Note: The personal recovery procedure, or total debt forgiveness, is open to debtors who are in the most difficult financial situations and who are incapable of repaying what they owe.

The overindebtedness procedure, which is aimed at individuals and households that are clearly unable to repay all their debts, is thirty years old. The number of applications filed, which had increased in the 1990s and 2000s, fell by 38% between 2014 and 2019, thanks to the legislation against abusive lending practices, the reduction in unemployment and the improvement in household solvency thanks to lower interest rates and to loan renegotiations. The legal framework for assisting over-indebted households, the methods of dealing with applications and even the goals of the procedure have changed profoundly over the past thirty years, as has the profile of the applicants. In the 1990s, a large proportion of overindebted households had financial resources but were struggling to repay too many loans, in particular consumer loans. Over the years, the overindebtedness has affected the most financially vulnerable individuals, in particular women raising children on their own.

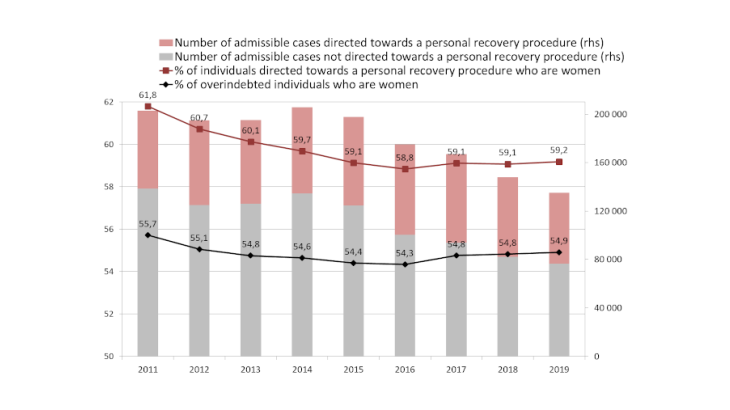

Even though the situation improved at the start of the current decade, women are still more overindebted than men: in the age groups most affected by overindebtedness (25 to 54 year olds), they accounted for 55% of debtors whose overindebtedness application has been considered admissible in France in 2019 (Chart 1, Household overindebtedness - 2019 typological survey), even though they only slightly outnumber men within the age group concerned (less than 51%).

Debts are not solely made up of loans. Increasingly, they include unpaid rents, tax debts, water or electricity bills, school canteen fees, etc. When the household debt commission considers that the debtor is not able to repay his/her debts (given his/her resources and unavoidable expenses), it imposes a write-off of all debts. The proportion of women in these most precarious situations (so-called "personal recovery" or personal insolvency) is even higher: their share exceeds 59%.

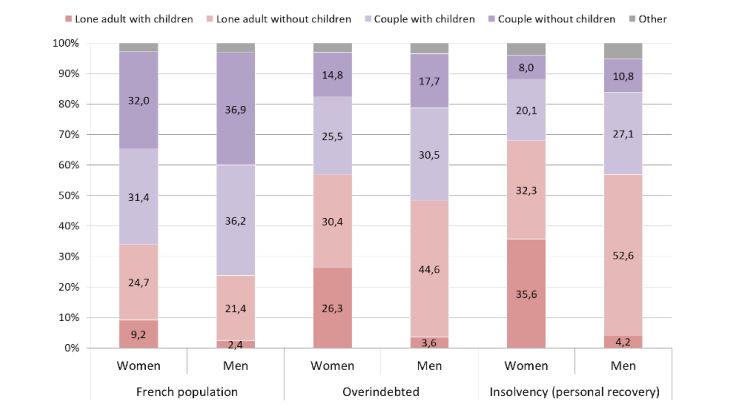

The main difference between over-indebted women and men lies in the composition of households: 26.3% of overindebted women are the head of a single-parent family (against 9.2% in the French female population, see Chart 2). In comparison, 3.6% of indebted men are the head of a single-parent family (against 2.4% in the French male population). The over-representation of single-parent mothers is even greater among the most destitute over-indebted population, since their share rises to 35.6% of overindebted women who have had all their debts written off.