Post n° 345. Opinion surveys show that women are more sensitive than men to inflation, and expect higher levels. This difference may stem from their different daily shopping experiences. Women report more frequently than men that they had to adjust their consumption decisions in response to the inflationary shock of 2022-23.

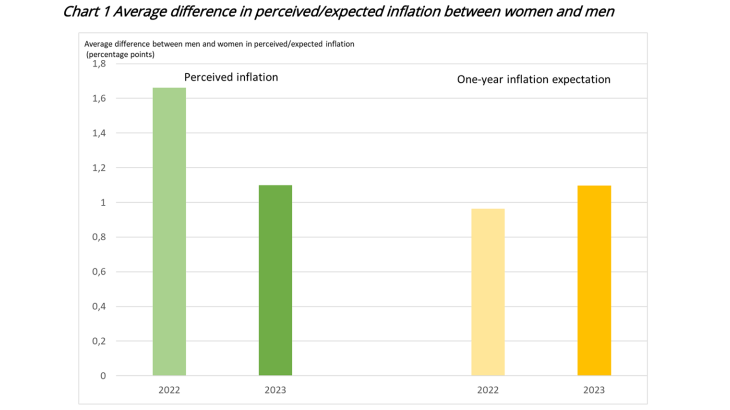

Note: all other things being equal, in 2022, inflation perceived by women was on average 1.6 percentage points higher than inflation perceived by men.

According to a recent survey (DREES 2023), housework and, in particular, grocery shopping are still overwhelmingly done by women. In 2023, food prices rose sharply (11.8% compared with 4.9% for inflation as a whole) and women were therefore more exposed to these price rises than men. Using survey data, this blog post explains how this difference in daily exposure to price rises may have generated higher perceptions and expectations among women than men (Chart 1), and the differences in the way women and men adjusted their purchases and budgets to the inflationary shock.

Women have higher inflation perceptions than men

According to surveys of more than 5,000 households carried out by the Banque de France in collaboration with the CSA institute, the proportion of individuals stating that the main economic challenge is inflation and purchasing power increased much more among women (from 58% to 66%) than among men (from 62% to 64%) between mid-2022 and early 2023.

In both 2022 and 2023, women's inflation perceptions were also higher than men's: 1.6 percentage points (pp) higher in 2022 and 1.1 pp higher in 2023 (Bignon and Gautier, 2023). This difference is reflected in their inflation expectations (Chart 1). The differences here are measured assuming all other things are equal, and are therefore not explained by socio-demographic differences such as age or qualifications, or by the overall level of economic knowledge.

A similar gap in inflation perceptions between women and men was found in almost every country in the world, with the exception of Argentina, Egypt, Turkey and Zimbabwe. This was first established forty years ago by Jonung (1981). This stylised fact is therefore not specific to France or to the recent period. How can it be explained?

Different daily shopping habits explain the inflation perception gap

Individuals often extrapolate from their personal experience to shape their perception and ultimately their expectations of overall inflation. In particular, they remember more easily the prices of their frequent purchases such as food or fuel and use this information more often to estimate current or future inflation (D’Acunto et al. 2021a). Similarly, people remember price rises more easily than price falls, and this influences their inflation perceptions and expectations (Cavallo et al. 2017). One example of this difference between people's price perception and actual inflation was the changeover to the euro in 2002, which may have been due to the fact that people continued to recall the last price in French francs, and that they were more sensitive to price rises, particularly those of everyday purchases (Leclair 2017).

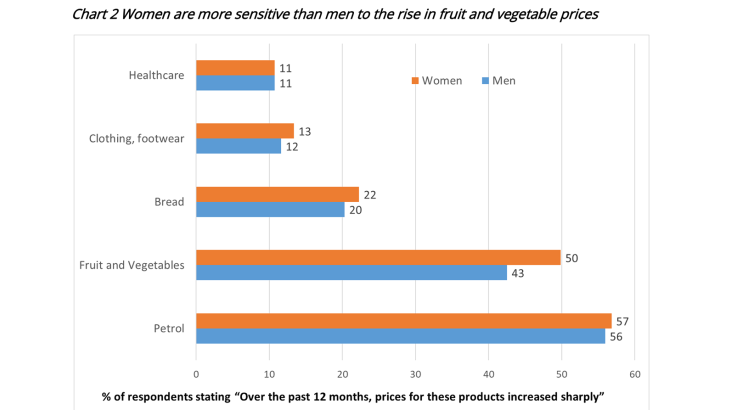

However, men and women do not necessarily have the same experience of everyday purchases and do not remember the same prices. For instance, according to the BdF-CSA survey conducted in 2023, more women than men say that the price of fruit and vegetables rose sharply between 2022 and 2023 (Chart 2). For the other expenditure items included in the survey, such as petrol, clothing and healthcare products, the differences between men and women are very small.

The sharp rise in food prices between 2022 and 2023 influenced women's perceptions of overall inflation and their inflation expectations: those who perceive a strong increase in food prices expect aggregate inflation to be 4.5 pp higher on average than those who do not perceive a significant rise in this product category (Chart 3). The corresponding difference is only 2.5 pp for men. No other product group has such a significant knock-on effect on women's overall inflation expectations. In sum, it is the daily shopping experience and the traditional gender role that explain these differences in inflation expectations: a man and a woman with the same exposure to price rises have the same inflation perceptions and expectations (D’Acunto et al 2021b).

Note: women who think that fruit and vegetable prices rose significantly between 2022 and 2023 have an inflation expectation 4.5 pp higher than those who think they remained stable (2.5 pp for men).

Differences in inflation perceptions – particularly through their role in the formation of expectations – can then have an impact on people's economic and financial decisions.

Inflation had a greater impact on women's consumption choices in 2023

According to a CREDOC-BdF survey of 3,000 households in October 2023, nearly three out of four French people changed their purchasing behaviour in response to inflation. However, this proportion is higher for women (79%) than for men (67%).

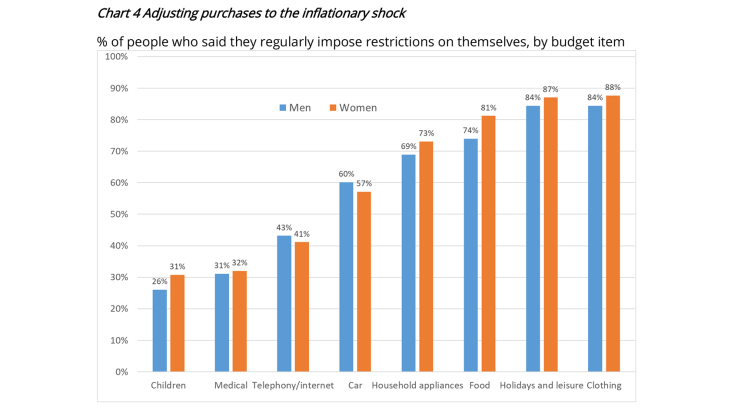

In terms of behavioural changes, a significant proportion of households (68%) report restrictions on certain budget items. Here too, more women than men seem to impose restrictions, i.e. 73% compared with 62%. The expenditure items most affected are broadly the same for men and women: for clothing, holidays/leisure and food, around 80% of people say they had to make restrictions, compared with around 30% for spending on children or medical expenses (Chart 4). That said, 81% of women declared they had to restrict food purchases, compared with 74% of men. Conversely, more men report restrictions on spending on cars and internet/telephony, although the differences are smaller (2 to 3 pp).

Margins for adjusting resources also differ

Overall, women say they are more often constrained than men in their day-to-day spending, and this is reflected in their savings behaviour: in 2023, only 53% of women said they could put money aside each month, compared with 61% of men.

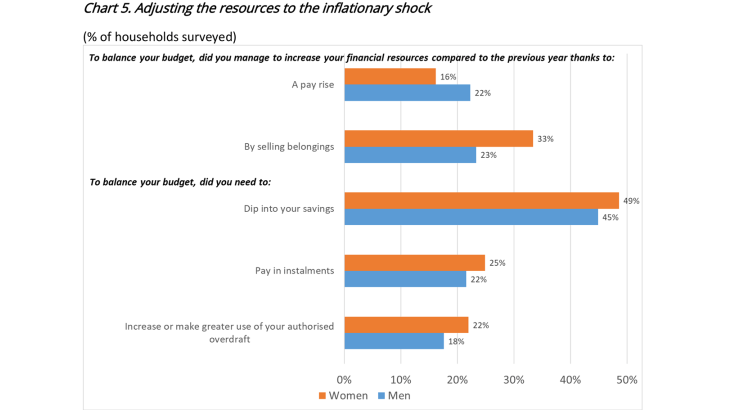

These results are also consistent with the patterns of adjustment to the inflationary shock on resources. Women's wages were less dynamic: in 2023, only 16% of women reported a pay rise, compared with 22% of men. Furthermore, 33% of women stated that they had sold possessions to balance their budget, compared with 23% of men. Lastly, women were more likely than men to have had to pay in instalments, dip into their savings or use their authorised overdraft to adjust their budget during periods of inflation (Chart 5).

The differences between women's and men's perceptions of inflation are potentially important for monetary policy: they underline the need for central bank communication to be more closely linked to people's experiences of inflation, and also to increase targeted efforts to educate people about inflation and the monetary policies pursued in order to stabilise prices. Recent examples include the Eurosystem's introduction of content aimed specifically at the general public (Herbert et al. 2023) and a personal inflation calculator. These efforts to explain monetary policy are particularly important given that, according to the BdF-CSA 2023 survey, 60% of women say they are not at all familiar with monetary policy, compared with 44% of men.

Download the PDF version of the publication

Updated on the 25th of July 2024