Growth in European financial integration after the introduction of the euro

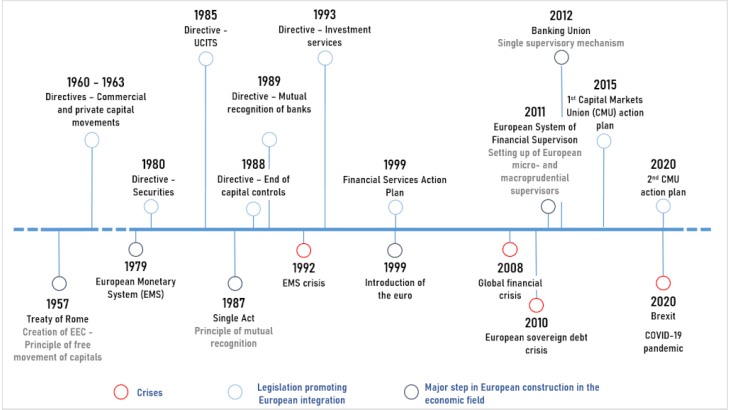

The changeover to the single currency altered the scale of financial flows, particularly as a result of the removal of exchange rate risk. Following isolated sectoral directives in the 1980s and 1990s, the euro’s introduction was accompanied by the Financial Services Action Plan, an overall plan designed to promote intra-EU financial flows (see diagram). Comprising 27 directives implemented between 1999 and 2007, it contributed directly to the acceleration of intra-euro area flows by harmonising the regulatory framework (Kalemli-Ozcan et al., 2010).

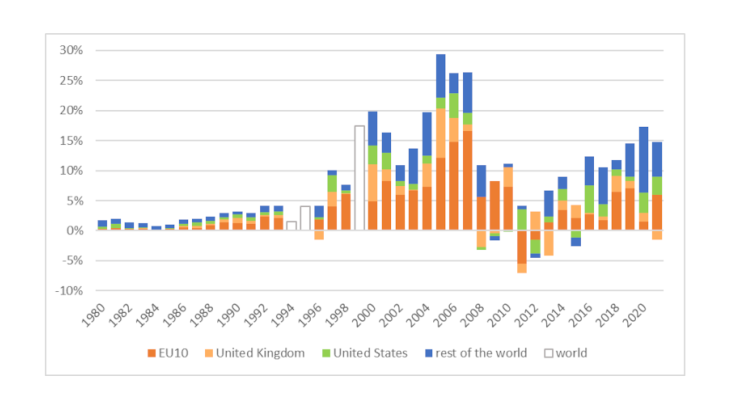

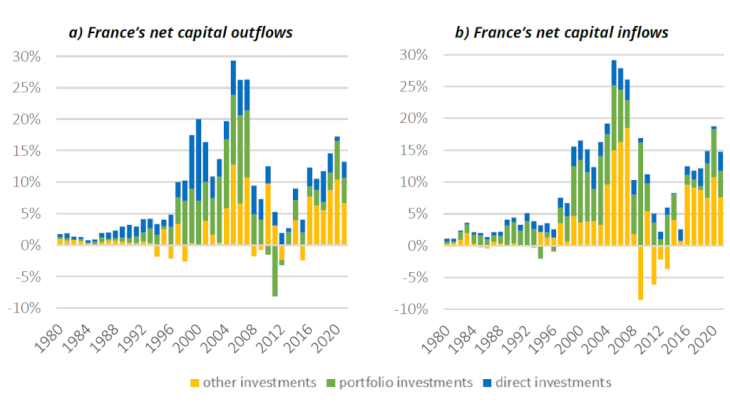

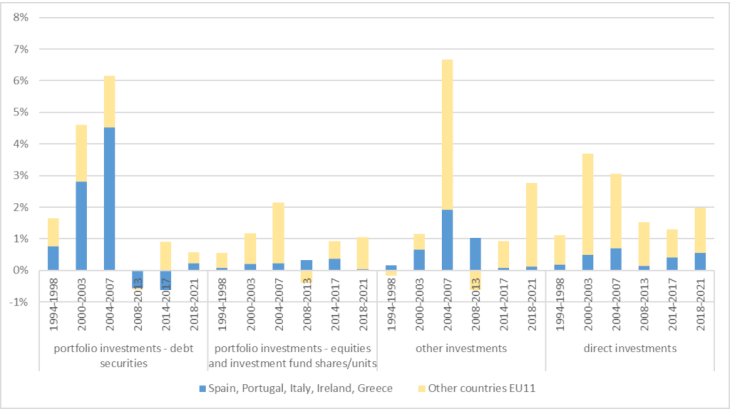

Financial integration in the 2000s was then mainly driven by outward direct and portfolio investment. France’s financial flows to the EU thus reached 18% of GDP in 2007, and were directed particularly at Germany, the Netherlands and the United Kingdom (mainly in the form of direct investment), whereas its integration with the rest of the world outside the EU stagnated at around 9% (Chart 1). France’s portfolio flows to Southern European countries (Spain, Italy, Greece and Portugal) and Ireland also increased, in the context of growing domestic imbalances in these countries. The composition of France’s financial flows to the EU changed substantially, with a sharp increase in debt purchases (portfolio investment in debt securities and other investment – Chart 3). These outflows were financed, in turn, by inflows of portfolio investment and other investment (mainly interbank loans) from countries outside the euro area, which reached 18% of GDP in 2004. France thus played the role of intermediary of financing flows between the rest of the world and the euro area.

The decade of crises: the global financial crisis and euro area debt crisis

As a result of the financial crisis in 2008 and the European debt crisis in 2010-12, French financial outflows shrank temporarily, with divestment in 2008 regarding other investment, and in 2011 for portfolio investment. The fall in intra-European flows was mainly due to the reduction in the size of banks’ balance sheets and the contraction in interbank lending (Emter et al., 2018), which was replaced by direct loans from the Eurosystem to banks (through the policy of tenders with full allotment).

Following the euro area debt crisis, there was also a sharp reduction in exposures to debt securities issued by the rest of the EU. With a vicious circle triggered, wariness of sovereign debt spread to banks that held a large share of government securities. Cross-border holdings of debt securities, especially government ones, in the euro area were thus reduced after the onset of the Greek debt crisis (by Haan and Vermeulen, 2018).

Since 2000, debt purchases have fluctuated more than purchases of capital (FDI and equities) in the rest of the EU. As in the rest of the world, FDI flows have been more resilient, particularly during the crisis periods.