In the recent period, India, Israel, Chile, Brazil and Peru have implemented forward guidance (Caballero and Gadanecz, 2023). While Brazil and Peru engaged in outcome-based forward guidance, Chile, Israel and India used open-ended statements. No countries engaged in calendar-based guidance, which offers less flexibility.

Caballero and Gadanecz find that first-time explicit interest rate guidance events were not associated with negative market reactions that would have hinted at a loss of central bank credibility (i.e. de-anchoring of inflation expectations, currency depreciation pressures, or increased sovereign credit risk). Instead, the authors observe a decrease in long-term local-currency yields immediately after these statements, as well as compression of term spreads, confirming the success of forward guidance in these countries. Yet, as pointed out by the authors, the greater reliance on bank credit relative to market-based finance can make forward guidance less effective at influencing long-term yields in emerging markets than in mature markets.

Employing interest rate guidance in today’s high-for-long inflation environment can prove arduous. Its effectiveness may be tempered by economic uncertainties and the need for adaptive and credible communication strategies. Despite these challenges, interest rate guidance is still used, as shown by the Brazilian Central Bank (Monetary Policy Committee, March 2024) clearly stating its intentions for future rate moves during its easing cycle that started in August 2023. Each country's experience reflects the balance between managing expectations and maintaining flexibility to respond to evolving economic conditions.

Asset purchase programmes

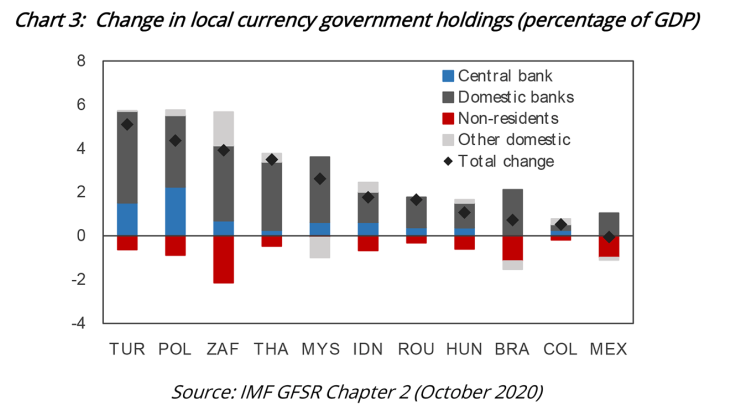

The pandemic triggered the first launch of asset purchase programmes in emerging market economies to reduce financial stress. The IMF's October 2020 Global Financial Stability Report (GFSR) identified three main motivations for emerging market economies to use this tool: (i) to improve bond market functioning and provide liquidity to the financial sector; (ii) to provide additional monetary stimulus to escape from the effective lower bound; and (iii) to explicitly ease government financing pressures. In some countries (i.e. Chile, India and Israel), asset purchases complemented interest rate guidance.

These programmes, which essentially consisted of central bank purchases of local currency bonds, were much smaller in scale than those of advanced economies, leading to more modest increases in the assets held by emerging market central banks (Hardy and Zhu, 2023). Most of the programmes were short-lived and stopped in 2020.

Overall, asset purchase programmes in emerging markets fulfilled their objectives of easing financial market stress and stabilising bond markets. The programmes helped to reduce government bond yields and spreads relative to US Treasury yields, which surged at the start of the pandemic, while ensuring improvements in market liquidity. Moreover, currency depreciation was avoided and inflation expectations were unaffected (IMF GFSR, 2020). Nonetheless, for these effects to have persisted, emerging market economies should have deployed large-scale asset purchase programmes such as those implemented in advanced economies (Mimir and Sunel, 2023).

A side effect of bond purchase programmes is their potential usefulness in mitigating the impact of sudden stops in capital inflows (Mimir and Sunel, 2023). Capital outflows and additional sovereign debt issuance during the pandemic were almost entirely absorbed by the domestic banking sector, while central banks played a minor role (Hardy and Zhu, 2023). However, in some economies, through asset purchases, central banks increased their holdings of local currency government bonds by an amount similar to that of capital outflows (Chart 3).