The paper contributes to the analysis of the inflation process and how consumer prices re-spond to supply shocks. Particularly during times of rising inflation, policymakers have voiced the suspicion that the inflation process is not stable over time but depends on the level or volatility of inflation itself. Such changing dynamics would have especially signifi-cant implications for central banks at times when they aim to contain price pressures gener-ated by supply shocks for at least two reasons. First, inflation projections hinge on quantifi-cations regarding the speed and extent to which changes in producer prices are transmitted to consumer prices that are often based on presumably stable relationships. Second, the optimal timing of interest-rate changes designed to achieve the goal of price stability relies on estimates of lags in the transmission of monetary policy.

We take up this issue empirically by analyzing whether and when inflation dynamics under-go changes. Using US data, we uncover two inflation regimes without restricting them to depend on some exogenous variable, such as an inflation threshold, but let the inflation process itself determine the regimes. It turns out that inflation volatility (quick changes in inflation rates) plays a more significant role in determining the regimes than its level. Above a threshold for annualized monthly inflation changes of 5.2 pp (as observed in April, May, and July 2022), the economy is likely to be in a high volatility regime.

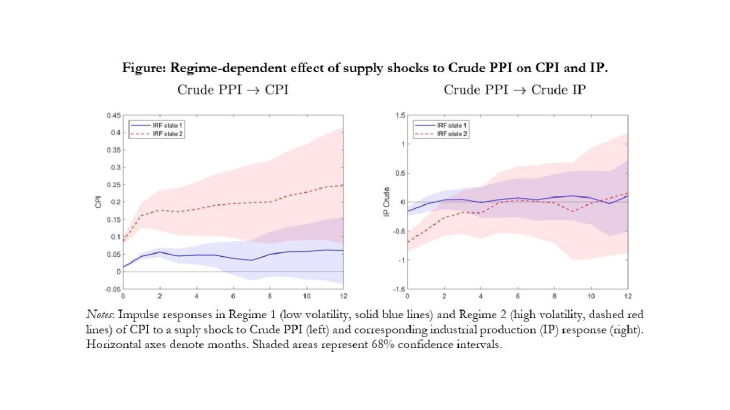

In a second step, we estimate the causal effects of a shock to producer prices—provided by the producer price index (PPI) of the Bureau of Labor Statistics that distinguishes between different stages of processing —on downstream price growth. We identify supply shocks with movements in the “crude material” PPI series that a) exceed normal fluctuations and b) move prices and industrial production at the same production stage in different direc-tions. Next, we estimate how these shocks at different stages affect intermediate and finished goods PPIs as well as consumer prices in a dynamic way.

Our results show that in periods of high inflation volatility, downstream prices, including the consumer price index (CPI), react much stronger to supply shocks in the initial and sev-eral following months. In this regime, prices are arguably more flexible and, hence, react more promptly to shocks and feature a higher cumulative pass-through. We validate our results by estimating the inflation responses to oil-supply shocks. Again, the CPI exhibits a swifter and more pronounced reaction in the high-volatility state. Additionally, we investi-gate the effects of monetary policy shocks in the two inflation regimes. In the high-volatility regime, CPI responds more promptly to such shocks, particularly in the short run. In con-trast, we hardly find an effect on monthly CPI inflation in the low-volatility regime. We infer that, given the more direct pass-through of cost changes to consumer prices and the heightened effectiveness of monetary policy during periods of high volatility, the economy is likely to revert to the low-volatility regime if central banks monitor producer prices closely and respond decisively and swiftly during times of increasing volatility.

To emphasize the critical role of inflation volatility in determining regimes, we explore whether similar state dependencies emerge when departing from the endogenous determina-tion of regimes. Specifically, we assess the impact of exogenously conditioning regimes on other potentially influential variables, such as the level of CPI inflation, the volatility in Crude PPI inflation, or the size of the shocks. None of these separations generates a state dependency for pass-through of producer price shocks that comes close to the one generat-ed by inflation volatility.

Regarding economic theory, our results speak in favor of models in which prices react quicker to shocks in the face of higher inflation volatility. We, therefore, propose a model in which price setters optimally invest in the flexibility of their prices. This mechanism can explain our finding of a more substantial pass-through of supply and monetary policy shocks during volatile inflation regimes. Monetary policy that reduces inflation volatility lowers optimal price flexibility and hence the reaction of consumer prices to future supply shocks, reducing volatility even further.