Without the threat of new competitors, leaders no longer have incentives to invest and innovate, and the entire economy ultimately suffers, as the IMF points out in its World Economic Outlook, April 2019.

New challenges brought by the emergence of digital giants

These ecosystems made up of a few major players do not call into question the economic principles on which competition law is based, but they do pose new practical problems in its application, as highlighted in one recent report submitted to the European Commissioner for Competition, Margrethe Vestager.

The risks of abusing a dominant position are inherently higher when the sector is highly concentrated. Leaders can seek to maintain or strengthen their position by, for example, buying out potential competitors before they have time to develop.

The sharing economy and the phenomenon of "uberisation" raise the question of equality between competitors, since traditional service providers are subject to different regulations from those of platforms. Using self-employed workers and private activity can distort competition: AirBnB vs. hotels or uber vs. taxis for example. Competition becomes biased because taxes, standards and charges differ according to the type of producer.

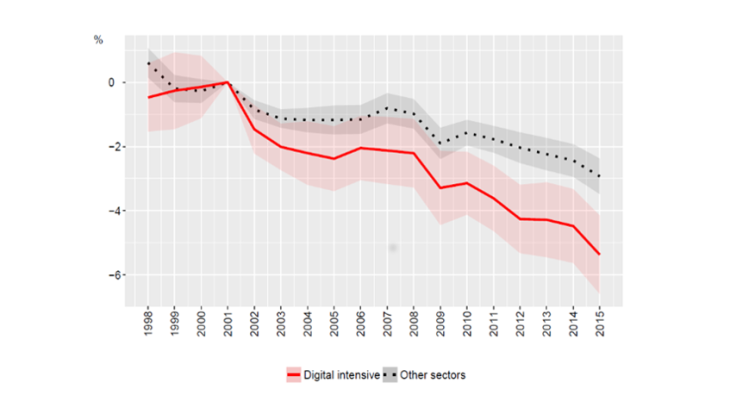

Lastly, the collection and storing of personal data by digital giants is likely to promote anti-competitive behaviour. The accumulation of user information can give incumbent companies an advantage and lead to the exclusion of competitors.

Competition authorities must meet these challenges by enhancing their digital skills and adapting their control instruments

More specifically, the competition authorities have identified two types of problem associated with the digital economy. First, legal proceedings are slow compared to the speed of business because, once critical size is reached, network effects can spread extremely rapidly. Second, we observe in all sectors where R&D plays an important role (digital as well as biotechnologies) “killer” acquisitions whereby a dominant player buys a potential competitor, which is often only in the research stage (therefore no turnover) and “kills” it before it becomes an actual competitor.

The first problem requires the competition authorities to increase their digital skills, i.e. data and algorithm specialists. Moreover, subject both to Regulation 1/2003, which specifies the conditions for ordering interim measures and to the strict control of the European Court of Justice, the European Commission (DG Competition) cannot easily make use of this instrument, which allows the market to be "frozen" in a state that preserves competition until the case is essentially resolved. Such an instrument would be very useful for dealing with cases quickly, before the potentially deleterious effects of certain practices destroy competitors' opportunities.

Several proposals aiming to counter the risk of killer acquisitions are being discussed, such as (i) reducing the threshold for the notification of mergers to the Competition Authority, (ii) introducing a control threshold expressed in terms of transaction values, and (iii) implementing a control of concentrations ex post. The latter solution is no doubt preferable: it would make it possible to target only the acquisitions that pose a problem in terms of competition (contrary to a lowering of the thresholds), without introducing new thresholds whose values could be manipulated (such as in the second option).