- Home

- Publications et statistiques

- Publications

- New interest rate benchmarks for financi...

Post n°200. Interest rate benchmarks, which are used to price money-market instruments as well as numerous financial contracts (bank overdrafts, real estate loans, bond debt, etc.), are only relevant if they are reliable and representative of the actual financing conditions experienced by economic agents. At the global level, they underpin some USD 350 trillion worth of financial instruments and contracts.

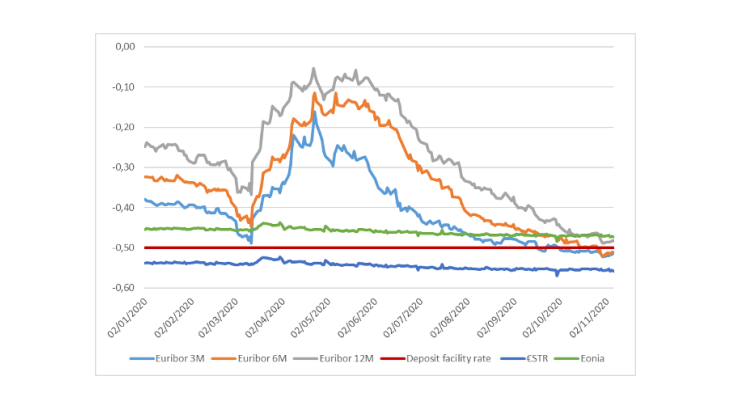

Sources: EMMI and ECB.

A consequence of the 2008 financial crisis

The issue first drew attention in the period following the 2008 Great Financial Crisis, when the Financial Stability Board (FSB) made two observations on the functioning of interbank financing markets: (i) the interest rate benchmarks used in these markets (i.e. IBORs or Interbank Offered Rates), which are calculated using the rates quoted by a panel of banks, may have been manipulated; and (ii) the flow of unsecured interbank funding had considerably decreased.

In 2014 therefore the FSB launched two projects: (i) the strengthening of IBORs by anchoring them to a greater number of actual transactions; and (ii) the identification of alternative risk-free or near-risk-free rates to which market participants can benchmark their contracts.

Progress has certainly been made in terms of methodology but more still needs to be done

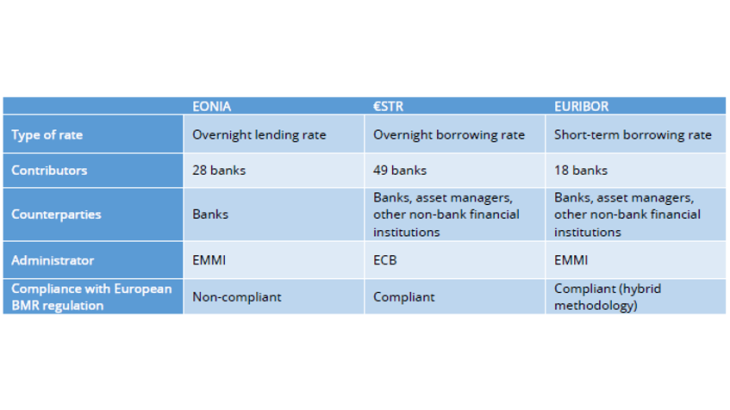

As highlighted by the FSB, the transition is advancing. In Europe, it is governed by Regulation EU 2016/1011 (the Benchmark Regulation or BMR), which applies notably to EONIA (Euro OverNight Index Average) and EURIBOR (Euro Interbank Offered Rate).

The European Money Markets Institute (EMMI), which administers EONIA and EURIBOR, has already announced that EONIA will no longer be published after 3 January 2022. In October 2019 the ECB began to publish a new overnight reference rate, the €STR (euro short-term rate), which is expected to gradually replace EONIA until the latter ceases to be published. In order to facilitate this transition, the EONIA calculation methodology has also been amended to become €STR plus a fixed spread of 8.5 basis points, which is the historical average difference between EONIA and €STR.

EURIBOR has in turn been made BMR-compliant, with the adoption of a new “hybrid” calculation methodology combining rates on actual transactions, estimates calculated by interpolation and judgement-based submissions. However, the contribution of actual transactions remains small for 1-week EURIBOR (around 30%) and even minimal for maturities of 1 month and above (less than 10%).

Another widely anticipated change is the development of an €STR-based term structure for interest rates. The working group on Risk Free Rates (RFR), which combines industry participants under the aegis of the ECB, is in the process of defining such a structure using €STR data and €STR swap prices. Market participants will thus have alternative benchmarks that can be used as fallbacks for financial contracts if EURIBOR stops being published.

Source: Banque de France.

Similar steps are being taken in other jurisdictions, notably the United States and United Kingdom where authorities plan to stop publishing LIBOR and replace it with risk-free rates as of end-2021 (except for US dollar LIBOR rates for maturities of 3 months and above for which the date is mid-2023).

As in the euro area, a key stage in this process is the definition of term structures based on the Secured Overnight Financing Rate (SOFR) in the United States, and on the Sterling Overnight Index Average (SONIA) in the United Kingdom. The development of SOFR and SONIA futures markets – in addition to the backward-looking data that will be available on both benchmarks – should facilitate the determination of a range of forward-looking risk-free rates.

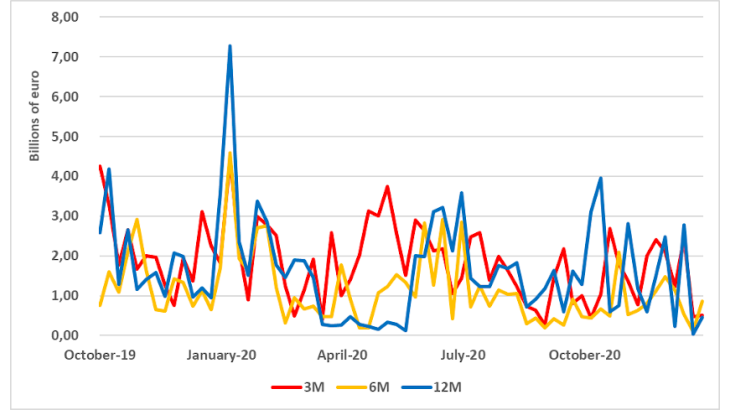

The transition is now under way at the global level. However, six years after the FSB’s call for reform, there are still fundamental weaknesses in LIBOR and EURIBOR, as illustrated in March 2020 when significant tensions resurfaced in the money markets. The disruption made it difficult to price money market instruments reliably, and there was almost no direct correlation between reference indices and banks’ real funding costs due to the sharp drop in transaction volumes (see Chart 3). This underlines the importance of the FSB’s effort towards reform.

Sources: ECB, Banque de France.

Note : Weekly borrowing volumes of all reporting agents with financial counterparts excluding call accounts. Some data points are merged for confidentiality reasons (weeks 13 to 16, 44 to 47 and 48 to 49 for the 6M maturity, weeks 50 to 51 and 51 to 53 for the 12M maturity).

Completing the transition to the new interest rate benchmarks is a collective responsibility

This is not the first time that the financial system has switched to a different interest rate benchmark. At the start of the 1990s, market participants unilaterally abandoned the benchmark on US Treasury securities, which measured the risk-free rate, and instead started using indices that incorporated credit risk (LIBORs), to make their hedging transactions more efficient (see Schrimpf and Sushko (2019)).

In contrast, the current reform is a joint effort by both regulators and private actors to switch from unsecured interbank reference rates to “near” risk-free rates. The transition is also the result of several years of work at the international level, which raises numerous operational, accounting, legal, fiscal and regulatory challenges.

There is no denying that progress has been made in adopting new indices. In 2020, €STR and SOFR were adopted as the standard discount rates for derivatives cleared respectively in the euro and US dollar markets.

But as in any marathon, it is most likely the last few kilometres that will be the hardest to complete. It is therefore essential that all stakeholders remain mobilised, to ensure that the impacts of the transition on financial institutions, their counterparties and customers, are managed in an orderly manner. Above all, the development of liquidity on these new benchmarks is crucial to financial market equilibrium. For example, it is now down to euro area market participants to ensure that €STR rapidly quickly replaces EONIA as a benchmark, and to actively contribute to increasing its liquidity.

An economic challenge

Short-term financing markets provide businesses, local authorities and financial market participants with the liquidity they need. If they dry up, the entire economy grinds to a halt: as in 2008!

When Christine Lagarde announced on 11 December 2020 that the anti-crisis measures adopted by the ECB in spring 2020 would be extended, she emphasised the need to maintain favourable financing conditions to ensure the flow of lending to economic agents, support the economy and ensure medium-term price stability.

The message is clear! Short-term financing markets are at the heart of the Eurosystem’s response to the Covid-19 crisis. The long-term success of this response depends on the sound functioning of these markets, and hence on the availability of reliable and representative interest rate benchmarks that ensure the effective transmission of monetary policy to the real economy.

Updated on the 25th of July 2024