Infrequent price adjustment is a crucial assumption in standard macro models used for the analysis of monetary policy. In these models, the frequency of price changes shapes the speed at which aggregate shocks impact inflation. In particular, a low frequency implies that a monetary shock will take longer to be transmitted to inflation and will have real effects in the short run. In addition to this nominal rigidity, the size of the adjustment also matters for inflation dynamics. Even with infrequent price changes, money can still be neutral if the price changes which occur are large. Specifically, a key factor is whether price setting is state-dependent, i.e., whether the prices that change are those that need to adjust the most, because they are most misaligned from their target value. In the presence of this selection effect large price changes can be associated with small aggregate shocks, accelerating the reaction of aggregate inflation. Instead, in the main alternative model of price setting (known as ‘time-dependent’), widely used in New Keynesian macro models, selection is absent: the probability of changing prices is exogenous and independent of price misalignment. This difference suggests that characterizing price stickiness requires information not only on the frequency of price changes, but also on the moments of their size distribution.

The calibration of price stickiness in macro models can only rely on the analysis of the most granular price data. However, until the early 2000’s, there was hardly any micro evidence on price adjustment, especially for the euro area. This paper provides an overview of available empirical evidence on price stickiness in the euro area, focusing on the period 2005-2019 but also including an update on the post-Covid surge in inflation.

We first describe the euro area price data sets that have been made available to researchers since the early 2000s. The initiatives behind these data sets have had to face the challenge of assembling and making comparable data from several different countries. The Eurosystem’s Inflation Persistence Network (IPN) pioneered studies of micro prices in the euro area. More recently, the European System of Central Banks (ESCB) Price-Setting Microdata Analysis Network (PRISMA) has embarked on a project to harmonize micro price data into a single dataset that provides comparable statistics on patterns of price adjustment, at the product level across euro area countries.

The main findings of the empirical literature on the euro-area price stickiness are the following. First, in a low inflation environment, consumer prices change on average once a year. Within the euro area, we find small differences in the frequency of price changes across countries. The frequency of price adjustments varies much more across sectors. Second, price changes in the euro area are large on average. Another important feature of the price change distribution is that non-zero price changes are highly dispersed, with many changes smaller than average inflation but with a significant number of large increases and decreases.

Price changes are more frequent in the US than in the euro area but the difference is primarily due to sales and, once price changes due to sales are excluded, prices changes are as frequent in the US than in the euro area. When we compare the frequency of producer price changes and the frequency of consumer price changes for similar products in the euro area, they are highly correlated, but for a majority of products the frequency of producer price changes is larger than that of consumer prices. Similarly, the average size of producer price changes is smaller than the one of consumer prices.

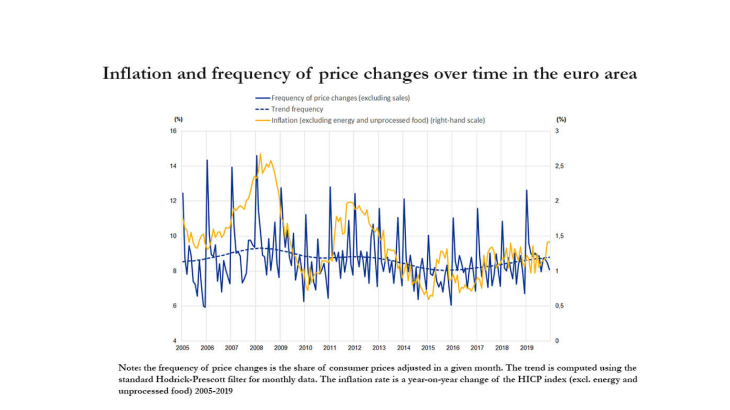

When looking at how price stickiness varies over time, the frequency of price changes remained broadly stable over the period 2005-19 and is not correlated to aggregate inflation (Figure 1). Price changes are much more frequent in January than in other months (even after removing price changes due to sales). This January effect is much stronger than any cyclical variation we can detect over the period 2005-2019 in the frequency of price changes.

Another crucial finding is that state dependence is a relevant feature of price setting in the euro area. In the recent inflation surge, characterized by large inflationary shocks, the frequency of price changes has increased, consistently with the nonlinear effects of shocks that state dependence predicts. This increase in the frequency of price changes entails faster inflation dynamics: for a given degree of persistence of the underlying cost shocks, inflation will rise more quickly than if the frequency of price changes had remained unaffected.

Keywords: Nominal Rigidities, Inflation, Micro Data, Euro Area

JEL classification: D40, E31