- Home

- Publications and statistics

- Publications

- Monthly Business Survey – Start of Augus...

The Banque de France publishes a range of monthly and quarterly economic surveys that provide a snapshot of the French economy in the form of business climate indicators and short-term forecasts.

Our survey of approximately 8,500 companies and establishments was conducted between 22 July and 5 August. As the period covered coincides with the summer holidays and the Paris Olympic and Paralympic Games (the

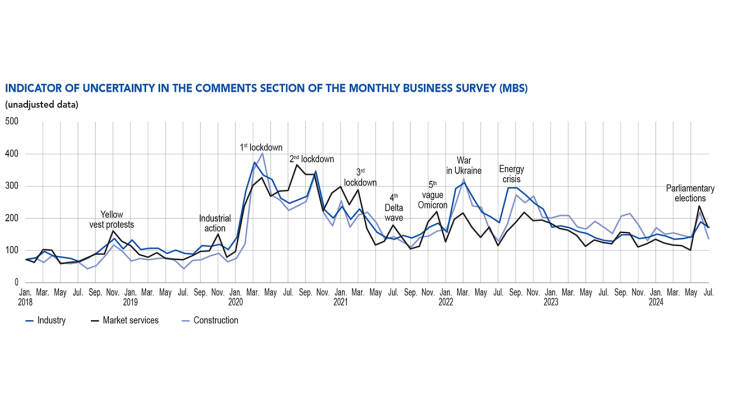

economic effects of which are only partially captured by the survey), the results and expectations need to be interpreted with caution. According to surveyed business leaders, activity rose in July in market services and construction, and remained little-changed in industry. For August, businesses expect activity to increase in services and industry but to decline in construction. Order books are still deemed weak in almost all industrial sectors, with the notable exception of aeronautics. In the structural works segment of construction, they remain well below pre-Covid levels, due to stagnation in the construction of new builds. Our uncertainty indicator, based on comments from surveyed businesses, has eased slightly, but nonetheless remains high after the strong jump

in our previous survey (conducted between the end of June and start of July), which was linked to the electoral context.

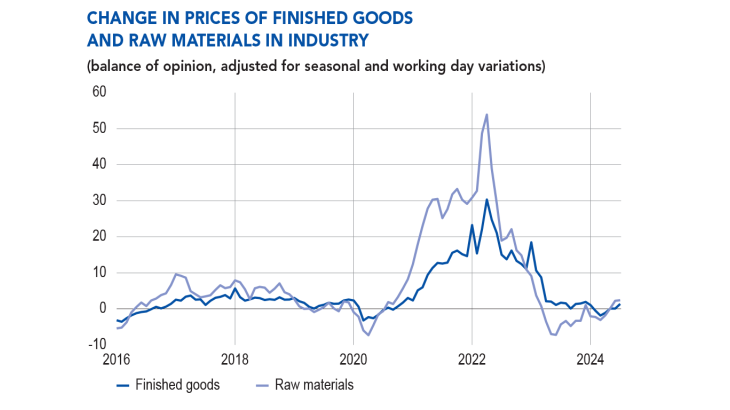

According to industrial firms, selling prices continued to moderate in July against a backdrop of slight growth in raw materials prices. In industry and construction, the proportions of businesses that raised their prices (6% and 3% respectively) were close to pre-Covid July levels.

At the same time, the proportions reporting a drop in their prices (4% and 9% respectively) exceeded pre-Covid levels. In market services, the share of businesses reporting a rise in their prices (8%) is still in the process of normalising.

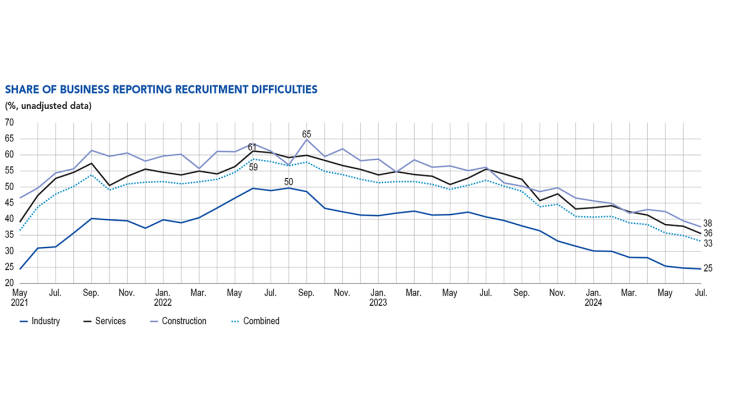

Recruitment difficulties continued their slow decline, with 33% of businesses mentioning them in July, down from 35% in June.

Based on the survey results, as well as other indicators, we expect GDP to rise significantly in the third quarter of 2024: underlying growth should be around 0.1-0.2%, and the temporary impact of the Paris Olympic and Paralympic Games should add another quarter point. This forecast is subject to both upside risks, linked to possible spillover effects from the Olympic Games, and downside risks stemming from the political uncertainty.

1. In July, activity expanded in market services and construction, but was little‑changed in industry

In July, activity remained flat in industry, contrasting with business leaders’ forecasts in our previous survey, which were for a slight rise. Growth in agri‑food and other industrial sectors was offset by a contraction in transport equipment, while equipment goods remained more or less stable. More specifically, aeronautics, pharmaceuticals, chemicals, rubber and plastic products, and computer, electronic and optical products all reported robust growth in activity; in contrast, machinery and equipment, metal and metal products manufacturing, wearing apparel, textiles and footwear, and especially the automotive industry, all saw a drop in activity over the month. In the latter sector in particular, business leaders reported a slowdown in electric vehicle sales in favour of combustion engine vehicles, notably following the suspension of the “social leasing” scheme (subsidy to help individuals lease an electric vehicle) in mid‑February after its unexpected success (50,000 beneficiaries in the first six weeks).

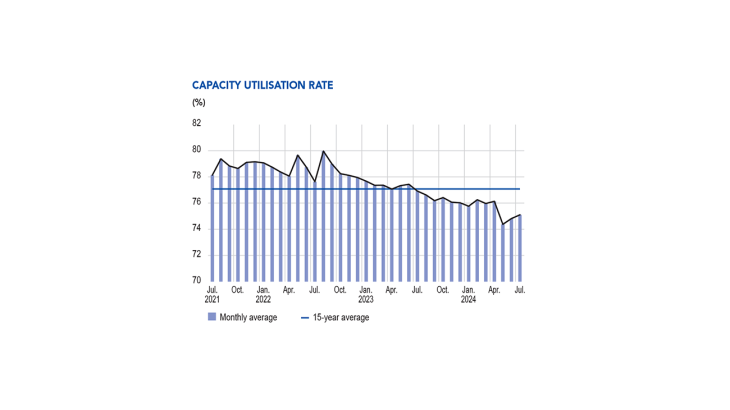

The capacity utilisation rate (CUR) for industry as a whole rose slightly to 75.1% (from 74.8% in June), but has still not

come back to the levels seen in the first four months of the year (around 76%).

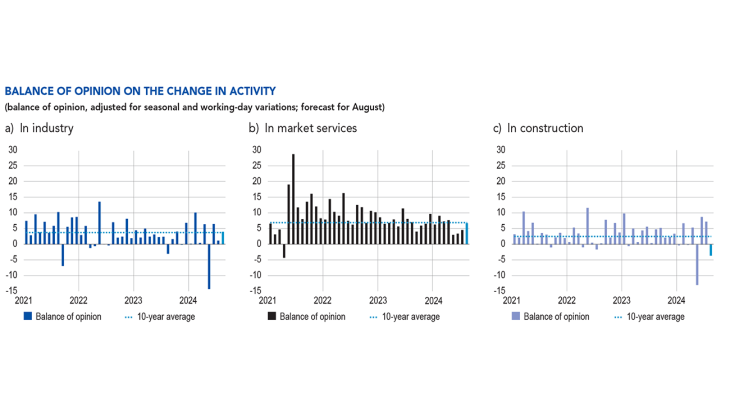

the past month) stood at 1 point in July in industry. For August (light blue bar), business leaders in industry expect activity to increase (+4 points).

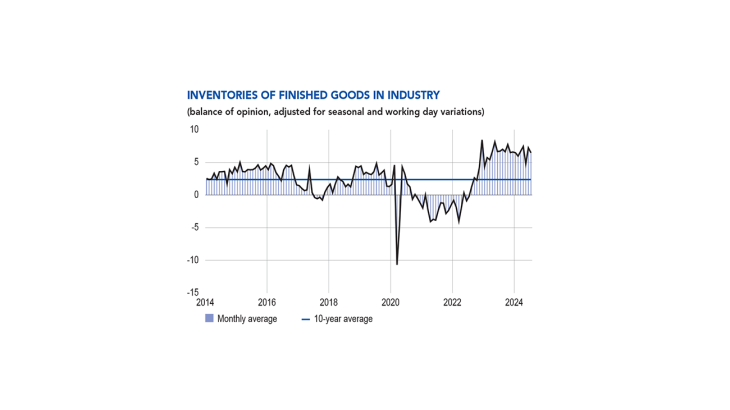

Inventories of finished products were relatively stable in July. They increased in the automotive sector, as well as in wearing apparel, textiles and footwear; business leaders in the latter sector cited a slowdown in the Chinese market

and a wait‑and‑see attitude on the part of US customers. Inventories declined in chemicals, pharmaceuticals and

agri‑food. However, they are still deemed high and above their long‑term average in most sectors, including in aeronautics and in the automotive industry.

Activity continued to expand in July in market services, and at a similar pace to that anticipated by business leaders in our last survey. All business services sectors reported higher activity (especially publishing, legal and accounting activities, engineering and cleaning). However, performances were more varied in consumer services: activity grew in rental services, accommodation – where firms reported the presence of US tourists – leisure activities and personal services, but declined in automotive repair and in food services – where Olympics‑related tourism failed to offset the loss of the usual summer customers. Temporary employment reported the third consecutive decline in activity – especially in the automotive sector.

In construction, activity increased in July, and by more than anticipated in the last survey, thanks to the relatively mild weather. However, the rise was limited to the finishing works segment, with structural works reporting a decline.

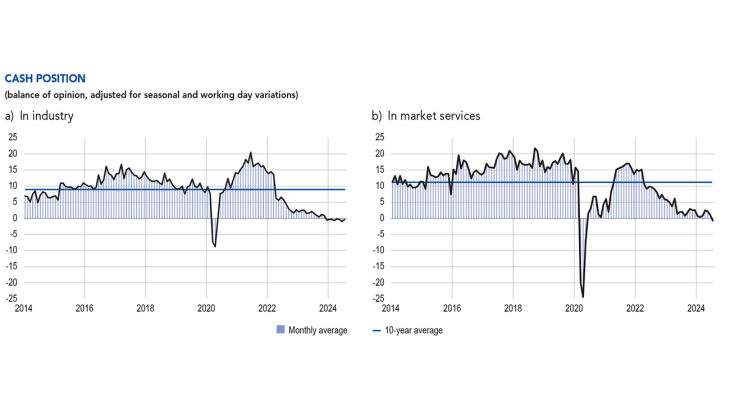

The balance of opinion on cash positions remained relatively stable at the aggregate level in industry, but continued to vary significantly across sub‑sectors. Cash levels were deemed satisfactory in pharmaceuticals, aeronautics and chemicals, but were still considered weak in wearing apparel, textiles and footwear, rubber and plastic products, computer, electronic and optical products, and metal and metal products manufacturing.

In market services, there was a slight deterioration in the balance of opinion on cash positions. Cash levels were deemed satisfactory in information services and publishing, but were said to have worsened in automotive repair, transportation, accommodation and, above all, food services.

2. In August, business leaders expect activity to rise in industry and market services, and to decline in construction

For August (for which expectations should be interpreted with caution due to the specific characteristics of the month), business leaders in industry expect activity to expand overall, although performances should vary across sub‑sectors. It should rise particularly strongly in chemicals, pharmaceuticals, wood, paper and printing, and agri‑food. Wearing apparel, textiles and footwear, and rubber and plastic products should both see a decline.

In services, activity is expected to increase, especially in business services (information services, legal and accounting activities, management consultancy, publishing), as well as in accommodation and food services. In the latter segment in particular, business leaders expect a catch‑up effect after a weak month of July. Temporary employment should continue to decline.

Lastly, in contrast with last month, construction activity is expected to drop sharply overall, reflecting a fall in finishing works, while structural works activity is anticipated to rise. Again, August expectations for construction should be viewed with caution as it is difficult to correct for summer holidays and stoppages at certain building sites.

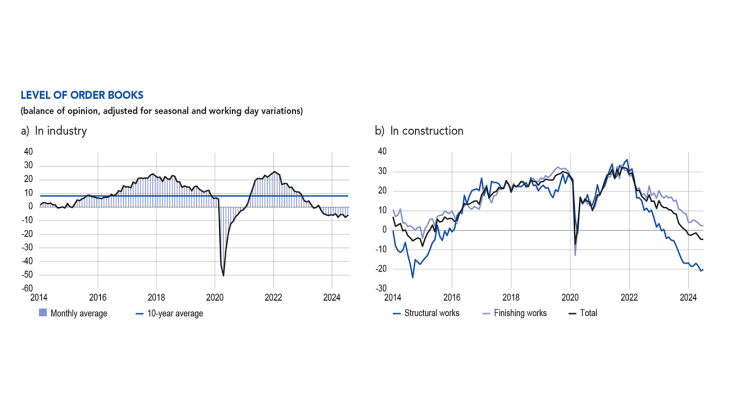

The balance of opinion on order books remained little‑changed in industry in July. It improved in agri‑food, pharmaceuticals, and machinery and equipment, but deteriorated in wearing apparel, textiles and footwear, and in computer, electronic and optical products, with the latter segment citing competition from China.

In construction, the balance of opinion on order books was little‑changed in finishing as well as structural works, and

remains particularly low in the latter.

After spiking in June as a result of the electoral context, our monthly uncertainty indicator, which is constructed from a textual analysis of comments from surveyed businesses, eased slightly in July. Nonetheless, it remains above its pre‑election levels in industry and especially in services.

3. Services price dynamics are continuing to normalise

In July, some industrial sectors continued to experience supply difficulties: although they were cited by only 11%

of industrial firms overall (down from 12% in June), high percentages of automotive and aeronautics firms said they

were still experiencing problems (38% and 26% respectively), due to issues with certain components and with maritime transport in the Red Sea. Supply difficulties remain rare in construction (3% of firms, stable on June).

In industry, business leaders said raw materials prices had risen slightly again, especially in wood, paper and printing, agri‑food, and wearing apparel, textiles and footwear. The balance of opinion on finished goods prices1 was very slightly positive in July.

At a more detailed level, 6% of business leaders in industry said they had raised their selling prices in July, which is similar to the proportions observed in July in the pre‑Covid period, and well below those seen in July of 2022 and 2023. Conversely, 4% of industry business leaders said they had lowered their selling prices in July. Cuts to finished goods prices were mainly reported in wearing apparel, textiles and footwear (17%), and in the automotive sector (9%).

In construction, only 3% of business leaders reported increasing their quote prices, which is lower than the proportions seen in July in the pre‑Covid period. Moreover, 9% of business leaders said they had reduced their prices over the month, which is the same proportion as in June.

In services, price dynamics have not yet completely normalised. The proportion of businesses reporting price increases came to 8% (compared with around 5% for the month of July before Covid), whereas the proportion reporting a cut in their prices was 4%. Increases in services prices were mainly reported in transport, accommodation and cleaning services. This may at least partially reflect a temporary effect of the Olympic Games on services prices.

For August, 4% of business leaders in industry expect to raise their prices, and 4% and 2% of business leaders respectively expect to do so in market services and construction.

Business leaders were also asked about their recruitment difficulties, which continued to ease slowly in July: 33% of the businesses surveyed reported difficulties, down from 35% in June.

1 The balance of opinion is the difference between the proportion of business leaders reporting increases or decreases, weighted by the intensity of the variation (with three possible grades in the monthly business survey: low, normal and high). A business leader indicating a “high” increase in prices will, all other things being equal, influence the balance of opinion more than a business leader indicating a “low” increase.

4. Our leading estimates point to a significant rise in GDP in the third quarter, taking into account the temporary impact of the Olympic Games

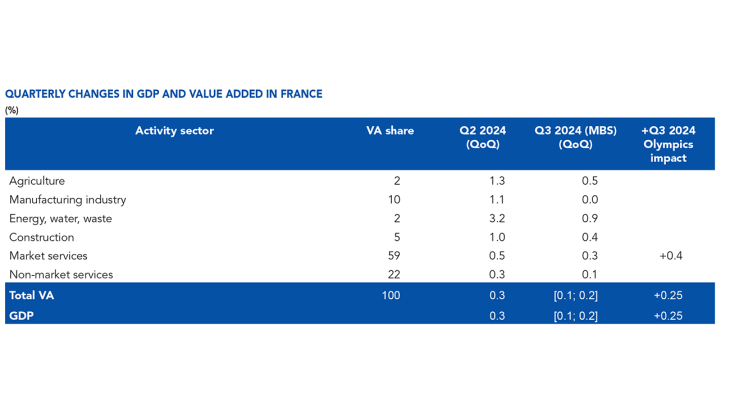

Based on the first estimate of the quarterly national accounts, published by INSEE at the end of July, GDP grew by 0.3% in the second quarter of 2024, exceeding our estimate of 0.1% growth in our last Monthly Business Survey (MBS). Falls in value added in agriculture, manufacturing and construction were offset by bigger rises than we expected in energy and services (market services, but also non‑market services).

Based on the results of the Banque de France MBS, as well as other available data (INSEE services and industry production indices and surveys, and high‑frequency data), and taking account of the effects of the Olympic Games, which are not captured in these indicators, we expect real GDP to rise significantly in the third quarter: underlying growth should be around 0.1‑0.2%, and the transitory impact of the Olympics should add roughly another quarter of a point. However, it is important to stress that our third quarter growth forecast is subject to substantial upside and downside risks – on the upside due to uncertainty over the impact of the Olympics, and, on the downside, to the impact of the political environment on firms’ behaviour.

The time period covered by the MBS means it captures some of the uncertainty linked to the political situation and part of the effect of the Olympics – in particular the activity boost for accommodation and food services firms in the Île-de-France region, and for firms helping to organise the Games (suppliers, event organisers, security firms, etc.). However, the bulk of the Olympics impact is not covered by the survey. This mainly consists of ticket sales: as INSEE pointed out, in accordance with national accounting principles, these will be recognised in full (under value added for services to households) at the time of the actual Games, regardless of the date of the ticket sales. The same applies to broadcasting revenues, which will be added to information and communication activities in the third quarter. There is also expected to be a rise in passenger transport activity, which is not covered by our survey. Lastly, the bonuses paid to public sector workers will have a positive impact on value added in non‑market services, as measured in the national accounts. We estimate that the full impact of the Olympic Games will add around a quarter point to third quarter GDP growth. It should be noted that this estimate

only relates to the third quarter and does not take account of previous effects on GDP of preparations for the Games (notably in construction), or of subsequent spillover effects.

Market services should be the main contributor to the rise in third quarter GDP, thanks to the boost provided by the Olympic Games. The energy sector should again prove robust, while value added in industry is expected to remain stable, as indicated by the balances in the MBS. Construction should decline again this quarter, due to continued sluggishness in new building starts.

Note: QoQ = quarterly change.

Download the full publication

Updated on 2 September 2024