A financial conditions index (FCI) can be seen as a barometer of the health of financial markets. Economists and market analysts have therefore constructed such indices as a way of analysing the effects of changes to financial conditions on the real economy. However, tracking developments in the financial sector has become increasingly difficult and there is still no consensus among experts about the correct way to estimate FCIs. The purpose of this article is to explain the construction of an alternative FCI that relies on a principal component analysis and on time-varying component weights. We compare its evolution with other FCIs and discuss the way in which it can be used for policy purposes (bearing in mind some well-known caveats with FCIs).

1. Key technical challenges in the calculation of financial conditions indices

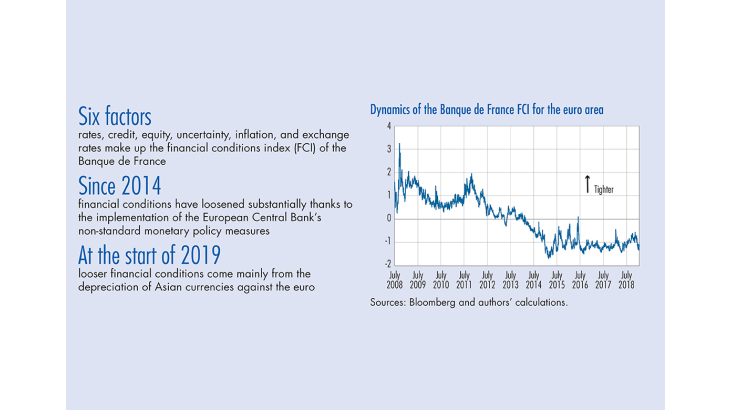

The key advantage of our framework compared to other methodologies is threefold: (i) it is based on a broader dataset; (ii) it is transparent; and (iii) it tracks the contribution of the main drivers of the Banque de France FCI (uncertainty, rates, credit, exchange rates, etc.). Furthermore, it is able to adjust to the rapidly changing environment of the financial sector through the time-varying weights attributed to each driver (see Box for details about the underlying methodology).

Data selection

Financial conditions are important because they influence current and future economic activity in ways that are not fully captured by the short-term interest rate, especially in times of crisis. For instance, asset prices are prime determinants of changes in the valuation of private sector portfolios, and therefore changes in private wealth, which affect the future spending behaviour of the private sector. Consequently, an FCI should cover a wide spectrum of data in order to keep track of various sources of complications in the financial sector. Our FCI is based on 18 daily series divided into 6 main components: rates, credit, equity, uncertainty, inflation, and exchange rates (the Appendix provides the details on the underlying data). The use of 18 financial series makes the Banque de France FCI the broadest index among established FCIs.

[To read more, please download the article]