1 Hong Kong’s currency board is a credible system

The system has adapted to the macroeconomic developments of recent decades

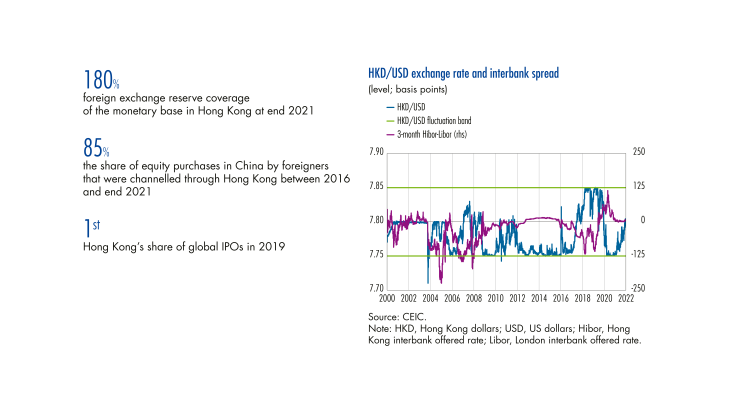

The Hong Kong dollar (HKD), which had been pegged to the pound sterling since 1935 (see Box 1), experienced a break in August 1971, when the US administration decided to suspend the convertibility of the dollar (USD) into gold and the British government was forced to float the pound sterling. The currency was then briefly pegged to the US dollar, first at a rate of HKD 5.65 to the USD and then, from February 1973, at HKD 5.085. But in November 1974, against a weakening of the US dollar, the Hong Kong dollar began to float freely. In the absence of a clear monetary policy objective, this exchange rate regime failed to anchor inflation, which reached 15.8% in 1980 (Hong Kong Monetary Authority – HKMA, 2000). The Hong Kong dollar depreciated rapidly from HKD 5.13 to the USD in 1981 to HKD 9.60 in 1983. This was compounded by speculative attacks and an escalating crisis of confidence over Hong Kong’s future. The latter reached its peak in 1983, due to the uncertainty surrounding the Sino-British negotiations that led to the signing of the Joint Declaration in 1984. On 15 October 1983, the SAR government, faced with both currency instability and doubts about the soundness of a number of banks that carried a high exchange rate risk, announced a new exchange rate regime, which is now the basis of Hong Kong’s monetary system: the link between the Hong Kong dollar and the US dollar at a fixed rate of HKD 7.80 to the USD, guaranteed by a currency board (see Box 2).

In addition, in parallel with the evolution of the Hong Kong dollar’s peg, the missions of the Exchange Fund (see Box 1) were broadened and the government’s reserves were entrusted to it in the 1970s. It was then integrated into the Hong Kong Monetary Authority (HKMA), which was created in 1993. The fact that a monetary authority now manages the foreign exchange reserves rather than an “exchange fund” is clearly a sign that the rules have been eased over time.

Over the last four decades, the system has thus undergone a number of changes, enabling it to adapt to the changing macroeconomic environment, without calling into question its fundamental principles.

[to read more, please download the article]