- Home

- Publications et statistiques

- Publications

- Stagnation or technology shock? The outl...

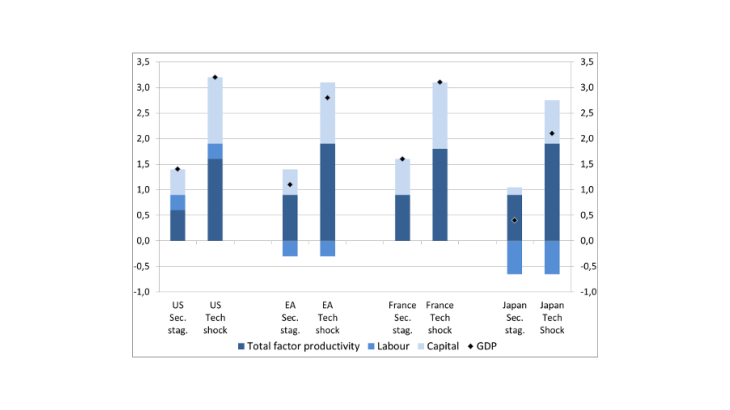

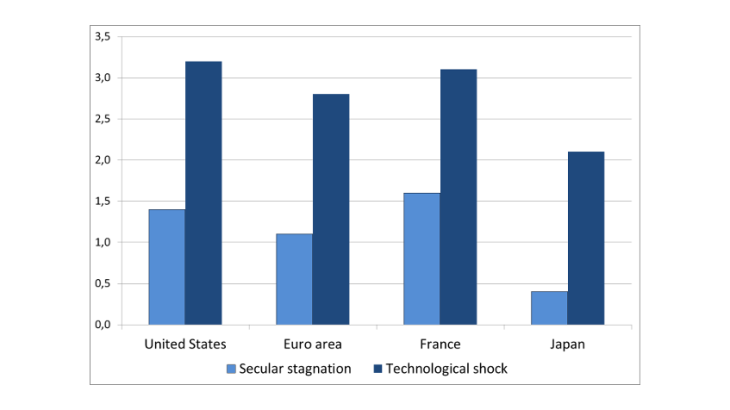

Post n°82. Growth in advanced economies has slowed in successive stages since the 1970s. Are we likely to see a return to the growth rates observed in the 20th century? The main uncertainty lies in the pace and diffusion of technological progress. Under a secular stagnation scenario, growth is expected to remain below 1.5% in advanced economies in the period up to 2060, compared with close to 3% in the case of a new technology shock.

Source: Cette, Lecat, Ly-Marin (2017)

Note: Secular stagnation = Sec. stag.; Technology shock = Tech shock. Annual average % growth 2018-60; contributions in percentage points. The contribution of labour is the total number of hours worked.

Note: Secular stagnation = Sec. stag.; Technology shock = Tech shock. Annual average % growth 2018-60; contributions in percentage points. The contribution of labour is the total number of hours worked.

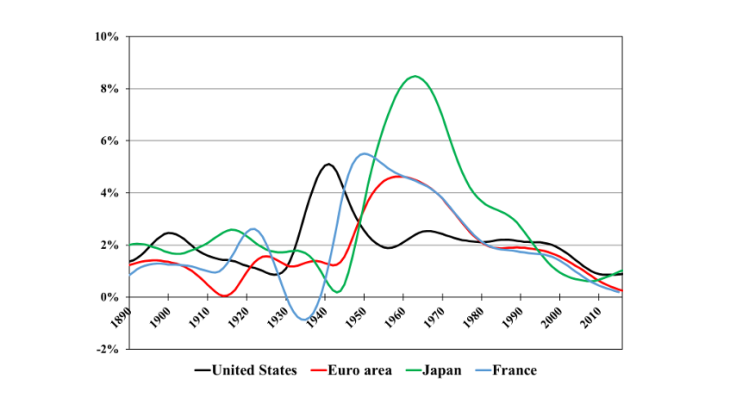

In advanced economies, and particularly Europe, economic growth has slowed in successive phases since the 1970s, falling to its lowest recorded peacetime rate (see Chart 2). The most recent slowdown, which began before the financial crisis, can be attributed to a waning of the contribution of information and communication technologies (ICTs) to growth (Bergeaud, Cette, Lecat, 2016).

Source: Bergeaud, Cette, Lecat (2016)

Note: Annualised % growth.

The growth outlook is the focus of heated debate between techno-optimists and pessimists

The slowdown in growth has sparked a heated and ongoing debate between so-called “techno-optimists” and “techno-pessimists”.

According to the techno-pessimists, the ICT revolution has run its course. ICTs made a significant contribution to growth, but their impact was more modest than that of previous technological revolutions and, above all, shorter lived – lasting from the mid-1990s to the mid-2000s. Since then, the diffusion of ICTs has stagnated, leading to a slowdown in productivity. For Gordon, ICTs cannot be likened to previous technological revolutions, as the latter took the form of “great leaps forward” in numerous domains: the shift from coal and animal traction to the electric and combustion engines, the development of chemicals (petrochemicals, plastics, pharmaceuticals), the shift from telegrams to modern telecommunications (telephone, radio, television), etc. Other experts (Bloom et al., 2017) highlight the growing cost of research: ideas have become harder to find. The number of researchers required today to achieve the famous doubling every two years of the density of computer chips (Moore’s Law) is more than 18 times larger than the number required in the early 1970s.

The techno-optimists, on the other hand, point to the huge potential for advances in artificial intelligence (Brynjolfsson and McAfee, 2014), which they say will trigger a self-sustaining process of innovation. Break-through innovations are on the verge of appearing, notably in electronics (3D computer chips, quantum electronics, etc.), while the use of computer chips in new fields could deliver major productivity gains (a process called “More than Moore” in International Technology Roadmap for Semiconductors, see Cette, 2014).

For countries that are still far from the technological frontier, the process of convergence also offers enormous potential for productivity growth. This catch-up process will not happen spontaneously, however. Countries need to be capable of assimilating technological innovations, thanks to a sufficiently qualified workforce and a labour market that is flexible enough to shift jobs towards innovative firms. There also need to be incentives for firms to adopt these innovations, such as a sufficiently high degree of market competition.

Opposite scenarios: secular stagnation or technology shock?

Cette, Lecat and Ly-Marin (2017) construct two opposite scenarios.

In the first scenario – the “secular stagnation” one inspired by Gordon’s projections – total factor productivity (TFP) in the United States should continue to grow at the same rate observed since the end of the ICT revolution (2005), that is by an average of 0.6% per year. In the second scenario – the “technology shock” – a new technological revolution should drive TFP up at a similar rate to that seen in the 20th century with the advent of electricity. According to Bergeaud, Cette and Lecat (2018), this shock corresponds to average annual TFP growth of 1.6% in the United States between now and 2060.

In other countries, educational attainment, labour market flexibility and competition are assumed to converge towards levels in the country where they are highest. The productivity catch-up in these countries, calibrated using econometric estimates, is conditional on the flexibility of the labour market and the degree of competition in the economy. The countries hence implement major structural reforms in labour and product markets and in education, which facilitate the process of convergence in this scenario.

According to our scenarios, future growth either will or will not be sufficient to face the challenges ahead

Using these two TFP scenarios, Cette, Lecat and Ly-Marin (2017) estimate GDP growth over a long-term horizon (see Chart 3). In addition to the assumptions cited previously, the authors deduce the change in capital stock by assuming that the ratio of capital to real GDP remains constant, which is consistent with historical data. They also use employment projections from the OECD.

Source: Cette, Lecat, Ly-Marin (2017)

Under the secular stagnation scenario, the United States should see average growth of 1.4% per year between now and 2060, with TFP making a contribution of 0.6 percentage point, capital intensity 0.5 percentage point, and labour 0.3 percentage point (see Chart 1). In the euro area, growth is expected to be slightly weaker at 1.1%, as the labour factor will be penalised by less favourable demographics. France’s economy should expand by 1.6% per year, as its demographic evolution should be slightly more favourable than in the broader euro area, albeit less favourable than in the United States. French GDP will nonetheless rise at a higher rate than in the United States thanks to higher productivity growth and a catch-up effect. Japan, in contrast, should see particularly weak growth (0.4%), as its demographics should be extremely unfavourable and its catch-up potential should be limited by various structural weaknesses.

Under the technology shock scenario, growth is projected to average 3.2% per year in the United States up to 2060, fuelled primarily by TFP. The euro area should see 2.8% growth, France 3.1% and Japan 2.1%. In the case of the euro area, structural reforms are projected to make a sizeable contribution to growth (around 0.3 percentage point per year) by accelerating the convergence process. These highly ambitious reforms will consist in a downward adjustment of product and labour market regulation towards levels in the country where they are weakest.

The two scenarios produce markedly different results. In France, for example, from 2018 to 2060, GDP is multiplied by a factor of 2 under the secular stagnation scenario, compared with a factor of 3.8 in the case of the technology shock. Gordon has highlighted a number of headwinds that advanced economies will face in the years ahead, including population ageing, stagnating education levels, high levels of inequality, environmental risks, and rising public and private debt levels. For economies to withstand these headwinds, they will need to grow at a sustained pace, in order to finance pension schemes, healthcare spending, redistribution policies, the energy transition, deleveraging, etc. It is hard to imagine how this would be possible under the secular stagnation scenario, whereas under the technology shock scenario, it becomes much easier.

Updated on the 25th of July 2024