In the wake of the crisis, some authors and institutions have suggested that the monetary policy framework should be updated to incorporate such features as including a financial stability objective in the strategy, raising the definition of price stability from today’s most frequent target of 2% or slightly below to higher levels, or keeping some ‘unconventional’ instruments, specifically large scale asset purchases –LSAPs –, in the central banks’ toolkit. Although the notion of a ‘New Normal’ primarily refers to the latter proposal regarding the implementation of monetary policy, it is also frequently associated with the idea that monetary policy should aim at ensuring financial stability on top of price stability and possibly also low unemployment. In contrast, this paper exposes some elements of a new central banking framework that would make it different both from the current one most of central banks operate in and from the ‘New Normal’. Those elements relate to the conduct of monetary policy and to the role of central banks in preserving financial stability. They implicitly rely on two old-fashioned principles: a clear assignment of responsibilities, keeping monetary and fiscal policies separate; and having at least one instrument per objective, in the spirit of the ‘Tinbergen rule’. Furthermore, they also keep central banks’ monetary policy objectives and instruments basically unchanged, in comparison with the pre-crisis period, while supporting their traditional role in pursuing financial stability. As a consequence, we label them parts of a ‘New Orthodoxy’.

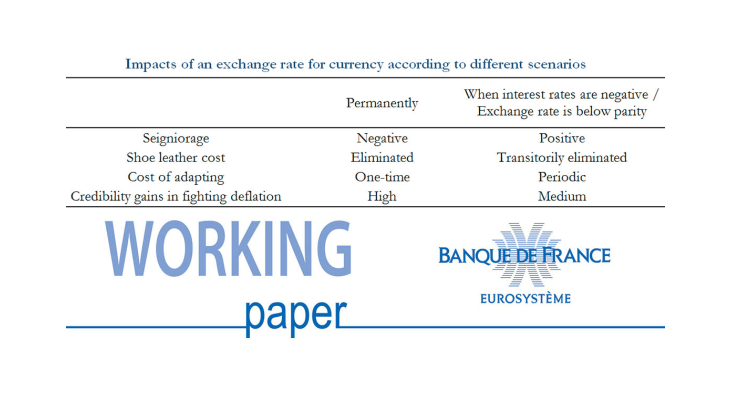

In a first part, we show how monetary policy, without changing the strategy, could greatly diminish the risk of the economy falling into deflation, while making LSAPs unnecessary. This could be achieved if nominal interest rates could be brought to sufficiently negative levels, thus overcoming the “effective lower bound” (ELB). However, converting reserves or a deposit into currency and using the latter in transactions or storing it in vaults prevents monetary policy from achieving NIRs significantly below zero. We discuss the advantages and drawbacks of NIRs in comparison with other instruments such as LSAPs, forward guidance or the depreciation of the exchange rate. We then review the rather scant literature on NIRs, although the subject has recently gained renewed interest. We ask how far interest rates might have, if used alone, to be brought into negative territory to fight a (risk of) deflation. We examine different scenarios to overcome the ELB constraint by introducing an exchange rate for currency: on a permanent basis (A), when interest rates are negative (B), or when the exchange rate is below parity (C). Scenario A would generate more credibility gains in pursuing a NIR policy and would eliminate shoe leather costs, but would have negative consequences for seigniorage and would likely lead to double pricing (for paying with currency or with scriptural money). Scenarios B and C would less likely lead to double pricing and would have a positive impact on seigniorage but credibility gains would be lower than in scenario A, shoe leather costs would be eliminated only transitorily and the public would have to adapt to the exchange rate each time NIRs are implemented. Furthermore, in scenario B, there would be a “jump” in the exchange rate when the NIR policy is discontinued, which would necessitate to withdraw the currency and introduce a new one. Possible reactions of the private sector (general public, long-term interest rates and the banking system) to adopting NIRS are also discussed.

In a second part, we expose how the role of central banks in preserving financial stability could be explicitly recognized, both by themselves and by society, making their contribution to this task more effective. We first review how central banks reacted in the face of the financial crisis in order to fulfill their mission as lenders of last resort (LoLR), then the issues that were raised by the crisis experience. Drawing on the lessons from this experience, we propose some elements of a new framework for acting as LoLR. This framework could incorporate the following three features. Firstly, central banks could offer liquidity support on a standing basis. Secondly, the interest rate on the LoLR facility could be set significantly above the policy rate or above the one on the marginal lending facility for those central banks that, as the ECB, operate a corridor. Thirdly, to avoid that banks in need of liquidity assistance rely on standard monetary policy instruments instead of the LoLR instrument(s), the list of eligible instruments accepted in the former ones could be narrowed to the highest quality instruments with the overall list remaining unchanged, thereby not reducing the potential overall provision of liquidity in comparison with the present situation. Also, central banks should be provided with the appropriate institutional environment. In particular, putting a limit on how long the central bank can lend a specific institution through its LoLR window (for instance three months in normal times and six months in crisis periods) could be useful. Once this limit is reached, the central bank would either appropriate the collateral posted by the institution the management of which would be taken over by the resolution board or be reimbursed by the resolution fund of the LoLR loan previously granted. The resolution fund would itself have to be pre-funded with enough resources and benefit from a fiscal backstop. Finally, charging the central bank with responsibility for financial stability without giving it adequate powers would generate risks, the main one being an over-burdening monetary policy). The central bank should thus have at its disposal appropriate macro-prudential tools it could activate at its own initiative or prompt other authorities to activate. In those cases where the central bank does not have a direct power of decision on the use of macro-prudential instruments but has instead to go through a separate committee to have its proposals enacted, transparency and accountability requirements for the functioning of this committee should be structured so as to reduce the risk of inaction.