets for further expansion. Strengthening the pipeline from early-stage funding to market exit – whether through IPOs or strategic acquisitions – would help retain high-growth firms in Europe. The underdevelopment of European VC is rooted in the fragmentation of our financial markets and tax regimes, the risk aversion of institutional investors and the limited role of pension funds, which amount to only 30% of EU GDP (against 136% in the US).

The Tibi initiative launched in France in 2019, has enabled to channel long-term institutional capital into equity financing of innovative and growing tech companies. “Tibi-labelled” funds have mobilised a total of EUR 13 billion for 2020-2026, effectively doubling insurers’ participation in VC fundraising rounds xi. This success inspired Germany’s “WIN initiative”, aiming to raise EUR 12 billion between 2025 and 2030. Complementing national initiatives, a new version of the European Tech Championship Initiative (ETCI), open to private investor could be boosted. We should complement this with much stronger public-private partnerships, with European public capital supplementing pari-passu cross-border private funds. To date, this initiative has gathered a funding of EUR 4,15 billion, a favourable yet insufficient amount to bridge the scale-up gap in Europe. Encouraging institutional investors to diversify their asset allocation through regulatory adjustments and incentive structures could unlock substantial capital, as proposed by the IMF xii.

2.3. Fostering a culture of well-informed risk-taking

Eventually, we have to sail closer to the wind. To unlock our untapped growth and innovation potential, fostering a culture of well-informed risk-taking is essential.

A competing explanation pointed out by entrepreneur Olivier Coste is that our innovation deficit stems not only from fragmented markets or insufficiently deep and liquid capital markets, but from the cost of failure deriving from overprotection of some stakeholders xiii. Our system could evolve to a more Danish style “flexisecurity”, and improved insolvency law possibly through the 28th regime. Corporate restructuring costs may be up to ten times higher in countries with stronger employment protection legislation xiv – in that case for highly qualified workforce –, such as France or Germany, undermining profitability and competitiveness. This factor especially affects the tech sector, where projects have a greater risk of failure. It discourages venture capital and private equity funds from investing in Europe.

With a more audacious mindset, investments are also concentrated on high-risk, high-impact projects xv. The US and China have built their technological and industrial leadership by channelling capital into bold, transformative ventures, particularly in sectors like AI, biotech, and green energy. By contrast, Europe often favours too incremental innovation, in fairly mature sectors, and excessive fragmentation in its public and private investments xvi, – the so-called “Middle-Technology trap”, stressed among others by Jean Tirole.

Financial education is another key pillar of the SIU. A better-informed public is more likely to engage in capital markets – with a reduced home-bias –, ensuring that European households savings are efficiently allocated to productive investments rather than sitting in low-yield deposits.

Let me conclude: Europe has strengths to leverage: stable institutions, high-quality human capital, advanced infrastructures, as well as abundant savings. We need to mobilise all available assets towards a common ambitious and meaningful goal. Let’s not downplay the obstacles we are facing, nor the international headwinds. But let’s have more of an American virtue: self-confidence. The stoics teach us that we are not defined by external events, but by how we choose to respond to them. Or as Seneca states: “We cannot direct the wind, but we can adjust the sails”.

i Villeroy de Galhau (F.), "Europe’s growth gap: reconciling Keynes and Schumpeter | Banque de France", speech at College of Europe, 31 March 2021.

ii These four companies are: SAP, ASML, Schneider electric and Spotify. Source: CompaniesMarketCap. Largest tech companies by market cap. Accessed March 2025.

iii Atomico, "The State of European Tech 2024", Executive Summary, December 2024.

iv OECD. National Accounts – Gross Saving, United States. OECD Data Explorer. (Accessed March 2025)

v See figure 3 in Bunel, S., Clymo, A., Garnier, O., & Zago, R., Revisiting the European performance gap vis-à-vis the United States, Bloc-notes Éco, Banque de France, February 28, 2025.

vi Lagarde (C.), “Follow the money: channelling savings into investment and innovation in Europe” Speech at the 34th European Banking Congress, European Central Bank (ECB), November 22, 2024.

vii Villeroy de Galhau (F.), “Towards a realistic simplification: untying some knots in European banking regulations”, Banque de France, February 6, 2024.

viii Von der Leyen (U.), Lagarde (C.), "Europe must act now to strengthen its competitiveness", Financial Times, February 2025.

ix Bordon, A. R., Di Leno, L., Monteiro, J., & Vanhala, J. et al. Europe’s Productivity Weakness: Firm-Level Roots and Remedies. IMF Working Paper No. 25/40, International Monetary Fund.

x Barbat-Layani (M.-A.), Villeroy de Galhau (F.), "European supervision: crypto first! | Banque de France", Banque de France, 14 November 2024.

xi France Invest (2023). Le capital-investissement Venture et Growth en France – Étude 2023. February 2023.

xii International Monetary Fund (IMF), "Europe Can Better Support Venture Capital to Boost Growth and Productivity", July 2024.

xiii Coste (O.), Europe, Tech and War, Amazon, November 2022.

xiv Coste, O. and Coatanlem, Y. The Cost of Failure and the Quest for Competitiveness: Disruptive Innovation as a Catalyst. IEP Policy Brief No. 24, IEP @ Bocconi. 2024.

xv Tirole (J.), "L’Europe prend le risque de devenir une figurante", Le Point, 30 janvier 2025.

xvi EconPol Europe, "EU Innovation Policy: How to Escape the Middle Technology Trap", Policy Report, February 2024.

Download the full publication

Updated on the 18th of March 2025