1. Cash usage remains significant in France despite consumers declaring a preference for cards

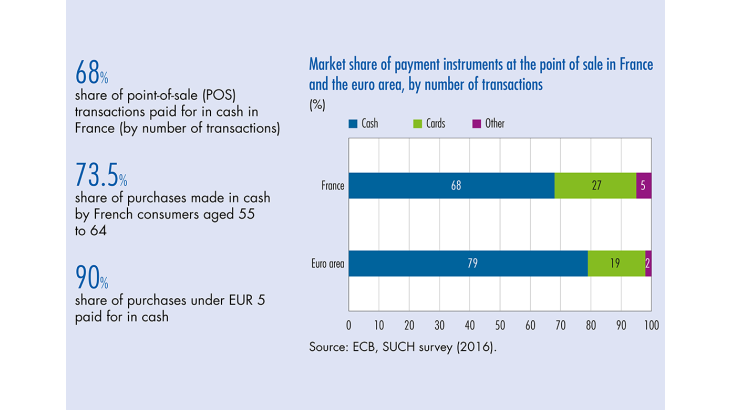

Cash was the most frequently used payment instrument among French participants in the SUCH survey: 68% of purchases at the point-of-sale (POS) were made with banknotes and coins, 27% by card and 5% using another method of payment (mainly cheques). France nonetheless has one of the lowest rates of cash usage in the euro area, alongside Luxembourg, Belgium, Finland, Estonia and the Netherlands (see Chart 1). By comparison, aggregate survey figures show that cash accounts for 79% of POS transactions in the overall euro area, with cards accounting for 19%.

In value terms, cash is used for 28% of POS spending in France, which is the second-lowest share in the euro area, after the Netherlands (27%), while the average for the euro area is 54%. The average value of a cash transaction is EUR 7.5 in France compared with EUR 12.4 for the euro area. These low figures indicate that French consumers tend to use cash primarily for small purchases. France also ranks second-to-last in the euro area, after Portugal, for the amount of cash carried by consumers in their wallets (EUR 32 compared with an average of EUR 65 for the euro area).

In response to the supplementary questionnaire distributed to a portion of survey participants, 1,434 individuals indicated whether they preferred cash or cashless instruments (card or other cashless instruments such as cheques), or had no clear preference. French consumers expressed a particularly strong preference for cashless instruments, including cards and cheques: 66% of respondents said they favoured these instruments (the highest share, alongside Belgium), compared with an average of 43% for the euro area, while only 17% said they preferred paying in cash.

2. An analysis of payment instrument use according to sociodemographic and transaction characteristics

The academic literature has identified various explanatory factors

There is an abundant literature on the topic of payment economics (Bagnall et al., 2016). Studies focus in particular on identifying the determinants of payment choices, with the aim of informing estimates of future demand for cash. As well as examining the role played by the characteristics of individual payment instruments (security, speed, etc.) or payment environments (network of branches or ATMs, etc.), the literature looks at two other types of determinants: sociodemographic criteria and transaction characteristics (see Table 1).

[To read more, please download the article]