The heterogeneity across households, in particular according to their financial positions, wealth composition, and indebtedness, has important implications for monetary policy transmission mechanisms and aggregate effects. Consumption reactions to wealth shocks are one channel through which wealth heterogeneity may have such macroeconomic consequences, due to the decline in marginal propensity to consume along the wealth distribution or to heterogeneous liquidity constraints among households. While there is already a vast empirical literature aiming at estimating consumption reactions to various types of income shocks, empirical evidence about the heterogeneity of the marginal propensity to consume out of wealth is more limited. The heterogeneous impact of wealth shocks on consumption is, however, a crucial issue given the importance of wealth inequality, the dynamics of housing prices, and the fact that housing assets together with mortgages play a major role in households' wealth.

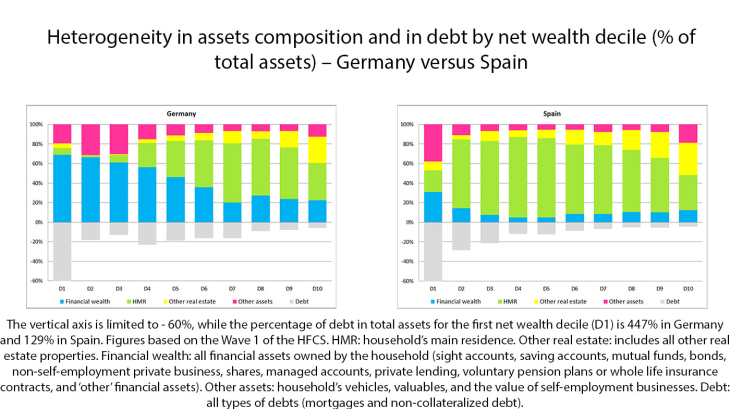

In this paper, we build an original micro dataset and use the whole wealth distribution to provide a systematic investigation on how heterogeneity in the total wealth composition (housing assets, financial wealth, and debt, see Figure 1) affects the marginal propensity to consume out of wealth (MPC) along the whole wealth distribution. One crucial difficulty encountered in the literature is the lack of suitable data that provides reliable information on both the distribution of consumption and the distribution of wealth across a representative sample of households (including information about their debt), and that additionally allows to identify wealth shocks.

Our contribution to the literature is threefold. First, we are the first to provide detailed estimates of how marginal propensities to consume vary for various components of wealth and across households over the whole wealth distribution. We provide these estimates for five euro area countries based on a fully harmonised approach in terms of both the data and the empirical approach. Note that we have to restrict our sample to countries for which we have panel data on wealth at the household level, and for which all necessary information is available over our period of interest, namely Belgium, Cyprus, Germany, Spain, and Italy. While the country selection is driven by data availability, nevertheless we cover a wide cross-country heterogeneity in terms of country size and economic situations in the euro area. Second, based on the heterogeneity across both households and countries, we provide a novel analysis of whether housing wealth and mortgages explain part of the heterogeneity in the MPC out of total wealth, since both housing assets and mortgages account for a crucial part of the wealth of many households. Third, we contribute to the understanding of how institutional and socio-economic differences across countries in homeownership rates, mortgage markets, demographics, and wealth inequality may induce cross-country heterogeneity in the transmission of monetary policy through the consumption-wealth channel.

We find that the marginal propensity to consume out of wealth is lower for wealthier people. We find significant marginal propensity to consume out of wealth, which is decreasing from the median wealth group (3.1 cents of additional consumption for one euro increase in total wealth) to the top wealth group (0.4 cent). Such a pattern is consistent across all countries. Moreover, we document some heterogeneity across countries. Second, we account for asset composition and show the significant role of housing wealth in all countries, with lower MPCs out of housing wealth for richer people. We also document cross-country heterogeneity in housing wealth effects. Such differences may reflect differences in the legal and regulatory framework affecting the supply of credit, or differences in the functioning of credit markets. Third, we show that our results are indicative that the collateral channel is a significant determinant of MPC differences, as consumption reacts more to wealth shocks in countries with a large share of mortgages. This suggests that increases in housing prices may relax financing constraints when households have contracted mortgages. Fourth, we show that differences in real estate ownership play a crucial role in explaining the cross-country heterogeneity in the transmission of housing prices to consumption. A striking result is obtained when comparing Spain (which is characterized by the highest homeownership rate) with Germany (which has the lowest): closing the gap in homeownership rate between these two countries would increase the average MPC in Germany and would fully close the MPC gap compared to Spain. Additionally, we find that factors related to mortgage markets, demographics, and wealth inequality contribute to cross-country differences in MPCs. Finally, based on our main results, we investigate how heterogeneous MPC, wealth composition, and wealth inequality can affect consumption inequality. We conduct a simple simulation exercise to assess the effect on consumption of an exogenous shock to the value of different assets. We find that housing price shocks decrease consumption inequality while financial wealth shocks have a limited effect on consumption inequality.

Keywords: Marginal Propensity to Consume out of Wealth, Collateral Channel, Household Surveys

JEL classification: D12, E21, C21