- Home

- Publications et statistiques

- Publications

- Sub-Saharan Africa: the financial gender...

Sub-Saharan Africa: the financial gender gap between men and women

Post n°309. Although it is a factor in financial inclusion and development, the growth of mobile banking in Sub-Saharan Africa (SSA) has nonetheless gone hand in hand with a growing gender gap in financial inclusion. This unexpected consequence of financial digitalisation calls for a rethink of development policies.

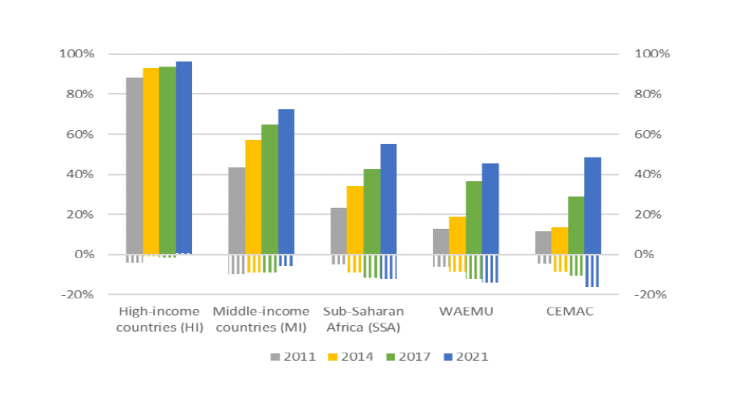

Source: Global Findex and authors’ calculations

Note: Percentage of the adult population holding an account at a bank or other type of financial institution.

A scissor effect connected with the spread of mobile banking?

The financial inclusion of both women and men has increased significantly in SSA over the past decade. According to the World Bank, a majority of the population in SSA now has an account with a bank or other financial institution (55% in 2021, compared to 23% in 2011, see Chart 1), with catch-up effects relative to middle- and high-income countries (where 72% and 96% of the population respectively have an account). An even greater increase has been observed in both the West African Economic and Monetary Union (WAEMU) and the Central African Economic and Monetary Community (CEMAC), where bank penetration rates have increased nearly fourfold. This stems from the rapid development of mobile telephony and mobile banking, which compensates for the weaknesses of fixed-line telephony infrastructures and the traditional banking sector. Mobile money accounts, which were held by one-third of the population of SSA in 2021, are an underexploited but growing channel for credit access, with 7% of the population borrowing money via this method in 2021, compared to 10% who borrowed via the formal financial sector (and 56% overall, including informal finance).

However, the increase in bank enrolment has not been as rapid for women as for men in SSA. While gender gaps in bank coverage have narrowed significantly in advanced and middle-income countries, the gender gap in bank access has increased by 7 percentage points (pp) since 2011 in SSA, reaching 12% in 2021. In terms of access to credit, the gender gap in SSA is similar to that observed in middle- and high-income countries (1-3%). While women are overrepresented in the portfolios of microfinance institutions (80% of clients globally and 64% in SSA) and informal savings and credit clubs, credit from microfinance institutions (or informal credit) is primarily targeted at the most disadvantaged populations, and the lending conditions differ from those offered by banks (small amounts, short maturities and very high rates).

Source: Global Findex and International Telecommunication Union

The growth of the gender gap in SSA could be linked to the spread of financial digitalisation. One might have expected that the technological innovations used by mobile banking would contribute to women's empowerment thanks to their ease of use, accessibility and the time and mobility savings they provide. However, women's low level of equipment tends to marginalise them: the gender gap in internet access has increased from 21% in 2013 to 33% in 2019 due to cultural or socio-economic barriers (lower income, lower access to education, lower access to formal employment). This has resulted in a doubling of the mobile banking access gap from 3% to 6% between 2014 and 2021, suggesting that the beneficial effects of these innovations have been gender-asymmetric in SSA.

The financial divide at the expense of women, a sustainable development issue

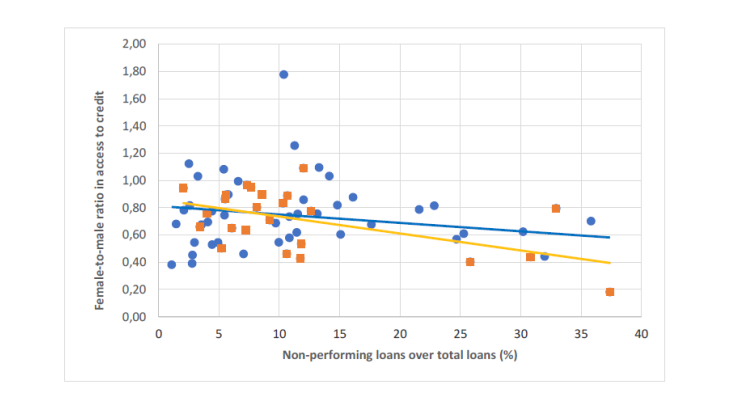

These gaps are contributing to the continued existence of financial constraints on private sector development, and are limiting potential growth in SSA. Financial inclusion not only contributes to the "countercyclical" smoothing of household consumption, it also helps to enhance business performances, improve the sectoral allocation of capital, and lower the cost of migrant remittances. On the banking side, better access to credit for women contributes to financial stability, as the quality of bank credit portfolios improves when women's share of credit increases, particularly in low-income countries (see Chart 3).

Source: Orbis BankFocus and Global Findex.

Women's access to financial services is a driver of social cohesion and sustainable development. Greater financial inclusion of women also helps to improve household well-being and economic resilience. As Esther Duflo (2012) has shown, women tend to invest more in less risky and more socially beneficial activities such as social protection and child rearing. Gender equality in financial inclusion is thus a lever that facilitates the achievement of eight of the 17 Sustainable Development Goals proposed by the United Nations.

What levers can be used to reduce the dual financial and digital divide?

Cross-cutting policies to fight poverty and promote human development help to address the inequalities that account for a large part of the gender gap in access to both digital tools and financial services. In SSA, the promotion of financial inclusion requires the reduction of numerous barriers to entry that are independent of gender, such as the cost of formal financial services or the persistence of significant information asymmetries.

Establishing an appropriate legal framework is a critical entry point to overcoming women's lack of financial inclusion. Depending on the country, this may involve removing laws that prevent women from opening a bank account without their husband's consent (still the case in six SSA countries in 2021), or laws to eliminate discrimination in access to banking services.

Recent international recommendations have highlighted the need, as part of national or regional strategies, to promote digital financial inclusion for women. The G7 Partnership for Women’s Digital Financial inclusion in Africa for example, has resulted in four multilateral initiatives covering a broad thematic area with a priority in Africa: digital identification, interoperability of payment systems, regulation, gender-based research on the impact of digital identification and payments in Africa.

Women's digital financial inclusion raises significant issues for the financial sector. The first issue is the adoption of statistical monitoring, procedures and practices that encourage women's access to and use of financial services. The second is the possibility, still not widespread in SSA, of adapting financial services to women's constraints and financial needs, for example through guarantee mechanisms that encourage female entrepreneurship. The last issue concerns microfinance institutions, the historical vector of women's financial inclusion, for which digitalisation entails excessively high costs in relation to their size and requires reconciling the automation of procedures with the human solidarity that underpins their effectiveness.

Post also published on the "All about Finance" blog of the World Bank

Updated on the 25th of July 2024