- Home

- Publications et statistiques

- Publications

- Update on business conditions in France ...

Update on business conditions in France at the start of November 2022

In a difficult economic environment marked by a succession of shocks, activity is continuing to hold up overall.

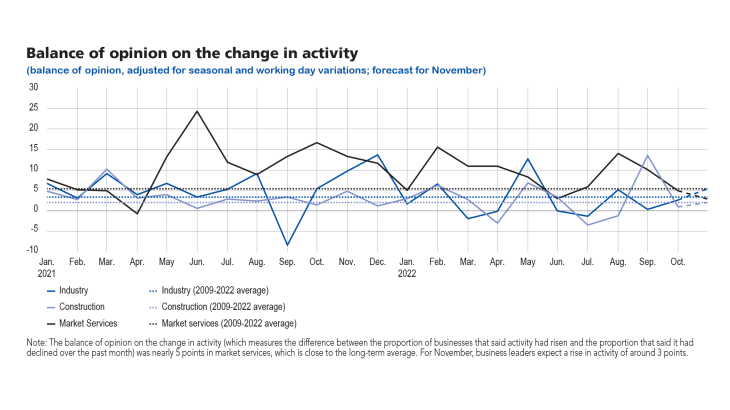

ccording to the business leaders surveyed (approximately 8,500 companies and establishments questioned between 27 October and 4 November), activity rose slightly in October in industry and services, and was more or less stable in construction. For November, business leaders expect this trend to continue.

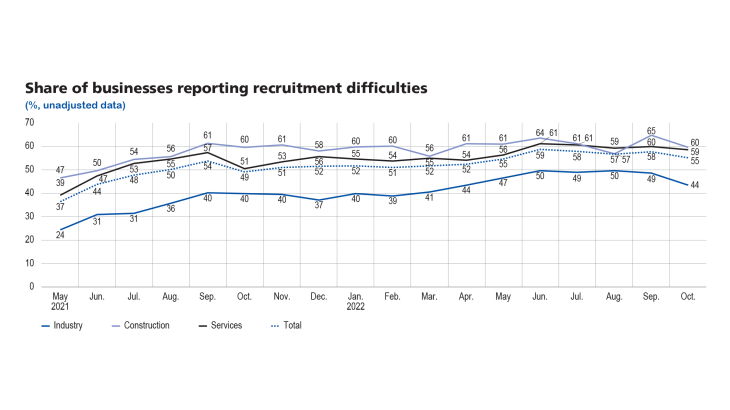

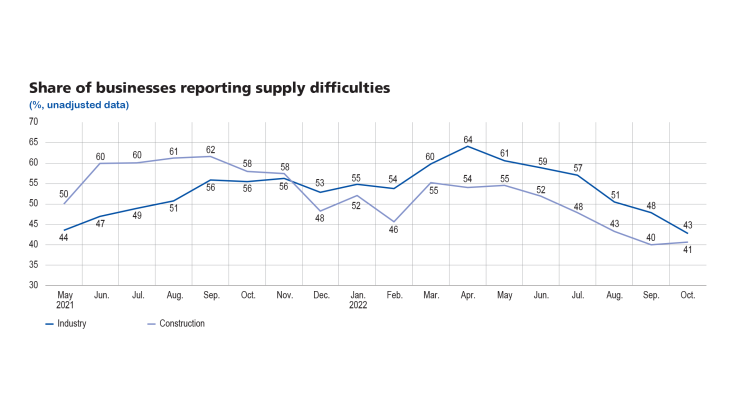

Supply difficulties eased further in industry (43% of industrial firms cited difficulties in October after 48% in September) and changed little in construction (41% after 40% in September). A slowdown was observed in the rise in finished goods prices. Recruitment difficulties eased slightly (cited by 55% of respondents compared with 58% in September).

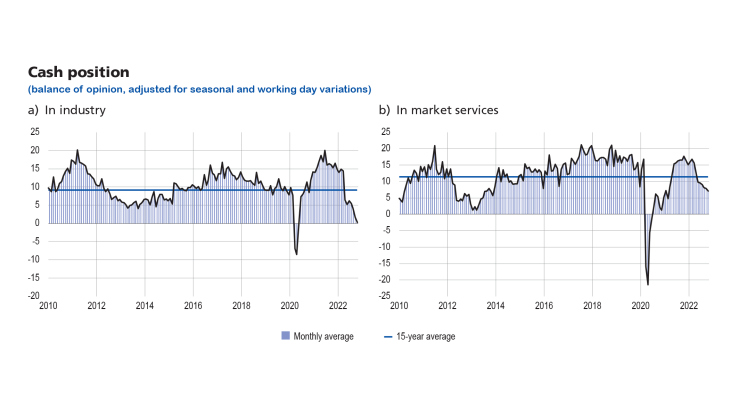

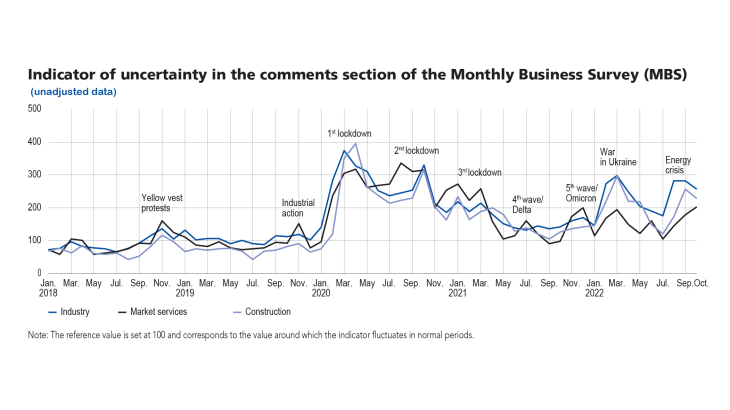

Our uncertainty indicator increased in services in October and remained high in industry and construction. Cash positions deteriorated again in industry and to a lesser extent in services.

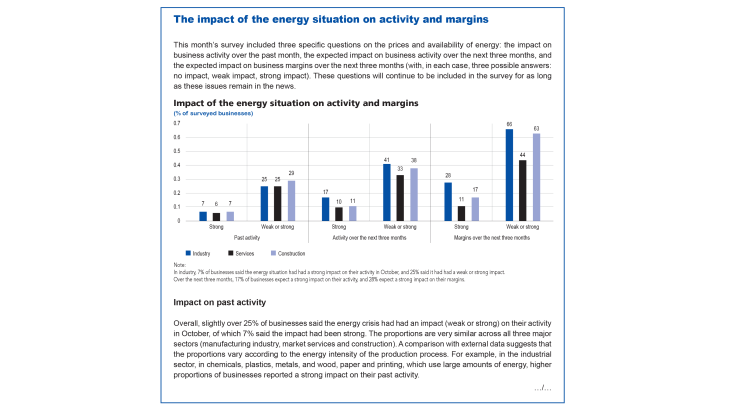

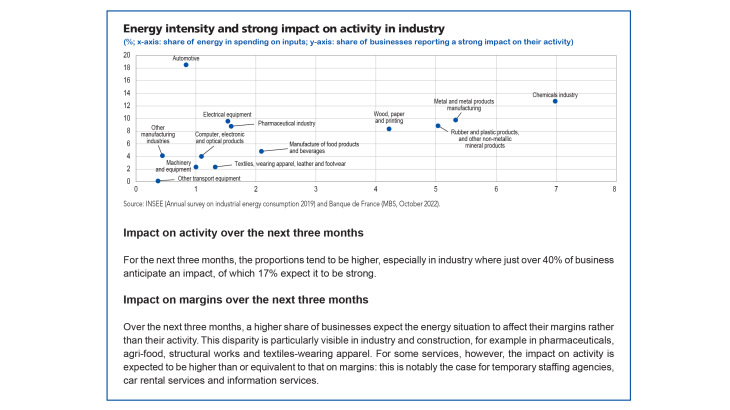

Questioned for the first time on the consequences of the energy situation, 25% of businesses said their activity had been affected over the past month, of which 7% said it had been strongly affected. Nearly four in ten firms said they expect it to have an impact (weak or strong) over the next three months. Two out of three construction and industrial firms and nearly half of market services firms expect their margins to be affected over the next three months.

Taking into account those sectors not (or less) well covered by the survey, such as energy, wholesale and retail trade, and transportation, which were harder hit by the refinery strikes and fuel shortages in October, early indications suggest that GDP growth should be very slightly positive in the fourth quarter.

1. In October, activity rose slightly in industry and market services, and was more or less stable in construction

In October, activity increased slightly in industry, in line with business leaders’ expectations last month.

Balances of opinion on production for October indicate that the rise was more marked in machinery and equipment, aeronautics, computer, electronic and optical products, and the agri-food industry. Conversely, activity declined compared with the previous month in the automotive industry, wood, paper and printing, chemicals, plastic products, and textiles and wearing apparel.

Activity continued to improve in market services in October but at a slower pace than over the previous two months, as forecast by business leaders in September. The slowdown was felt in the majority of sectors; however, it was more marked in information services and in certain personal services (hairdressing, home services), where activity contracted over the month. Activity also declined in those transportation services hit by the fuel shortages, as well as in car rental services, albeit to a lesser extent.

There was little activity growth in construction, and it even declined slightly in structural works.

The balance of opinion on cash positions deteriorated again in industry and is now very low compared with the past 15 years, especially at large businesses which reported a bigger gap between current cash levels and the long-term average. This gap is visible in the majority of industrial sectors, with the notable exception of aeronautics. It is particularly marked in sectors such as electrical equipment, computer, electronic and optical products, chemicals, pharmaceuticals and plastic products, as well as in textiles and wearing apparel, and the manufacture of machine tools. This could notably reflect higher working capital requirements as it has become more costly to build inventory.

In market services, cash positions continued to deteriorate in October but to a lesser extent than previously (4 points below the 15-year average). The contraction was more marked in certain business services: cleaning, advertising, information services and car rental services. In these sectors, business leaders said payment times had increased.

2. In November, business leaders expect activity to continue rising moderately in industry and services, and to remain little-changed in construction

For November, the surveyed business leaders expect activity to continue rising in industry. Certain sectors should see a particularly strong improvement: electrical equipment, the automotive industry and pharmaceuticals. Conversely, activity should continue to contract in rubber and plastics.

In services, business leaders expect activity to rise modestly overall. However, in accommodation and food services, as well as in cleaning, business leaders forecast a marked slowdown.

In construction, activity is anticipated to remain little-changed, with a slight contraction in structural works and a rise in finishing works.

Our monthly uncertainty indicator, which is constructed from a textual analysis of comments by the respondent companies, shows higher than normal levels of uncertainty, although with differing trends across sectors. In construction and manufacturing, after peaking in September, uncertainty has declined slightly but is still more than twice its normal level. In services, uncertainty is continuing to spread, with the indicator rising steadily for the third consecutive month.

Activity continued to improve in market services in October but at a slower pace than over the previous two months, as forecast by business leaders in September. The slowdown was felt in the majority of sectors; however, it was more marked in information services and in certain personal services (hairdressing, home services), where activity contracted over the month. Activity also declined in those transportation services hit by the fuel shortages, as well as in car rental services, albeit to a lesser extent.

There was little activity growth in construction, and it even declined slightly in structural works.

The balance of opinion on cash positions deteriorated again in industry and is now very low compared with the past 15 years, especially at large businesses which reported a bigger gap between current cash levels and the long-term average. This gap is visible in the majority of industrial sectors, with the notable exception of aeronautics. It is particularly marked in sectors such as electrical equipment, computer, electronic and optical products, chemicals, pharmaceuticals and plastic products, as well as in textiles and wearing apparel, and the manufacture of machine tools. This could notably reflect higher working capital requirements as it has become more costly to build inventory.

In market services, cash positions continued to deteriorate in October but to a lesser extent than previously (4 points below the 15-year average). The contraction was more marked in certain business services: cleaning, advertising, information services and car rental services. In these sectors, business leaders said payment times had increased..

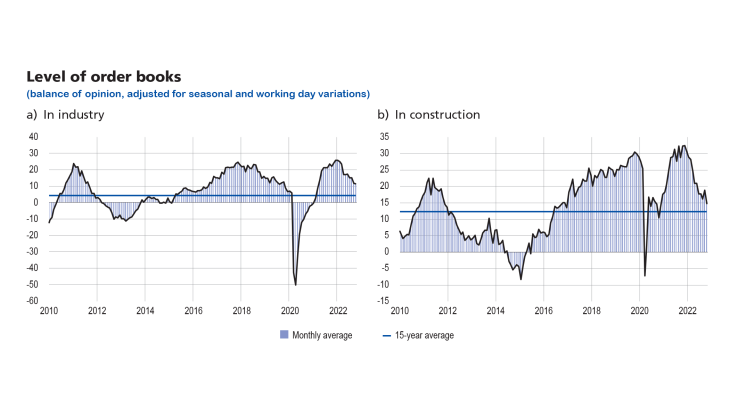

The balance of opinion on order books stabilised in industry in October, and fell in the construction sector. In both cases, current levels are above the long-term average.

3. Easing of supply difficulties, and now of recruitment difficulties; slight slowdown in price rises

Supply difficulties continued to ease in October in industry (43% after 48% in September). While nonetheless high in absolute terms, October’s reading was the lowest since the indicator was introduced in May 2021. In construction, the decline in supply difficulties came to a virtual standstill in October (41% after 40%).

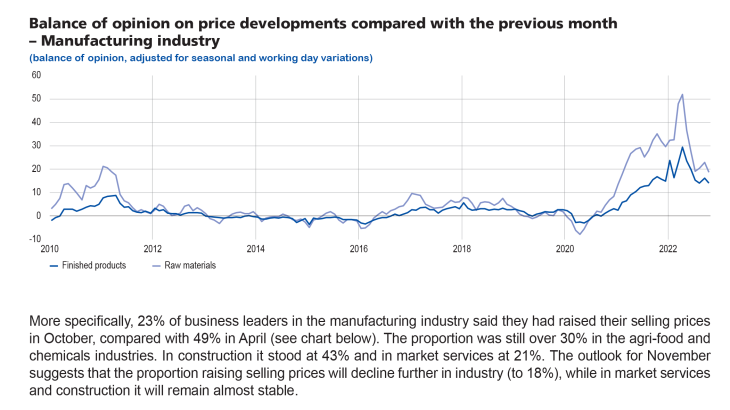

According to business leaders, the fall in supply difficulties is being accompanied by a renewed slowdown in the rise in finished goods prices, after the slight seasonal rebound seen in September.

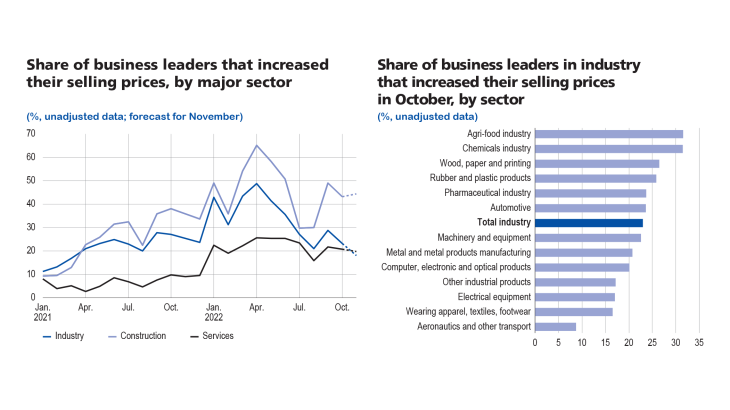

More specifically, 23% of business leaders in the manufacturing industry said they had raised their selling prices in October, compared with 49% in April (see chart below). The proportion was still over 30% in the agri-food and chemicals industries. In construction it stood at 43% and in market services at 21%. The outlook for November suggests that the proportion raising selling prices will decline further in industry (to 18%), while in market services and construction it will remain almost stable.

Business leaders were also asked about their recruitment difficulties. These remain high, affecting 55% of

all surveyed businesses, but have declined since September, especially in industry (44% in October after 49%

in September) and construction (60% after 65%).

4. Estimates primarily derived from the survey and supplemented by other indicators suggest that GDP should expand very slightly in the fourth quarter

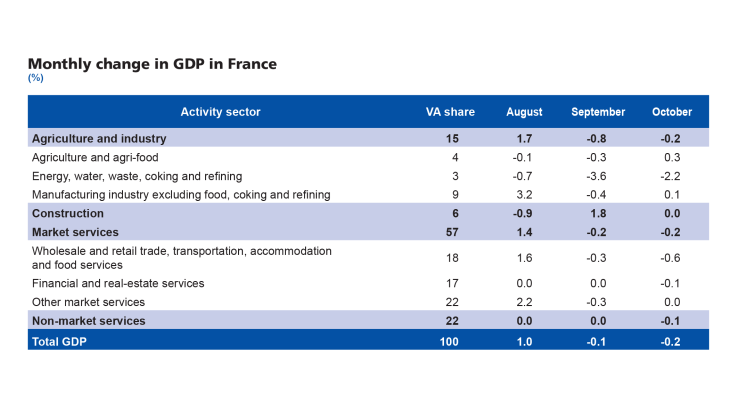

In our previous update on business conditions published on 12 October 2022, we estimated that activity rose by about a quarter of a percentage point in the third quarter. The quarterly national accounts published by INSEE at the end of October showed an increase of 0.2%. Over this last quarter, activity declined in construction and was driven down by the energy component in industry. In market services, however, activity increased.

For the month of October, using granular survey data and other available data, we estimate that GDP fell compared with September. This can be attributed to a contraction in those sectors excluded from or only partially covered by the survey, such as energy, wholesale and retail trade and transportation.

According to the survey data, in the food industry and in manufacturing excluding food, coking and refining, value added is estimated to have increased in October. However, the energy component is projected to have dragged on value added across industry, in line with the trend in previous months. Activity in those services covered by the survey is estimated to have risen, albeit at a slower rate. However, the high-frequency data that we monitor in parallel for those sectors excluded from or only partially covered by the survey (notably energy, construction, wholesale and retail trade and transportation), or to confirm our assessment of industry and those services that are covered, paint a more negative picture of the change in activity in October.

Data on electricity consumption point to a decline since the summer. Road traffic and credit card data, which provide information on the transportation sector, indicate that activity declined due to the fuel shortages in the second half of October. Spending on credit cards, which is also an indicator of activity in retail trade, suggests that the sector was also negatively affected by the fuel shortage in October. Overall, taking into account these declines in transportation and retail trade, value added in market services is expected to have declined in October.

Based on the business expectations reported in the survey for November, we expect GDP to rise compared with October, but with performances contrasting again across sectors. The environment remains highly uncertain, however, especially with respect to costs and energy availability.

GDP growth in the fourth quarter of 2022 is also expected to be boosted by a positive carry-over effect linked to the expansion observed in August. Our first forecast, based on survey data, is for GDP to grow very slightly in the fourth quarter.

Updated on the 25th of July 2024