- Home

- Publications and statistics

- Publications

- Monthly Business Survey – Start of March...

The Banque de France publishes a range of monthly and quarterly economic surveys that provide a snapshot of the French economy in the form of business climate indicators and short-term forecasts.

According to the business leaders surveyed (approximately 8,500 companies and establishments questioned between 26 February and 5 March), activity in February grew in industry but changed little in market services and construction. In March, business leaders expect activity to remain stable in industry and construction, and to increase slightly in market services. Order books continue to be deemed weak across all industrial sectors, with the exception of aeronautics. The cash position is no longer deemed weak in industry or in market services.

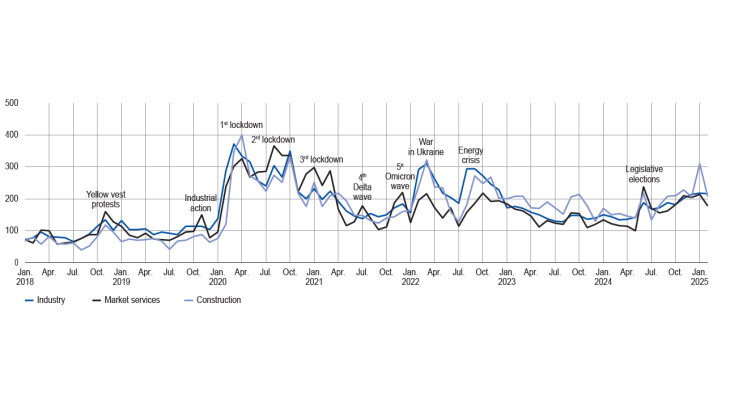

Our uncertainty indicator based on comments from companies has eased somewhat in market services, particularly in construction, following the enactment of the budget for 2025.

Business leaders are now mainly concerned with the potential effects of the tariff hikes announced by the United States.

Increases in both raw materials and selling prices continue to be considered moderate in industry. Quote prices in the construction sector were reported to be down slightly. Services prices continued to return to normal levels and recruitment difficulties to gradually subside.

Based on the survey results as well as other indicators, we reiterate our estimate of a slight increase in GDP of between 0.1% and 0.2% in the first quarter of 2025.

1. In February, activity grew in industry

but changed little in market services

and construction

In February, activity grew once again in industry, even though last month business leaders had expected it to stabilise. This growth was especially marked in aeronautics (including the space industry and military equipment), computer‑electronics‑optical products, and wearing apparel‑textiles‑footwear sectors, due to the recovery experienced by certain luxury goods companies. Conversely, chemicals and machinery and equipment (particularly agricultural machinery) reported a slight decline.

There was little change in activity in market services as forecast by business leaders last month. It increased in the accommodation and food services sector (high levels of activity during the holiday period, especially in the mountains) and in certain business services: publishing, cleaning, advertising (driven notably by large general retailers), and vehicle repairs (following the recall of defective vehicles). However, activity fell back once again in programming and IT consultancy, and declined less markedly in information services and management consultancy. Activity in the temporary work sector remained slightly positive, against a backdrop of considerable uncertainty.

In construction, activity grew in the finishing work sector – which continued to be buoyed by energy retrofit work – but declined in the structural work sector. Nevertheless, building contractors reported a slight uptick in demand for offices and industrial premises, whereas demand for standalone or collective housing remained weak. Moreover, the renewal of the zero‑interest loan scheme in the budget for 2025 is also seen as a positive factor for the coming months.

The capacity utilisation rate (CUR) for industry as a whole declined slightly for February to 75.1% (75.3% in January), close to the levels reported since last May but well below its long‑term average (77.2%). The indicator improved in aeronautics and other transport, excluding the automotive sector (up 1 percentage point), but fell back 1 percentage point in the chemicals and pharmaceuticals sectors.

Balance of opinion on the outlook for activity (balance of opinion adjusted for seasonal and working-day variations, for March: forecast)

the past month) stood at 5 percentage points for January in industry. For March (light blue bar), business leaders in industry expect activity to be virtually stable in industry (0 percentage point).

Capacity utilisation rate (%)

Inventories of finished goods changed little in February. They fell sharply in the wood‑paper‑printing and automotive sectors (continued deliveries amidst weak demand), but increased in the aeronautics, electrical equipment, machinery and equipment, and agri‑food sectors. In most sectors, inventories are above their long‑term average, with the exception of the wearing apparel‑textiles‑footwear and wood‑paper‑printing sectors.

In February, the balance of opinion on cash positions remained close to zero in industry. It improved in chemicals and aeronautics, but deteriorated in machinery and equipment (longer payment terms).

Cash position (balance of opinion, adjusted for seasonal and working day variations)

Inventories of finished goods in industry (balance of opinion, adjusted for seasonal and working day variations)

The drop in energy prices (downward renegotiation of electricity contracts) is often mentioned as a favourable factor for business cash flow. In all industrial sectors, the balance of opinion remains below its long‑term average, particularly in electrical equipment, machinery and equipment, and aeronautics.

In market services, the balance of opinion on cash positions improved slightly, although it varied widely across sub‑sectors. The cash position was deemed to be satisfactory in the motor vehicle rental, publishing and engineering sectors, however, it was deemed weak in advertising, accommodation and food services and vehicle repairs.

2. In March, business leaders expect activity to change little in industry and construction, and to improve slightly in market services

In March, business leaders in industry expect activity to change little overall. It should once again grow strongly in aeronautics, still buoyed by the space industry and military equipment sectors, however, it is expected to decline in the metal and metal products and automotive sectors.

In market services, after a flat month of February, activity should grow slightly in March. It is expected to remain on an upward trajectory in the accommodation and catering and publishing sectors, and to grow in legal and accounting activities. However, it is forecast to decline in the temporary work sector, due to a wait‑and‑see attitude on the part of customers in an environment described by business leaders as one of heightened anxiety.

Lastly, in construction, activity is expected to change little. The finishing works sector is forecast to perform better than the structural works sector.

At the end of February, industrial order books were still considered weak (well below their medium‑ to long‑term averages) in all sectors except aerospace. They were especially weak in rubber and plastic products, the automotive industry, machinery and equipment, and metal and metal products. The erosion is more marked this month for machinery and electrical equipment, due in particular to strong competition from Chinese products.

Level of order books (balance of opinion, adjusted for seasonal and working day variations)

In construction, the level of order books is deemed to have improved slightly in structural works, but remains strongly negative. It was stable in the finishing works sector.

Our monthly uncertainty indicator, which is constructed from a textual analysis of comments by surveyed companies,changed little this month in industry but dropped back in market services, and more sharply in the construction sector following the enactment of the budget law. Business leaders now mainly mention the international business environment, especially fears over the effects of increases in US customs duties, principally in the metal and metal products and capital goods sectors.

Indicator of uncertainty in the comments section of the monthly business survey (mbs)

3. Selling prices continued to normalise

In February, supply difficulties were generally stable when compared to the previous month (9% of companies

reported them, which was the same proportion as in January). For transport – the sector most affected – supply difficulties increased slightly in the automotive sector (12%) and continued to be relatively high in aeronautics (28%), but they remained rare in the construction sector (2%).

In industry, business leaders reported that raw materials prices have increased slightly. They expect them to increase in the rubber and plastic products sector, especially in the wood‑paper‑printing sectors. More specifically, they report an increase in the price of concrete, aluminium and paper. The balance of opinion on finished goods prices1 is generally close to zero: price increases in certain sectors (aeronautics, wood‑paper‑printing and chemicals) are offset by decreases in others (apparel‑textiles, electrical equipment, machinery and equipment).

More specifically, 9% of business leaders in industry reported that they had raised their selling prices in February, close to pre‑Covid February figures and below the same month in 2022 and 2023. Price increases mainly concerned aeronautics and other transport equipment (19%), chemicals (15%) and agri‑food (13%). Conversely, 4% of business leaders in industry reported cutting their selling prices, a higher proportion than in the month of February pre‑Covid. Decreases in finished goods prices were mainly concentrated in metal and metal products and the manufacture of fabricated metal products (8%), as well as in apparel‑textiles‑footwear (6%).

In construction, the balance of opinion on price movements was once again negative in February, dragged down by competition in the structural works sector. 4% of business leaders reported increasing their quote prices, which was less than the level observed in February of previous years. Conversely, 9% of business leaders said they had reduced their quote prices, a much higher proportion than in February of previous years.

In construction, the balance of opinion on price movements was once again negative in February, dragged down by competition in the structural works sector. 4% of business leaders reported increasing their quote prices, which was less than the level observed in February of previous years. Conversely, 9% of business leaders said they had reduced their quote prices, a much higher proportion than in February of previous years.

Change in prices of finished goods by major sector

Share of businesses reporting recruitment difficulties (%, unadjusted data)

In March, 10% of industrial firms plan to raise their prices (versus 9% in March 2024). This proportion is higher in the agri‑food sector (28%), as is usually the case at this time of year when annual price revisions negotiated with large general retailers come into effect: price rises are forecast in cocoa, milk and dairy‑based products. Business leaders in this sector also mention the forthcoming tax on sugary drinks and egg shortages as factors driving price increases. In market services and construction, the proportions are 9% and 3%, respectively (compared with 10% and 5% in March 2024).

In February, 19% of business leaders reported recruitment difficulties2 (20% in January).

4. Our estimates suggest that GDP

will edge up slightly in the first quarter of 2025, by between 0.1% and 0.2%

The detailed results of the quarterly accounts, published by INSEE at the end of February, reported a 0.1% decline in GDP growth in the fourth quarter of 2024, partly due to the negative counter effects of the Olympic and Paralympic Games, which had temporarily boosted third‑quarter GDP. Value added declined in agriculture, manufacturing, construction and market services, but rose in non‑market services and energy.

Based on the results of the Banque de France monthly business survey (MBS), rounded out by other available data (INSEE service and industry production indices and surveys and high‑frequency data), we maintain our January forecast of a slight increase in GDP in the first quarter, by between 0.1% and 0.2%. Value added in market services is expected to rise once again following the drop reported in the previous quarter (reflecting the negative counter effects of the Olympic Games), and should increase once again in the energy sector. Value added in manufacturing is forecast to remain stable reflecting mixed signals, between a drop in the industrial production index in January and the positive monthly business survey balances. Lastly, value added should also remain stable in the construction sector after several quarters of decline.

Quarterly changes in gdp and value added in france (%)

Sources: INSEE data for the fourth quarter of 2024, Banque de France forecast for the first quarter of 2025.

Download the full publication

Updated on the 16th of April 2025