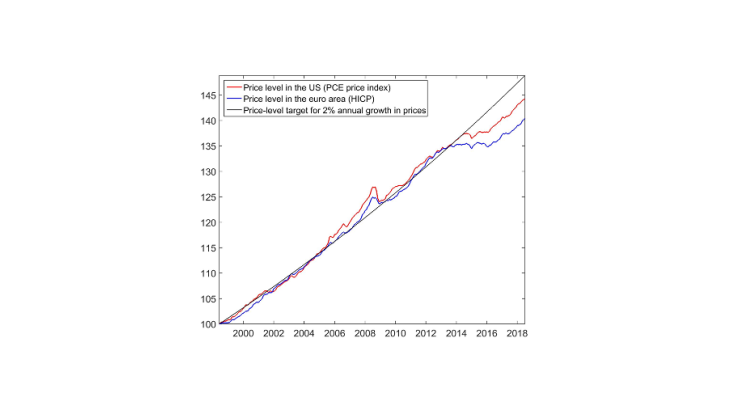

The blue and orange lines give the realised evolution of consumer prices in the US and euro area, normalising the 1998 level at 100. The black line gives the counterfactual evolution if inflation had been exactly 2% every year since 1998

Most central banks have translated their price stability mandates into inflation targets – 2% for the Fed, below but close to 2% for the ECB. However, an ambiguity to these quantitative definitions remains: if inflation is only 1% in one year, will the central bank compensate by seeking 3% the year after, or will it stick to seeking 2%? In other words, is monetary policy like archery – shooting one arrow below the target is no reason to shoot the next one above – or is it more like repaying debt – if you missed a payment you need to pay it next time?

The first approach is called inflation targeting and has been followed by central banks since inflation targets appeared in the 1990s. The second approach is called price-level targeting, because it sets a target for the level prices should ultimately reach: if prices are 100 today, they should be 102 in one year, 104 in two years, etc. So far, it has only been implemented once, by Sweden in the 1930s, at a time when the debate was between the Gold Standard and anything else.

Since the late 1990s however, many economists have come to favour price-level targeting on theoretical grounds. Recently, several present and past Fed officials, including New York Fed President John Williams, as well as former Fed Chairman Ben Bernanke, have expressed their support for various versions of it.

A framework to fight deflationary recessions

The primary argument for price-level targeting is that it would be more effective in preventing one major threat to price stability: deflationary recessions (Eggertsson Woodford, 2003). Under inflation targeting, the recipe to keep inflation on target is usually quite simple: if inflation falls below target, then decrease the nominal interest rate at which banks borrow. As banks pass lower rates on to firms and households, this stimulates consumption and investment and therefore puts upward pressure on prices. It works well in normal times.

But this framework has one shortcoming: it cannot handle deflationary pressures so high that they would require decreasing the nominal rate below zero. Unfortunately, this was the situation confronted by the Fed in December 2008 (and by the ECB in July 2012). And losing the tool to increase inflation is a big problem because below-target inflation easily slides into a spiral: it increases the burden of debt, which depresses consumption and investment, which adds more downward pressure on prices, and so on. A deflationary recession sets in.

There is a solution however. Most firms and households borrow over long horizons. Banks offer lower long-term rates if they can borrow at lower rates today, but also if they know that obtaining funds will remain cheap in the future. This gives the central bank a new lever: it can commit to keeping rates low not only during the recession, but for some time after the recession too. This decreases the cost of borrowing today, and therefore puts upward pressure on prices today. It also puts upward pressure on prices tomorrow, but a little inflation after the recession is enough to avoid a deflationary spiral during it.

This fix to inflation targeting is called Odyssean forward guidance, because the central bank pledges to depart from its usual policy just after the recession, just as Odysseus pledged to resist the temptation of the sirens. It is one of the main unconventional tools introduced by the Fed since 2008. But communicating it is difficult. The Fed first announced that rates would be kept low for long. However, was this an indication that the Fed would keep rates low after the recession, or that it expected the recession to last long? To remove the ambiguity, in December 2012 the Fed switched to announcing that rates would be kept low at least until inflation was projected to be half a percentage point above its 2% target (among other conditions).

But tolerating more inflation tomorrow if there is less inflation today is precisely the essence of price-level targeting. This is why several Fed officials see price-level targeting as the natural next step in the evolution of the Fed’s forward guidance. It would provide the benefits without the tedious communication and inherent unpredictability. It would turn an unconventional policy into a conventional policy.

Price-level targeting or temporary price-level targeting?

However, some, such as Ben Bernanke, worry that price-level targeting would require overtightening policy in response to temporary inflationary shocks, such as an increase in oil prices. For this reason, Bernanke advocates temporary price-level targeting: turning to price-level targeting only when interest rates have reached zero, while sticking to inflation targeting in normal times. This would provide most of the benefits of price-level targeting, while also constituting a smaller departure from the current framework.

Would inflation become more uncertain?

However, price stability includes another dimension: easily predictable inflation, which removes unnecessary financial uncertainty. Some (e.g. Bank of Canada, 2011) worry that price-level targeting would make forecasting inflation more cumbersome – a borrower would need to research whether the central bank has recently missed its inflation target.

However, strictly speaking it would make inflation less uncertain (Koenig, 2013; Sheedy, 2014). Consider a borrower who took out a 10-year loan in 2013 expecting 2% inflation. Since 2013, US inflation has averaged 1.4%. If, as inflation targeting calls for, the Fed delivered 2% inflation from 2018 to 2023, average inflation over 2013-23 would be 1.7%. Under price-level targeting, the Fed would deliver 2.6%, making average inflation consistent with initial expectations.

Would long-run inflation expectations remain well anchored?

Sceptics also worry that price-level targeting would undermine a prerequisite to price stability: the anchoring of long-run inflation expectations. When seeing the central bank tolerate above-target inflation, couldn’t firms and households infer this is the new long-run target rather than temporary compensation for past below-target inflation? Proponents of price-level targeting, on the other hand, argue that in the current context expectations anchoring is more at risk under inflation targeting. If the public expects that tomorrow will be a succession of recessions with inflation below target, and expansions with inflation on target but never above, long-run expectations will be somewhere in between, i.e. below target (Kiley Roberts, 2017).

Ultimately, a policy’s success in anchoring inflation expectations depends on how the public reacts to its introduction. And here lies the main argument in favour of sticking to inflation targeting: experience. Over the past twenty years, it has had a rather good record at keeping expectations anchored. We will only know whether price-level targeting can do as well (or better) if a central bank implements it.