An over-representation of mortgage debt excluding primary residences

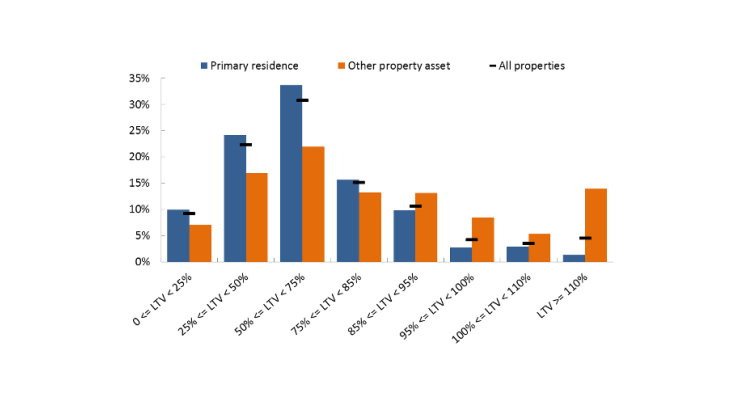

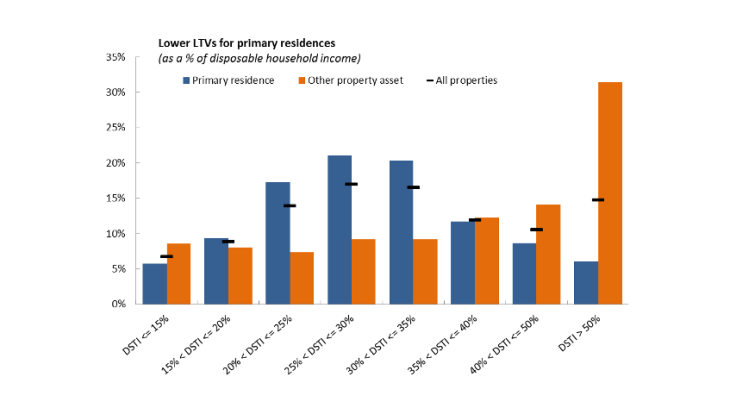

The survey highlights the difference between the features of debt arising from the purchase of a primary residence and those of other mortgage debt (secondary residence or rental investment chiefly). Mortgages excluding primary residences are granted with shorter maturities and higher LTVs and DSTIs, as observed in the Survey on home financing conducted by the ACPR. In total, loans with a current LTV of over 110% correspond in 79% of cases to property purchases excluding primary residences.

Households generally more affluent than average

For instance, we observe among households whose current LTV is over 110% an over-representation of the higher socio-professional categories. The disposable income of these households is 54% higher than French households’ average income but is also 4% higher than borrowers’ average income. The same applies to their net wealth, which is over 25% higher than that of households as a whole.

A risk associated with house price movements

The high ratio of debt of this category of the population, made possible by their resources, also reflects movements in prices, i.e. the denominator of the LTV. For example, the prices of properties financed with a current LTV of over 110% appear to have depreciated by 23% since their purchase whereas, according to the survey, properties with outstanding mortgages as a whole seem to have appreciated by 30%.

More recent purchase dates are not sufficient to explain the higher current LTVs. Indeed, mortgages on properties purchased less than three years ago only account for 43% of outstandings with an LTV of over 110%, compared with 66% of outstandings with an LTV of between 95 and 100%. One plausible explanation is that the decline in property prices in France between 2011 and 2015 was particularly sharp on some secondary residence and rental investment markets. By way of illustration, in the survey, the value of the properties with an outstanding mortgage appears to be 34% higher than their purchase price for primary residences, compared with only 18% for other types of property.

Some financially vulnerable households also have high LTVs

However, the profiles of the households whose LTV is between 100% and 110% are more heterogeneous. While debt excluding primary residences is also over-represented in this category, it still constitutes a minority (38%). Overall, the disposable income of these households is 7% lower than that of the average borrower. Moreover, these households state more often than the others that their wealth has fallen during their lifetime. While they have less debt than the “affluent but in debt” households described above, this category covers a significant proportion of households that face financial difficulties and are more vulnerable.

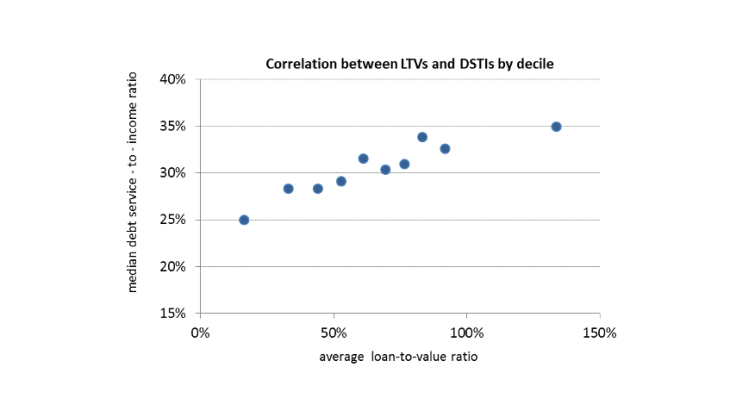

The LTV alone is insufficient to accurately assess credit risk

The category of highly-indebted households includes very different realities ranging from affluent households financing a rental investment or a secondary residence and capable of absorbing a downward price shock, to vulnerable households. The risks to which these two populations are exposed are different meaning that the assessment must be carried out with care and discrimination (Dietsch and Welter-Nicol (2014)).

Given the volumes concerned, few analyses specifically identify the financing of secondary residences or rental investment. Data from the Wealth Survey nevertheless show that they are very different markets, characterised by lower average down payments and larger price swings, but also by households that have higher incomes and greater wealth.