Over the past decade, central bank activities have seen considerable changes, marked by substantial expansions in balance sheets through several quantitative easing (QE) programs. These measures involved large-scale asset purchases that played a crucial role in stabilizing economies during times of crisis by strengthening liquidity and economic resilience. Similar unconventional policy tools might be necessary to handle future shocks, especially if interest rates fall back to low levels. Central banks are therefore reducing their holdings of financial assets to ensure flexibility for future monetary stimulus. However, while various studies have investigated the macroeconomic implications of QE, the effects of unwinding it, referred to as quantitative tightening (QT), remain largely unexplored.

This paper addresses this gap by investigating the macroeconomic effects of QE and QT with a theoretical framework, focusing in particular on the role of state dependency and heterogeneity across households. To do so, it presents a New Keynesian model with two types of households (borrowers and savers, i.e. a two-agent New Keynesian, or TANK, model) in which central bank asset market operations affect the real economy through the rebalancing of household portfolios between short-term and long-term government bonds. An occasionally binding zero lower bound on the short-term interest rate captures the idea of different states of the economy in which the central bank shrinks its balance sheet compared to when it expands it.

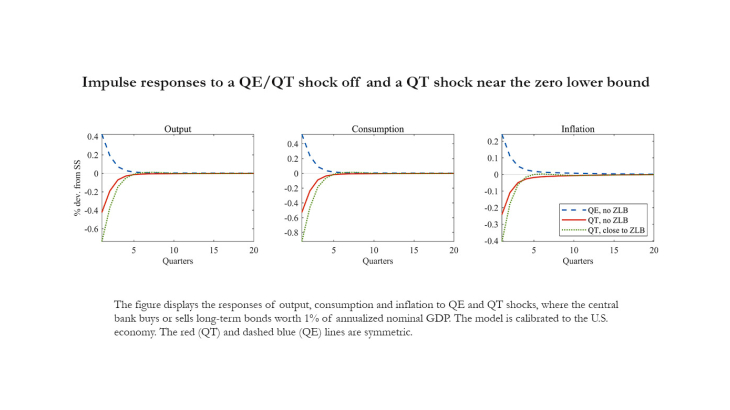

The model analysis reveals several key insights. First, a binding zero lower bound amplifies the impact of central bank asset market operations on aggregate variables. In the graphs above, the negative impact of QT on output, consumption and inflation is more pronounced when the economy is close to the ZLB (dotted green line) compared to when it is away from the ZLB (red line). This implies that, when facing the risk of a liquidity trap, raising the policy rate before unwinding QE can mitigate the economic costs associated with monetary policy normalization. It also suggests that asset sales have a smaller impact on the aggregate economy than asset purchases implemented at the ZLB, implying an asymmetry in their effects. Second, the influence of heterogeneous households in propagating QE or QT shocks in this context considerably depends on the state of the economy. Household heterogeneity does not enhance the macroeconomic effects of asset market operations when away from the lower bound. However, in a liquidity trap, it implies substantial amplification at the aggregate level and widens the revealed asymmetry between the effects of state-dependent QE and QT.

Keywords: Unconventional Monetary Policy, Quantitative Tightening, Quantitative Easing, Heterogeneous Agents, Zero Lower Bound

JEL classification: E21, E32, E52, E58