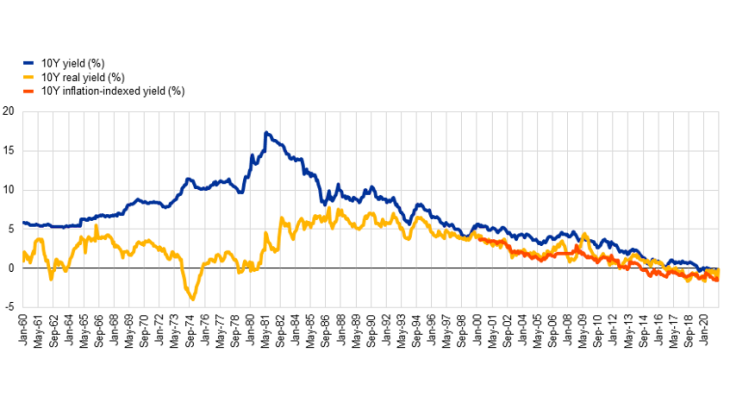

ow nominal and real interest rates are not a recent phenomenon but reflect long historical trends. Chart 4 shows that nominal 10-year government bond yields in France peaked at 16 % in 1981, having risen from around 5% in the early 1960s. Most of this increase in nominal yields reflected rising inflation. Indeed, there were several episodes of negative real rates of interest during the 1960s and 1970s, comparable with the real rates of return observed today.

Real rates of interest peaked at around 6-7% in the mid-1980s and early 1990s. Real rates have been declining ever since. This is not just a French or European phenomenon but has been a global trend related to a decline in the natural real rate of interest. The underlying drivers of the drop in natural rates include structural elements such as demographics changes, as well as the slowdown of global productivity growth (see Penalver (2017) and Garnier, Lhuissier, Penalver (2019)). These long-run structural forces affect the relative supply of savings and demand for borrowing for investment and therefore the rate of interest that equilibrates the capital market. An ageing population, for example, has a growing supply of savings as households plan for retirement. This also means that there is less need for investment because the growth rate of the working age population is rising more slowly. Lower expected productivity growth reduces the average expected rate of return on investment.

Monetary policy plays a role in pushing yields into negative territory

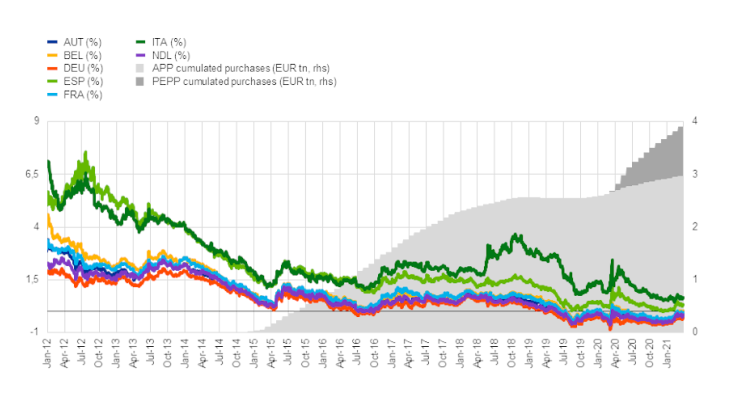

Long-term yields have also been compressed by monetary policy and in particular by asset purchase programmes by the ECB and other central banks. When short-term nominal policy rates reached their effective lower bound, central banks sought other means to provide more accommodative monetary policy. Under asset purchase programmes (also known as Quantitative Easing (QE)), central banks buy sovereign and corporate bonds, financed by the issuance of central bank reserves. These operations shorten the average maturity of public debt (government plus central bank) held by the private sector, raise bond prices and reduce long-term yields by compressing the term premium , thereby helping to ease financing conditions generally. Since March 2015, the Eurosystem (ECB plus the national central banks of the euro area) have purchased around EUR 3.9 trillion under the APP and PEPP (the Pandemic Emergency Purchase Programme, a QE programme initiated in March 2020 and which is specifically tailored to address the economic consequences of the coronavirus crisis (see Odendahl et al (2020)). – see Chart 1.

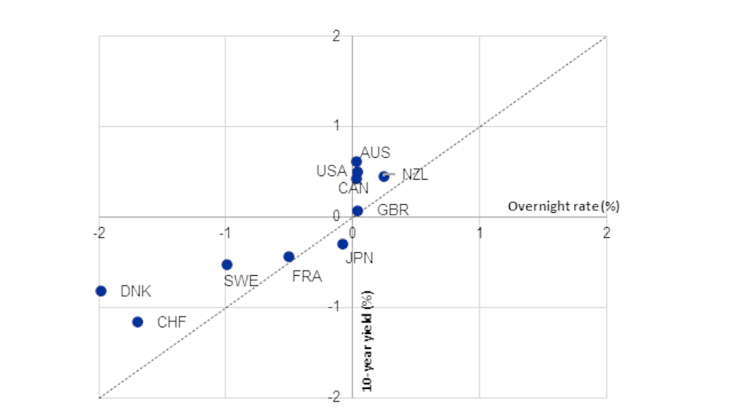

Negative long-term rates, however, are not a global phenomenon. Although the recent compression in yields seems to have occurred across the board in advanced economies between mid-2020 and the beginning of 2021, long-term rates have fallen below zero only in those countries whose short-term policy rates are (or have been) negative (Chart 5). This, together with the major role played by asset purchases in shrinking sovereign borrowing costs, suggests that lowering short-term policy rates has influenced long-term yields. Theoretically, long-term bond yields are comprised of the expected future short-term rate and term premia. Except in unusual circumstances when term premia are negative, the lower bound on short-term policy rates will also be the lower bound on long-term rates. By setting negative policy rates (the Deposit Facility Rate in the euro area is currently -0.5%), the ECB has lowered the floor on long-term rates, thereby permitting negative rates on sovereign and corporate bonds in the euro area.