- Home

- Publications et statistiques

- Publications

- The rise in refinancing in the UK from a...

Post No. 395. Uptake of the Bank of England’s Short-Term Repo (STR) facility has increased significantly, reflecting rising market interest rates in a context of quantitative tightening. In the euro area, a similar trend has not yet materialized, due to the price of central bank funding relative to market alternatives. However, the UK experience offers valuable insights for the Eurosystem.

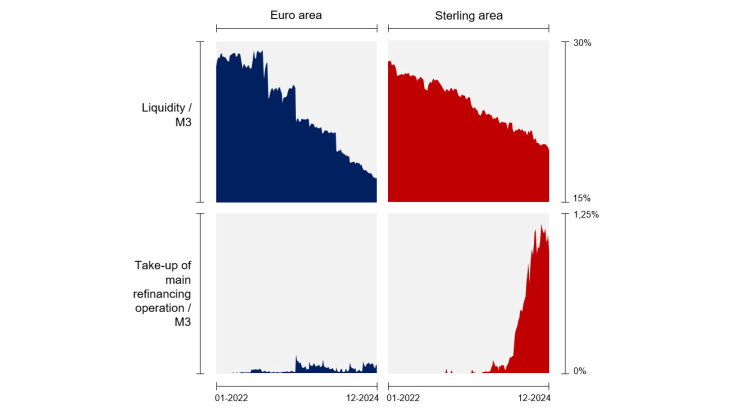

Chart 1: Liquidity position and uptake of main refinancing operation in euro and sterling areas

Note: The volume of liquidity corresponds to the total amount of bank excess reserves. The refinancing operations are MROs (Main Refinancing Operations) for the euro area, and STR for the sterling area.

Monetary policy operational framework and steering of rates

Bank reserves (“liquidity”) are deposits that financial institutions hold with their central bank. They are created when the central bank purchases securities from, or provides loans to, its counterparties. Since the launch of quantitative easing programmes and long-term refinancing operations, particularly after the Great Financial Crisis, the volume of reserves has risen considerably, generating a liquidity surplus far exceeding banks' needs. This surplus has pushed interbank rates down to their lower bound, which in the euro area corresponds to the deposit facility rate (DFR) and in the United Kingdom to the Bank Rate (the rate applied to reserves). This operational framework is known as a “supply-driven floor” system, where the central bank steers rates at floor level through an excess supply of liquidity.

In the current macroeconomic environment, marked by the repayment of long-term loans (TLTRO III in the euro area) and quantitative tightening, the stock of liquidity is declining amid uncertainty surrounding aggregate demand for reserves. Most central banks have opted to keep their policy rate at the floor, as this provides greater precision in rate control. However, this required adjustments to their operational framework. The US Federal Reserve has chosen to maintain a “supply-driven floor” system, providing just enough liquidity to anchor rates near the floor. Conversely, the BoE is transitioning to a “demand-driven floor” framework in which banks can obtain financing at the same rate applied to reserves. In its new operational framework announced in March 2024, the Eurosystem has adopted an intermediate approach, though it leans closer to the BoE’s model, as refinancing operations will become the main instrument for adjusting liquidity conditions.

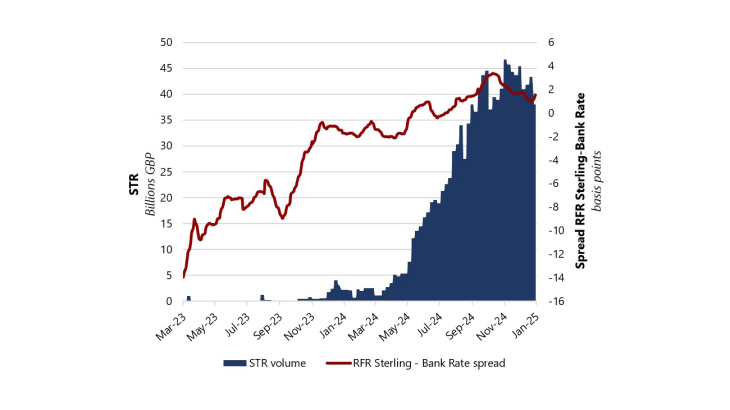

The rise in STR uptake as part of the BoE’s transition to demand-driven steering

Introduced by the BoE in August 2022, the STR consists of repurchase agreements with a one-week maturity, allowing banks to obtain fixed-rate full-allotment sterling refinancing against high-quality collateral, mainly UK government bonds (gilts). It was intended to become one of the main mechanisms for steering interest rates, and uptake of the facility has increased sharply (from GBP 2.2 billion in January 2024 to GBP 41.0 billion in December 2024), driven by shifts in reserve supply and demand dynamics, as well as the facility’s relatively attractive pricing. On the one hand, the BoE has implemented an active quantitative tightening policy, ceasing the reinvestment of maturing securities and launching a gilt sales programme. On the other hand, reserve demand remains structurally high due to prudential liquidity requirements introduced under Basel III in 2015.

This is placing upward pressure on money market rates. The spread between SONIA (Sterling Overnight Interest Average, the unsecured overnight benchmark) and the Bank Rate has narrowed by 2 basis points since January 2023, while the overnight secured rate (RFR Sterling) has exceeded the Bank Rate, currently standing 2 basis points above it – compared with 16 basis points below during Q1 2023 (see Chart 2). Meanwhile, STR lending is priced at the Bank Rate, encouraging banks to increase their reliance on BoE funding during auction days due to its competitive price, while also helping to reduce the stigma historically associated with borrowing from the central bank.

The BoE has reinforced this trend though proactive communication, explicitly stating that STR is a standard financing tool within the new operational framework. Furthermore, it aims to promote a more sustainable approach to liquidity management, encouraging banks to increase their reliance on longer-term refinancing operations, which is becoming crucial as excess reserves in the UK financial system continue to decline.

Chart 2: STR volume & RFR Sterling-Bank Rate spread

Note: The RFR Sterling-Bank Rate spread has been smoothed (one-month moving average).

Use of the Eurosystem’s MROs has not risen to a similar extent, as their relative price remains less attractive

Sterling and euro area liquidity cycles are broadly synchronised. In January 2022, just before the start of quantitative tightening, excess liquidity in both areas accounted for approximately 28% of M3, which is the monetary aggregate that measures the broad supply of money excluding bank reserves. Since then, this share has gradually declined, reaching 20% and 17% of M3 respectively in December 2024 (see Chart 3).

Yet, the uptake of the Eurosystem’s MROs has not risen to the same extent as that of the STR (MRO borrowing remains below 0.05% of M3, see Chart 1). This can be explained by the non-negligible spread between the MRO rate and the DFR, which stood at 50 basis points, and was reduced to 15 basis points since 18 September 2024) - unlike the zero spread between the STR and Bank Rate in the United Kingdom. Another key difference lies in the availability of securities that can be used as collateral on the repo market. Asset purchase programmes reduced the availability of securities, strengthening the market power of repo borrowers, who can obtain cash at more favourable conditions due to the scarcity of collateral. This has exerted downward pressure on repo rates, especially for highly-sought government bonds. For example, borrowing against German Bunds was priced at 52 basis points below the DFR in September 2022. Since then, the gradual reduction in the Eurosystem’s balance sheet, higher net government debt issuance, and the end of TLTRO III have helped alleviate collateral scarcity, leading to a rise in repo rates. However, as of December 2024, repo transactions were still priced below or around the DFR, including those involving less in-demand securities, referred as “non-specific” collateral. Consequently, while both secured and unsecured UK market rates have remained close to or slightly above the STR rate, euro area equivalents remain significantly lower than the MRO rate. €STR (Euro Short Term Rate,the unsecured overnight money market benchmark) was 23 basis points below the MRO rate by the end of 2024, while RFR Euro (the secured repo rate) stood 16 basis points below. As a result, credit operations remain marginal in the overall liquidity provision of the Eurosystem.

Chart 3: Synchronisation of liquidity volumes in the euro and sterling areas

Note: The notion of surplus liquidity does not apply to the sterling area as the Bank of England does not require counterparties to hold minimum reserves.

A useful insight for the revision of the Eurosystem’s operational framework

Under the new operational framework announced in March 2024, the Eurosystem will continue to steer short-term rates at the floor level. Liquidity needs will be met using a broad set of instruments, among which MROs are set to play an increasingly important role. To enhance their attractiveness, the Eurosystem decided to reduce the spread between the MRO rate and the DFR to 15 basis points as of 18 September 2024. However, an immediate increase in MRO uptake is not expected, as excess liquidity remains above the Floor Required Excess Liquidity (FREL) level – despite persistent uncertainty regarding its precise estimation. Nevertheless, MROs offer features that could encourage higher participation even before market rates approach the level of the MRO rate. Unlike the STR facility, the MRO collateral framework is broad, as it includes non-HQLA securities such as private credit claims. Consequently, bank’s choice between market-based funding and MROs depends on more than just pricing considerations. MROs provide an additional advantage by allowing counterparties to transform non-HQLA collateral into reserves – which are classified as HQLA and included in the calculation of the liquidity coverage ratio. This added benefit may be worth paying the few extra basis points compared with a standard HQLA-secured repo transaction.

Finally, the gradual rise in STR uptake suggests that the transition from an environment of abundant liquidity to one requiring more active liquidity management via the interbank market and central bank refinancing operations is unlikely to be abrupt. The Eurosystem will reassess the key parameters of its operational framework in 2026, with the option of making adjustments earlier if needed to ensure a transition as smooth as possible.

Table 1: Elements of vocabulary and comparison between the two operational frameworks

| Euro area | Sterling area | |

| Representative unsecured money-market rate (overnight) | Euro Short-Term Rate (€STR) | Sterling Overnight Index Average (SONIA) |

| Main central bank refinancing operation | Main Refinancing Operations (MROs) | Short term repo (STR) |

| Rate applied to reserves | Deposit facility rate (DFR), i.e. 15 basis points below the MRO rate | Bank rate |

Download the full publication

Updated on the 13th of March 2025