- Home

- Governor's speeches

- Financial services: The European mysteri...

Financial services: The European mysterious gap

François Villeroy de Galhau, Governor of the Banque de France

Published on the 4th of September 2024

Bruegel Annual Meetings – Brussels, 4 September 2024

Speech by François Villeroy de Galhau, Governor of the Banque de France

Ladies and Gentlemen,

I am delighted to be in such good company this afternoon in Brussels; and I would like to take this opportunity to thank Bruegel very warmly for its work and for its memo on EU financial services. This is a key topic for the future of the European economy, and, more generally, for European sovereignty. Yet it is marked by a mysterious and increasing gap: the more reasons we have to go forward on financial services, the less progress we make (I). In order to close this gap, three key courses of action appear of particular relevance (II).

I. A mysterious and increasing gap

Let me start by recalling four major reasons why Europe should move forward again.

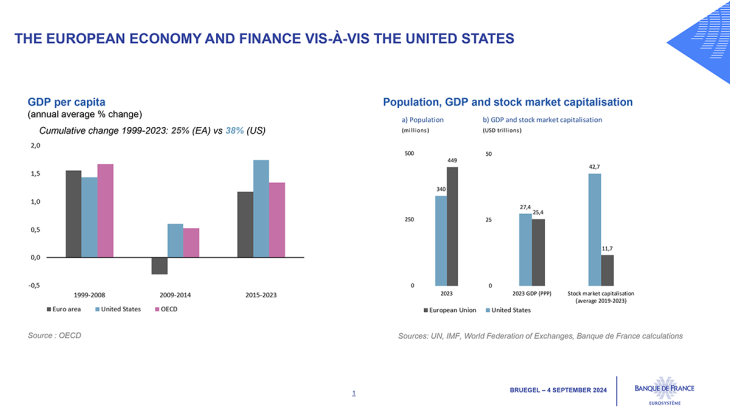

First, Europe is still lagging behind in terms of economic dynamism. Over the last 25 years, GDP per capita has increased by a cumulative 25% in Europe, compared with 38% in the United States.

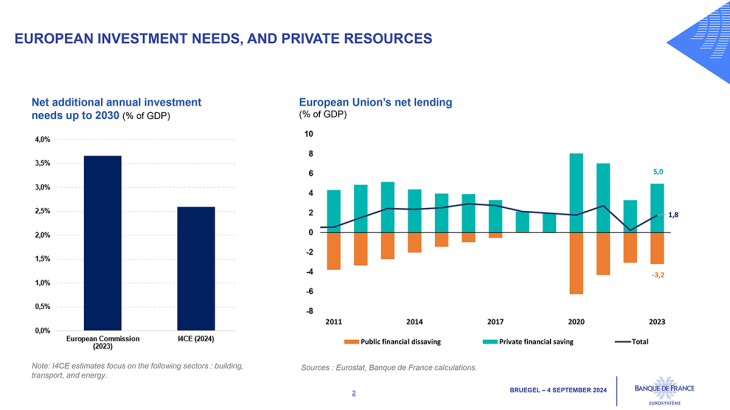

This has a primary, “Schumpeterian” cause: an innovation gapi, and is coupled with a much smaller financial firepower despite fairly similar market size. Second, while climate change has unfortunately seemed lately to be less of a priority in international fora, the need to address it is becoming more pressing. Studies released this year suggest that the damage from chronic physical risks could amount to 15% of GDP by 2050, higher than the 5% estimated so farii. Third, public debt and deficits remain very high in some major EU countries. In this context, it is imperative to better mobilise our abundant private savings in order to fund the needed investments. Fourth, geopolitical tensions and political uncertainties remain at a high level, and call for a stronger economic and financial autonomy of Europe.

Meanwhile, we have been slow on measures to enhance European financial services. While we have a Supervisory Union – we are celebrating this year the 10th anniversary of this huge successiii –, we don’t have a real Banking Union. Beyond supervision, how to resume progress on the two other institutional pillars? Regarding the second pillar, namely resolution, we should not run the risk of enshrining disparate national procedures, and ultimately significant variations in the recourse to external funding. Regarding the third pillar, the stalemate on a fully-fledged European Deposit Insurance Scheme (EDIS) leaves it up to us to find alternatives, I will come back to it later.

Furthermore, without large European banks operating at the scale of the euro area, the Banking Union has little substance. The official side cannot, on its own, make these banks exist, but we should be mindful of not impeding their development. Cross-border mergers within the euro area have been few, small and all but transformative in the past 10 yearsiv. Even in the European wholesale financial markets, where financial integration is effective, European banks are not leaders: among the top 10 banks generating the bulk of investment banking fees in Europe, there are only 3 SSM banks, accounting for 29% of these fees while US banks bring in 55% of investment banking revenues. As for the Capital Markets Union (CMU), which has been promoted for the past ten years, it has proved insufficiently galvanisingv from a political standpoint.

This gap between reasons for action and progress on action remains a bit of a mystery. Jean Monnet famously predicted that Europe would be built through crisesvi, and Europe has not faced a financial crisis since 2012 – which is per se obviously good news. However, it would be too heavy of a paradox if the financial security created by our efficient Supervisory Union prevented Europe to move forward to an efficient Banking Union. To change gears and boost investments in priority sectors for long-term European growth and innovation, let me share today three key and somewhat new ideas.

II. Three new ideas to overcome the gap

1) A Hybrid model for Deposit Guarantee

First, regarding the third pillar of the Banking Union, we have to work on more targeted solutions than a fully-fledged EDIS. In the words of my German colleague, Joachim Nagel,vii “a hybrid model would offer multiple benefits over a centralised, purely European model”. With this in mind, we could indeed keep the current national schemes, with their autonomous decision-making, as permitted by the Deposit Guarantee Scheme Directive (DGSD). Therefore, fully in line with the subsidiarity principle, we could build a European support scheme for DGSs as a liquidity backstop when a DGS’s own resources would be put under excessive strain.

I support this idea, provided that we clarify that this European scheme should complement DGS resources in their traditional role: interventions to compensate covered depositors of a failed bank. Supporting other types of DGS interventions would create issues, as they are less harmonized and may be extended by the ongoing CMDI review. Introducing this new common safeguard would bring considerable benefits for financial stability in all participating Member States. And it would pave the way for renewed discussions on waivers and cross-border integration, which are much needed to achieve the Banking Union.

2) Refocusing the purpose and content of CMU

Second, regarding the CMU, the objective today is very clear: we must unlock the funding needed for Europe’s twin transformation – green and digital – and ensure its effective allocation.

Shifting to this allocation objective – rather than mere stabilisation – calls for a rebranding as a Savings and Investments Union, to reflect this higher purpose. And on its content, let us refocus and replace a long list of small technical items by a short list of big itemsviii – green securitisation, venture capital, supervision.

In concrete terms, the development of green securitisation could boost banks’ capacity to finance green projects by several hundred billion euro a year; it could be accelerated by the creation of a common European issuance platform, or even by public incentives such as a European guarantee. As advocated by Bruegel’s memoix, our green transformation could also benefit from a clarification in the EU legal framework of “sustainable finance” and “transition finance”. When it comes to venture capital, we should develop a more ambitious public-private partnership with pari passu co-investments, around the European Investment Bank, in particular to close the financing gap for scale-up companiesx. I also concur with your memo to advocate a genuinely European supervision, along the lines of the US SEC or the European SSM for banks. In this way, ESMA could exercise single or at least joint oversight over cross-border players that have acquired systemic importance, including certain market infrastructures: central securities depositories and CCPs.

3) An innovative European sovereignty strategy on payments

Payments have too often been considered as a technicality, a boring and back office issue.

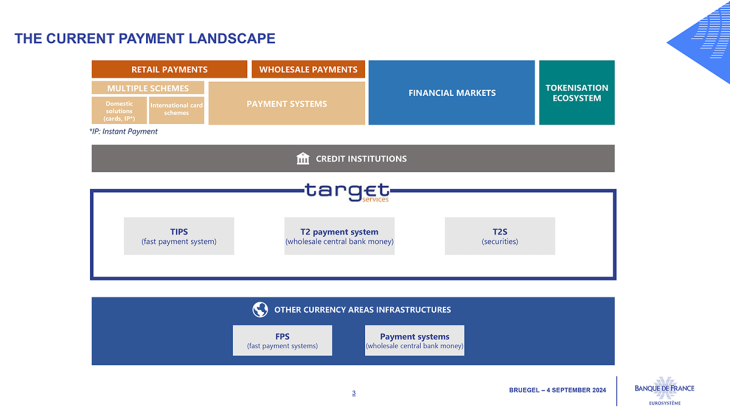

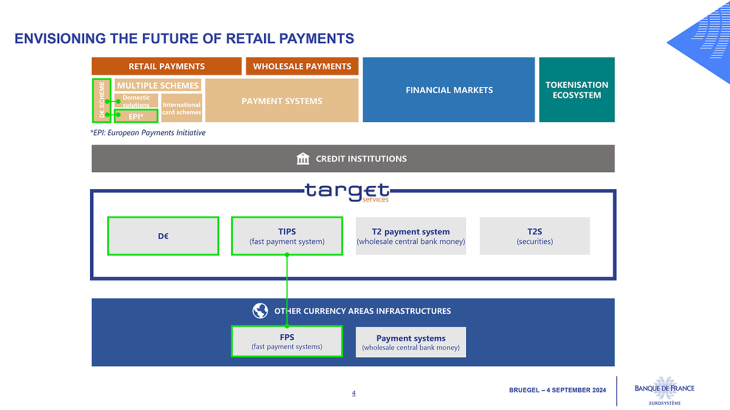

We should definitely change our view: this field is highly innovative and more and more competitive globally. A European strategy here could reinvigorate Banking Union and CMU. Let me start with retail payments: here, we need to address fragmentation and increase our strategic autonomy. To meet this ambitious goal, the Eurosystem welcomes private initiatives such as the European Payments Initiative (EPI), and should focus its own efforts on the “last kilometre”; we have TIPS, but we don’t have yet harmonised front-end payment solutions. Some countries, including Brazil and India, have met this challenge through enhanced fast-payment systems. In the euro area, the digital euro project could also help here.

Furthermore, in line with the G20 roadmap, we are set to reduce the frictions, delays and costs in cross-border payments, including by interconnecting TIPS with other fast-payment systems.

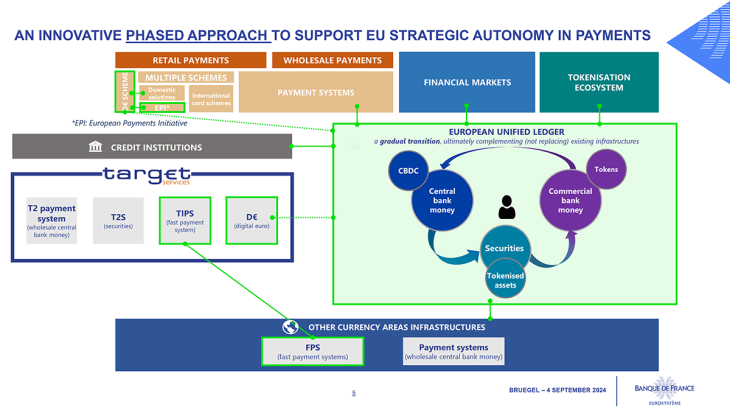

On wholesale and financial markets, we should develop a new type of market infrastructure to meet the growing demand for tokenisation in finance. This is why we need to explore a DLT-based European unified ledger, namely a new public-private infrastructure built around a distributed ledger that would include a wholesale central bank digital currency (CBDC), tokenised commercial bank money and tokenised financial instruments, and potentially the digital euro later on. This shared infrastructure would streamline transactions, reduce risks and costs, and thus foster CMU, while preserving the two-tier financial system.

The transition towards a unified ledger would nevertheless not be a “big bang”, as current TARGET Services in Europe already provide state-of-the-art services for most use cases. A phased approach could start with a wholesale CBDC for specific market segments that currently rely largely on manual and domestic processes; it would gradually extend into a broader range of tokenised assets and cross-border capabilities.

Let me conclude by borrowing the motto of the Olympic and Paralympic Games, hosted in Paris this summer: we need to take European financial services “faster, higher and stronger together”.xi To achieve this, we need to bridge the somewhat mysterious gap between our objectives and our means. The three ideas I have put forward could be key levers towards a genuine European “Savings and Investments Union”. Thank you for your attention.

iIt is illustrated by these telling figures: in the United States, high-tech industries, supported by a dynamic venture capital ecosystem, account for 85% of private R&D. By contrast, in the EU, mid-tech industries – especially the automotive industry – still absorb roughly 50% of private R&D (Fuest (C.), Gros (D.), Mengel (P.-L.), Presidente (G.), Tirole (J.), EU Innovation Policy – How to Escape the Middle Technology Trap, European Policy Analysis Group, Report, 14 May 2024).

iiVilleroy de Galhau (F.), Climate economics: from the veil of uncertainty to three convictions for action, speech, 25 June 2024

iiiVilleroy de Galhau (F.), Ten years of SSM: great achievements, and new journeys to complete, speech, 24 June 2024

ivECB, Financial Integration and Structure in the Euro Area, June 2024

vArnold (N.), Claveres (G.), Frie (J.), “Stepping Up Venture Capital to Finance Innovation in Europe”, IMF Working Paper No 2024/146, July 2024

viMonnet (J.), “I have always believed that Europe would be built through crises, and that it would be the sum of the solutions adopted for those crises”, Memoirs, 1976, p. 488

viiNagel (J.), Monetary union, capital markets union, banking union – a triad for Europe’s prosperity and resilience, speech, 23 April 2024

viiiVilleroy de Galhau (F.), Letter to the President of the Republic – France and Europe : from crisis management to a longer-term ambition, 21 April 2024

ixMerler (S.), Véron (N.), Memo to the commissioner responsible for financial services, Bruegel, 4 September 2024

xEuropean Investment Bank, The scale-up gap – Financial market constraints holding back innovative firms in the European Union, EIB Thematic Studies, July 2024

xi“Citius, Altius, Fortius – Communiter”

Download the PDF version of the publication

Updated on the 4th of September 2024