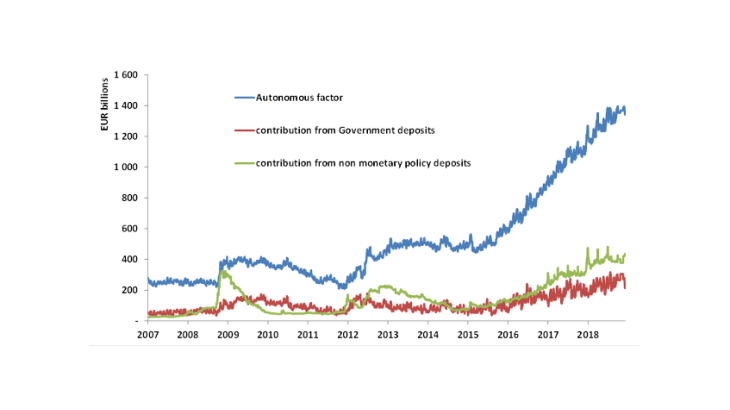

Monetary policy implementation is about managing the amount and price of liquidity that banks exchange in the interbank market. In practice, the central bank supplies or rations the liquidity available by managing its own balance sheet. Yet parts of its balance sheet – the so-called autonomous factors such as, for instance, banknotes or non-monetary policy deposits - are not fully controlled by the central bank. These autonomous factors will have to be monitored carefully to ensure a smooth exit from unconventional non-standard monetary policy measures and hence avoid volatility in short-term market interest rates.

The liabilities of the Eurosystem have tripled since 2007 …

In January 2007, the consolidated liabilities of the Eurosystem were around EUR 1.2 trillion. Just over half of these liabilities, EUR 620 billion, were banknotes. Autonomous factors such as accounts held by general government (EUR 45 billion) and liabilities in euros to non-euro residents (EUR 17 billion) were relatively small. Banks held current accounts of EUR 175 billion to cover required reserves of EUR 174 billion so excess reserves were less than a billion euros.

This meant that the banking system had just enough reserves in total and banks could lend or borrow their daily cash surplus or deficit in an active interbank market. Use of the deposit and marginal lending facilities were negligible and the overnight interbank interest rate (EONIA) hovered around the middle of these two rates which usually coincided with the main refinancing operations (MRO) rate. Central bank liquidity managers would estimate the likely change in autonomous liquidity demand and offset it through refinancing operations so that liquidity conditions were largely balanced and short-term interbank interest rates stayed close to the MRO target set by the Governing Council of the ECB.

Fast-forward to December 2018 and the consolidated liabilities of the Eurosytem were EUR 4.7 trillion. This tripling of the balance sheet is the result of unconventional monetary policy measures such as the Expanded Asset Purchase Programme (EAPP) (around EUR 2.6 trillion) and the Targeted Longer-term Refinancing Operations (around EUR 730 billion).

As a result, excess liquidity – the sum of bank reserves in excess of the minimum reserve requirement and funds held in the deposit facility - has grown from just over EUR 1 billion in January 2007 to EUR 1.9trillion in December 2018 – see Chart 1.

…keeping interbank rates close to the deposit facility rate

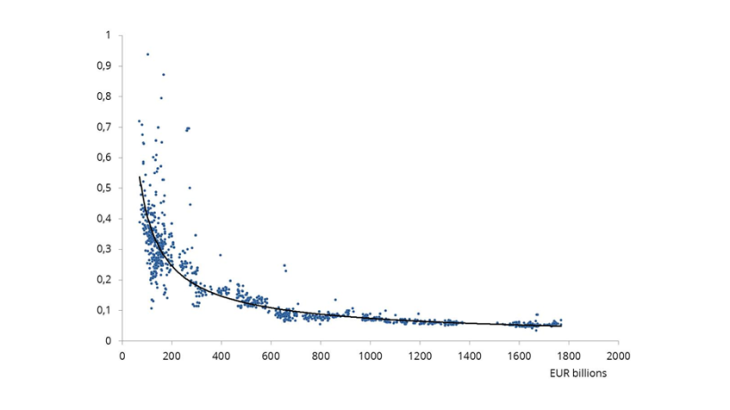

All this excess liquidity is more than enough to keep interbank interest rates very close to the deposit facility rate (DFR). From mid-2015 to December 2018, the spread between EONIA and the DFR was around 10 bp – see also Chart 2.