Various determinants of the size of the fiscal multiplier have been found in the literature, such as the level of public debt, the exchange rate regime, the position in the economic cycle, the degree of development, and trade openness.

In this paper, we show that the size of the fiscal multiplier may also depend on both the proportion of debt that is denominated in foreign currency and the degree of home bias. Our theoretical demonstration is based on a real two-country dynamic stochastic general equilibrium (DSGE) model with incomplete and imperfect international financial markets, external indebtedness and financial frictions due to asymmetric information. In a costly state verification framework à la Townsend, firms have to bear an external finance premium (EFP), which increases with their debt-to-wealth ratio. While domestic net wealth is supposed to be entirely denominated in domestic goods, firms’ debt is assumed to be – to some extent – denominated in foreign goods. We demonstrate that such a currency mismatch can be at the origin of a financial accelerator mechanism, which in turn influences the macroeconomic impact of fiscal shocks.

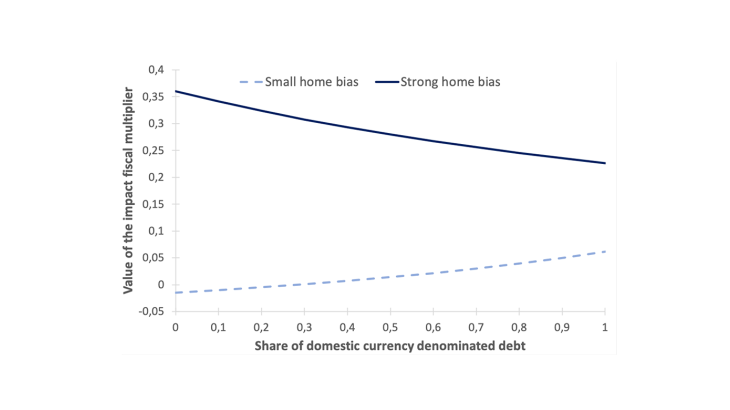

Indeed, the figure below shows the sensitivity of the impact fiscal multiplier to the degree of home bias and the proportion of debt that is denominated in domestic currency.

On the one hand, a small home bias (dotted line) is associated with a low fiscal multiplier. This is not only due to the increase in domestic demand for imported goods, as in the textbook model, but also to balance sheet effects. Indeed, we find that the terms of trade worsen following a positive public spending shock under low home bias. Therefore, the balance sheet structure of domestic firms that are heavily indebted in foreign currency deteriorates. Firms have to bear a higher EFP, which depresses private investment. Negative balance sheet effects are combined with the standard crowding-out effect to make the fiscal multiplier very low. In this configuration, the higher the debt in foreign currency is, the lower the fiscal multiplier. The impact multiplier can even be negative when private debt is mainly denominated in foreign currency.

On the other hand, the solid line reveals that being indebted in foreign goods is beneficial when home bias is strong. In this case, we show that the terms of trade improve in the wake of an exogenous increase in public spending. Because this enhances the quality of firms’ balance sheets by reducing real debt, firms can benefit from better credit conditions (i.e. lower EFP), which stimulates private investment and mitigates the traditional crowding-out effect. Hence, under this configuration, the higher the debt in foreign currency is, the higher the fiscal multiplier.

These results lead to rather nuanced normative conclusions regarding currency mismatch. From a fiscal multiplier perspective, policies designed to restrict debt denominated in foreign currency are not necessarily desirable. They may mitigate the crowding-out effects of public spending stimulus in the case of a small home bias. However, they may reduce the fiscal multiplier when the home bias is large. Ultimately, the main issue concerns financial imperfections. We show that currency mismatch is less crucial for the size of the impact of public spending in the absence of financial frictions.