- Home

- Publications et statistiques

- Publications

- Monthly Business Survey – Start of Febru...

The Banque de France publishes a range of monthly and quarterly economic surveys that provide a snapshot of the French economy in the form of business climate indicators and short-term forecasts.

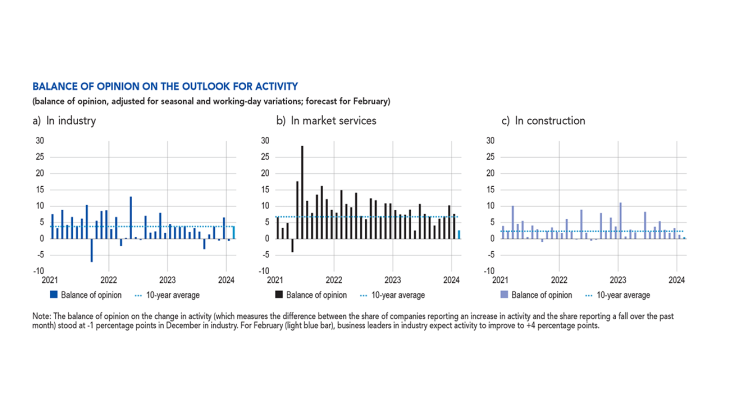

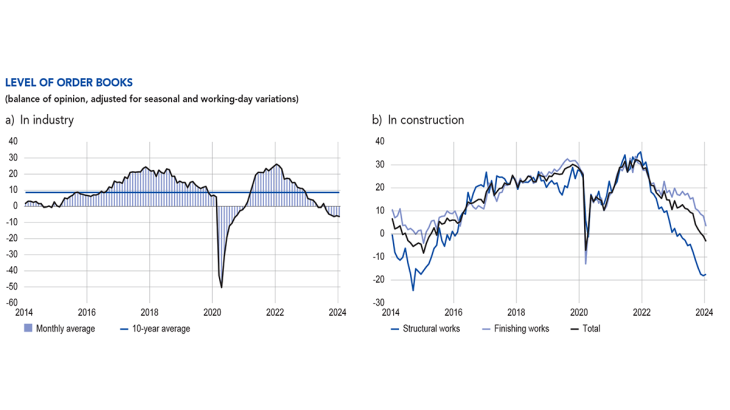

According to the business leaders surveyed (approximately 8,500 companies and establishments questioned between 29 January 2024 and 5 February 2024), activity changed little in January in industry but grew on the whole in market services, despite farmer’s blockades, which may have affected certain activities at the end of the month. In construction, while activity in the finishing works sector grew slightly, there was a further decline in the structural works sector. Based on forecasts for February, activity is expected to expand in industry, to expand to a lesser extent in services, and to contract once again in the structural works sector of the construction industry. Order books are still considered weak in industry and are continuing to contract in the construction sector, where the decline has now spread to the finishing works sector.

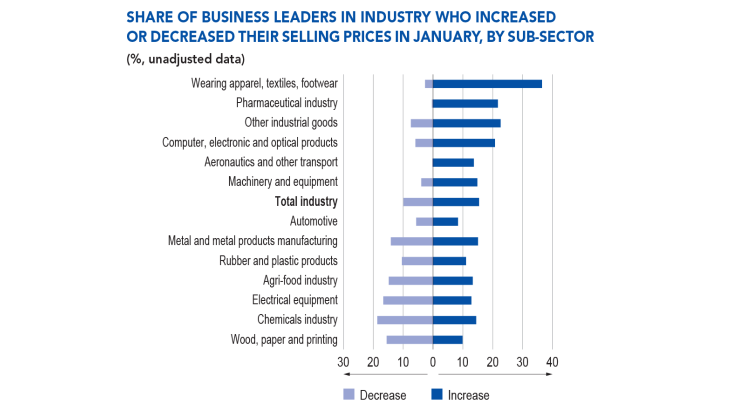

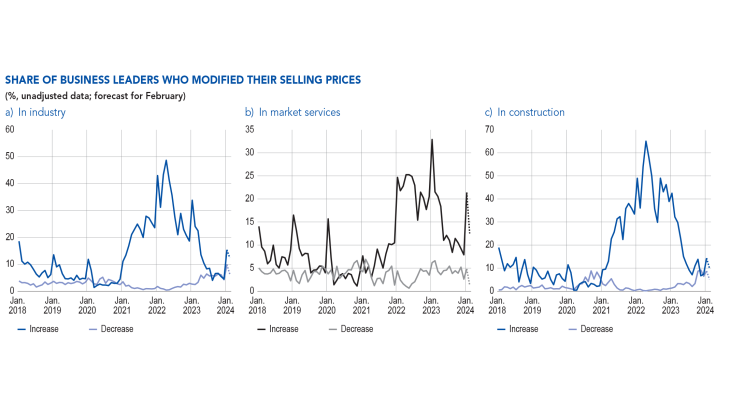

Price moderation continued, despite the one-off rebound this month attributable to the usual revision of prices at the start of the year. According to business leaders in industry, raw materials prices remain stable. In January, the share of businesses increasing their prices in industry, market services and construction was close to January levels in pre-Covid years, but significantly lower than in early 2022 and early 2023. Moreover, the share of businesses reporting a drop in their prices has risen sharply in industry and construction, but remains low in services.

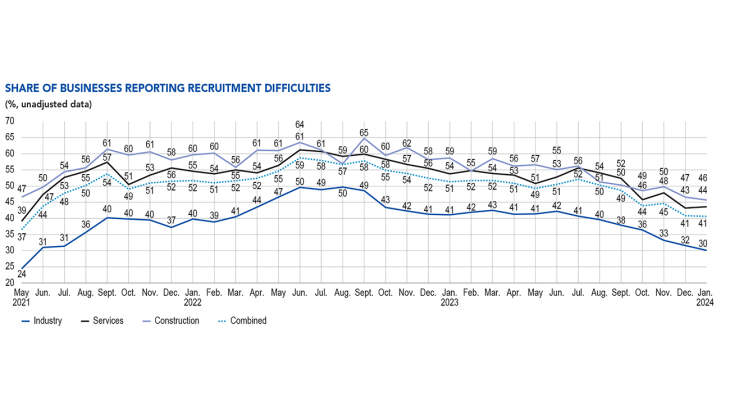

Recruitment difficulties remained stable and continued to affect 41% of businesses in January.

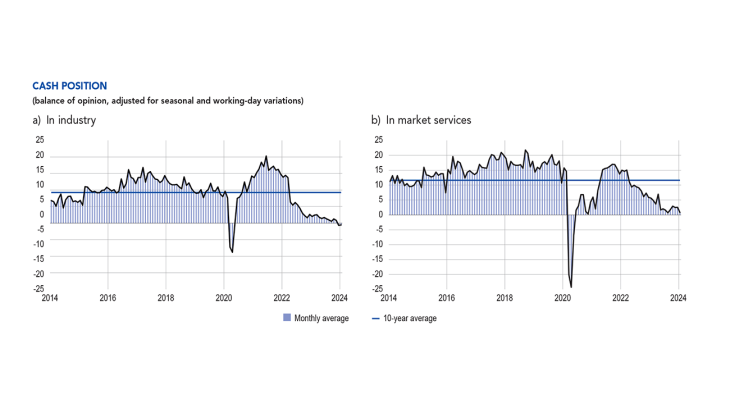

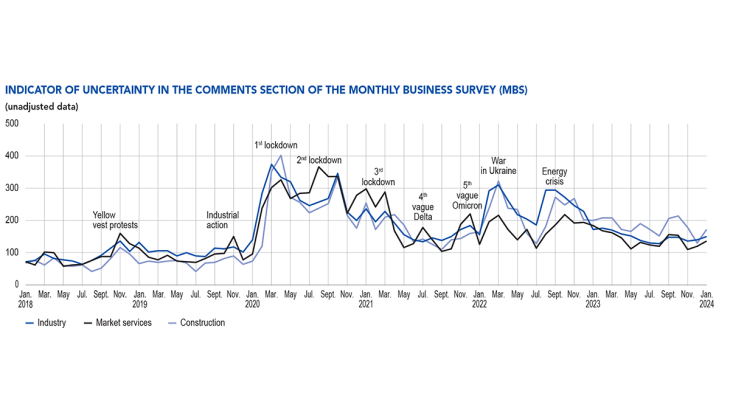

The uncertainty indicator rose slightly in January due to the lack of visibility over the coming months, partly attributable to the sharp decline in new orders and to renewed tension in the Red Sea, which is affecting the supply of certain products. Cash positions deteriorated in the services sector and remain very weak in industry, especially for SMEs.

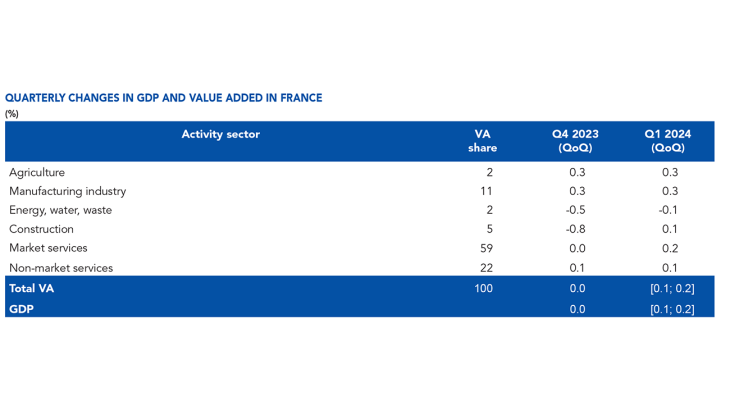

Based on the survey results, together with other indicators, we estimate that GDP should increase slightly (by 0.1% to 0.2%) in the first quarter, following two quarters of stability.

1. In January, there was little change in activity in industry but activity expanded in market services. The construction finishing works sector once again recorded a decline.

In January, there was little change in activity in industry, and it was well below business leaders’ expectations last month. Activity rose in January in computer and electronic products, aeronautics and chemicals, however it declined in machinery and equipment, pharmaceuticals and other industrial products.

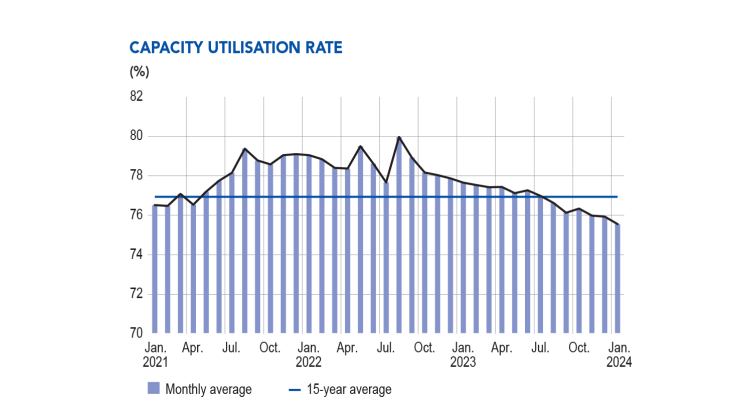

The overall capacity utilisation rate (CUR) for manufacturing industry fell slightly to 75.5% (after 75.9% in December), the lowest level recorded for three years and significantly below its 15-year average of 76.9%. More specifically, CUR declined in the automotive industry and in other industrial goods (by 2 percentage points).

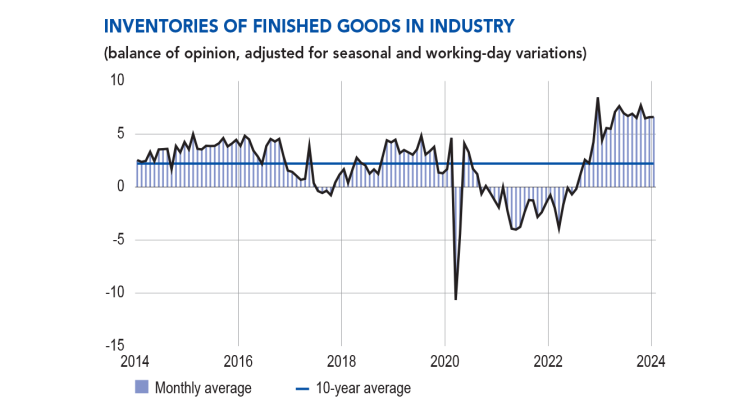

Inventories of finished goods remained stable in January albeit at levels deemed to be high and above their long-term average in all sectors, especially electrical equipment, and with the exception of the pharmaceuticals and chemicals sectors.

In market services, activity continued to expand in most sectors at a faster pace than that expected last month by business leaders. In business services, advertising, engineering activities, management consultancy and publishing were especially buoyant; conversely, the blockades linked to farmers’ protests at the end of the month negatively impacted transport (trucks blocked), car repairs (delays in parts deliveries) and – to a lesser extent – food services. Lastly, temporary employment activity contracted slightly with most sectors – with the notable exception of aerospace – making less use of temporary workers against a backdrop of a decline in their orders.

In construction, activity was stable overall, with contrasting trends across the different sectors: while activity in the finishing works sector grew slightly, buoyed by energy renovation work, the structural works sector recorded a fresh decline, particularly in new builds.

The balance of opinion on cash positions remained unfavourable in industry. It was considered satisfactory in the aeronautics and pharmaceutical sectors, but particularly weak in wood-paper-printing and in rubber and plastic products. It was well below its long-term average in the manufacture of electrical equipment and computers. In our sample, heads of SMEs reported a worse cash position than the leaders of larger businesses.

In market services, the cash position deteriorated in January, after recovering slightly in previous months. It worsened in most business services – due in particular to longer payment times reported by the business leaders surveyed – although it recovered slightly in consumer services.

2. In February, business leaders expect activity to expand in industry and in services to a lesser extent. It is expected to contract in the structural works sector.

Business leaders in industry expect activity to continue to grow in February, with a certain variability across sectors. For example, sharper growth is expected in the agri-food, automotive and aeronautics sectors. Conversely, activity in rubber and plastic products and in metal and metal products is expected to contract slightly.

In services, activity should continue to expand albeit at a slower rate. However, business leaders expect good momentum in the management consultancy, publishing and accommodation sectors.

Lastly, construction activity is expected to stabilise in the finishing works sector and to contract slightly in structural works.

The balance of opinion on industry order books remained weak in January. It improved in the aeronautics sector, but deteriorated in the machinery and equipment and automotive sectors. It is deemed below its long-term average in all sectors apart from aeronautics and computer products. In the construction sector, order book levels deteriorated once again, especially in the finishing works sector.

Our monthly uncertainty indicator, which is constructed from a textual analysis of comments by surveyed companies, has risen again, particularly in industry and construction. The lack of visibility, partially attributable to a decline in new orders for French businesses, is exacerbated by the situation in the Red Sea, which is compounding supply difficulties for products passing through the Suez Canal (electrical equipment, for example). Lastly, blockades linked to farmers’ protests were mainly reported in the transport sector.

a) In industry b) In construction

3. Price moderation continued, excluding the usual effect of the revision process at the start of the year.

In January, overall supply difficulties did not change in industry (14% of businesses reported them, the same as in December): the clear improvement in the aeronautics sector was offset by a slight increase in several sectors affected by the situation in the Red Sea (e.g. rubber products, plastic products and metal and metal products). Supply difficulties have again decreased in construction, where they are on the verge of disappearing (4%, after reaching 7% previously).

In industry, business leaders reported little change in the prices of raw materials or finished products.

At a more detailed level, 15% of business leaders in industry reported that they had raised their selling prices in January. This rebound reflects the traditional revision process at the start of the year and this proportion is close to pre-Covid levels: whereas in 2023, 34% of business leaders reported a price increase in January, this figure was 12% in January 2020, 14% in January 2019 and 19% in January 2018. Moreover, 10% of business leaders in industry reported having lowered their

selling prices in January (after 4% in December), the highest figure for over five years. Decreases in finished goods prices were most common in chemicals (19%), electrical equipment manufacturing (17%) and in wood-paper-printing (16%); in all these sectors, the share of businesses that lowered their prices was higher than those that raised them. In the agri-food sector, as the timetable for commercial negotiations was moved up (deadline brought forward to January instead of 1 March 2024), 13% of business leaders reported that they had increased their prices in January (compared with 36% in January 2023 and 35% in January 2022), a slightly lower percentage than for price cuts (i.e. 15%, compared with 2% at the start of last year).

In construction, the proportion of business leaders reporting price rises (14%) was also down on the January figures for the two previous years, but in line with January levels observed in pre-Covid years. Moreover, the proportion of business leaders reporting a drop in prices has risen significantly: 9% reported that they had lowered their prices, again the highest figure for over five years.

In services, the proportion of businesses reporting price rises was 21%, slightly higher than the January figures for pre-Covid years (i.e. 16% in 2020, 17% in 2019, 14% in 2018), but lower than those reported for January 2022 (25%) and 2023 (33%). However, unlike the industry or construction sectors, the proportion of businesses reporting a drop in prices remains low, at 5%. Price increases in services mainly concern business services, and in certain service sectors they reflect higher insurance costs (leasing), as well as higher labour costs following revision of the NMW in January (cleaning services).

Business leaders’ expectations for February point to less frequent price rises: 12% of those surveyed expect to increase their prices in industry, 13% in market services and 10% in the construction sector.

for example, 17% of electrical equipment manufacturers reported that they had lowered their

prices in January while 13% of industrial firms in this sector reported that they had raised

their prices during the month.

a) In industry b) In market services c) In construction

Business leaders were also asked about their recruitment difficulties, which were unchanged in January: 41% of the businesses surveyed across all sectors reported difficulties, as was the case in December, although the proportion continued to decline in industry (to 30%). Since peaking in the summer of 2022, recruitment difficulties have declined by almost a third but remain relatively high in services and especially in construction.

4. Our estimates suggest that GDP should rise slightly in the first quarter

According to the quarterly national accounts published by INSEE at the end of January, GDP remained stable in the fourth quarter when compared with the previous quarter. Declines in the construction and energy sectors were offset by higher value added in industry, while market services remained stable for the second consecutive quarter.

Based on the results of the Banque de France monthly business survey (MBS), as well as other available data (INSEE production indices and surveys and high-frequency data), we estimate that real GDP will rise slightly in the first quarter of 2024 by around 0.1% to 0.2%.

It should be boosted this quarter by manufacturing and market services, particularly information and communication, accommodation and food, transport services and business services, whereas value added in wholesale and retail trade is expected to fall. Our estimate of higher value added in the manufacturing sector is mainly underpinned by the industrial production index, which rose by 1.2% in December, whereas the Banque de France survey pointed to a slowdown in January. Value added in the energy sector is expected to fall slightly.

Lastly, activity in the construction sector could recover slightly (after a sharp drop in the fourth quarter of 2023), due to an increase in the number of building permits – particularly for collective housing – and in housing starts in December, probably in anticipation of tighter controls on compliance with new building regulations (CRC) that came into force in January 2024.

Note: QoQ = quarterly change

Download the paper

Updated on the 25th of July 2024