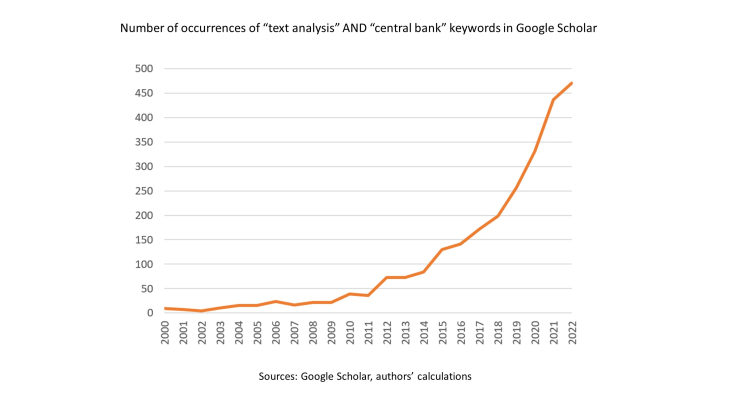

Over the last years, text mining has expanded in economics, in particular in relation with central banks as shown by figure 1 that indicates the number of occurrences in articles registered in Google Scholar of “text analysis” combined with “central bank” keywords. Among other players, central banks and supervisory institutions have mobilized it for multiple uses, in relation with their missions.

Text mining is a polyvalent tool to gauge the economic outlook in which central banks operate, notably as an innovative way to measure inflation expectations. Beyond inflation, text mining also contains significant information for forecasting key variables such as GDP, private consumption, or employment. Research has shown that text-based indicators retain significance for forecasting even after controlling for traditional indicators, suggesting that text captures information that would not otherwise be reflected by the usual indicators.

This is also a pivotal tool to assess risks to financial stability, both at the macro (economy-wide) and micro (for individual financial institution) levels. The economic literature shows a clear link between text-based sentiment analysis and financial markets, demonstrating how capturing investors’ sentiment via text can help predict market returns.

Beyond financial markets, text mining can also help supervising individual financial institutions. As central banks increasingly consider issues such as the climate challenge, text mining also allows to assess the perception of climate-related risks and banks’ preparedness.

The analysis of central banks’ communication provides a feedback tool on how to best convey decisions. Central banks’ communication delivers information outside central banks and may be studied, using text analysis, to assess its impact on the financial markets. Communication can indeed be an effective tool for central banks as it can impact financial markets, increase the predictability of monetary policy actions, and help achieving macroeconomic goals. In addition to financial markets, central banks increasingly target non-experts. For example, tweets from central banks announcing the launch of new coins and banknotes, and those related to monetary policy decisions, seem to be associated with a higher public engagement.

It is important to notice that, albeit powerful, text mining complements – rather than replaces – the usual indicators and procedures at central banks. The literature generally concludes that a combination of text-based and traditional indicators is more adequate. Beyond technical problems at the pre-processing stage (e.g., multilingual text), text-mining techniques can exhibit interpretative issues. Indeed, one word may have several meanings and can be interpreted in multiple ways: such an ambiguity leads to noise in the data. Moreover, sentiment analysis often relies on a binary classification of positive and negative words but several typical nuances such as negation, irony, ambiguity, idioms, and neologisms, make such a binary classification likely too simplistic.

Going forward, generative AI also opens new frontiers for the use of textual data, for example for ideation and feedback, writing, background research, data analysis, coding, or mathematical derivations. However, the literature also acknowledges challenges associated with bias, interpretability, and reproducibility which seem important when considering LLMs into monetary policy.

Keywords: Text Mining, Sentiment Analysis, Central Banking, Generative AI, Language Models

JEL classification: C38, C55, C82, E58, L82