- Home

- Publications et statistiques

- Publications

- Monthly Business Survey – December 2022

The Banque de France publishes a range of monthly and quarterly economic surveys that provide a snapshot of the French economy in the form of business climate indicators and short-term forecasts.

Despite the highly uncertain economic environment, marked by a series of massive external shocks, activity remained generally resilient.

According to the business leaders surveyed (approximately 8,500 companies and establishments questioned between 28 November and 5 December, activity improved in December in the three major sectors, and to a greater extent than expected the previous month.

- For December, business leaders expect activity in services to continue to firm, while it should stabilise in industry and decline in construction; the medium-term outlook is shrouded in greater uncertainty;

- Supply difficulties eased further in industry (41% of industrial firms reported difficulties in November after 43% in October), and in construction (36%, after 41%). Finished goods prices continued to rise at a sustained pace.

- Recruitment difficulties eased slightly (cited by 53% of respondents compared with 55% in October).

Our uncertainty indicator declined in services, but increased in construction and remained high in industry. Firms’ cash position stabilised at a subpar level in industry, and slightly below in average in services.

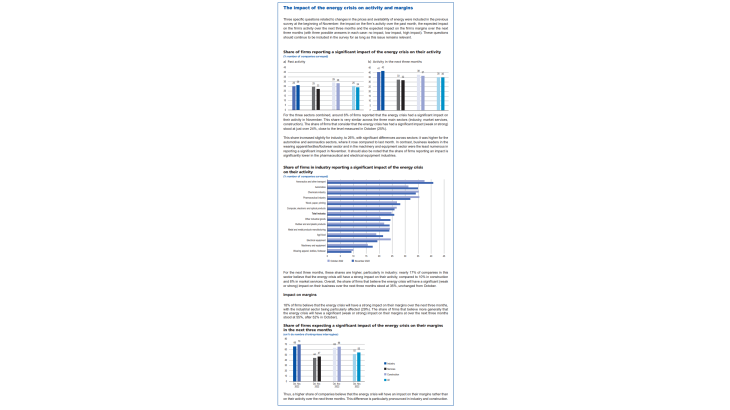

As regards the consequences of the energy crisis, 24% of companies reported that their activity over the past month had been affected, of which 6% significantly. For the next three months, 35% of firms expect this to have an impact (weak or strong) on their activity (42% in industry). In terms of the impact on their margins over the next three months, two-thirds of companies in the construction and manufacturing sectors reported concerns, and nearly half of companies in market services.

Based on the survey results, combined with other indicators, we expect GDP to rise slightly in November and to be almost stable in December. GDP is thus expected to grow by around 0.1% in the fourth quarter of 2022 compared with the previous quarter, in line with our three-year projection for the French economy.

1. In November activity picked up in industry, market services and construction

In November, activity increased in industry, somewhat more vigorously than expected by business leaders the previous month. The balances of opinion on production in November suggest a marked increase in activity in the pharmaceutical industry, electrical equipment, computer, electronic and optical products and, to a lesser extent, in the automobile industry. Conversely, activity in the chemicals industry and rubber and plastic products was down on the previous month.

Stocks rose and are deemed to be at a high level. This increase may be due to a drop in demand (machinery and equipment, rubber products, plastics), or to supply difficulties – resulting in an increase in stocks of semi-finished goods in purchasing companies – or in the delivery of finished goods (automotive, aeronautics). Conversely, in the food and pharmaceutical industries, stocks are still deemed to be well below their normal level.

In market services, activity continued to strengthen – again more rapidly than expected by business leaders last month – both in personal services (accommodation, food services) and in business services (management consulting, information services, programming, publishing).

Activity in the construction sector rose sharply, particularly in the finishing works sector.

The balance of opinion on the cash position was almost stable in industry compared to last month, albeit at very low levels compared to the past 15 years, especially for large enterprises. With the exception of the transport equipment sector (including the automotive industry), most industrial sectors reported a significant divergence between the current cash position and its long-term average, particularly in the chemicals industry, electrical equipment and computer, electronic and optical products, where the gap was close to 20 points.

In market services, the slow deterioration in the cash position came to a halt in November, with the spread between the balance of opinion and the long-term average standing at only -3 percentage points.

2. In December, business leaders expect activity to continue to expand in services, be almost stable in industry and decline in construction

For December, business leaders in industry expect activity to remain almost stable overall, but with ongoing significant sectoral disparities. Some sectors are expected to decline sharply: this is the case for electrical equipment, rubber and plastic products, wood, paper and printing and, to a lesser extent, chemicals. Conversely, activity is expected to pick up again in pharmaceuticals, computer, electronic and optical products, automobiles and aeronautics, and other transport.

In services, business leaders expect activity to grow further in most sectors, notably accommodation, food services and management consultancy. Staff levels are expected to continue to grow strongly.

Lastly, in the construction sector, activity is expected to slow, in both structural and finishing works.

Our monthly uncertainty indicator, which is constructed using text mining of respondents’ comments, reflects high levels of uncertainty compared to normal, but with sectoral differences. While it declined slightly in services and industry, it increased in construction.

The balance of opinion on order books was stable at in November in industry and in construction. In both cases, the current levels remained slightly about their long-term average. However, this situation also reflects marked differences across sectors, with very healthy order books in aeronautics, machinery and equipment, and computer, electronic and optical products, while they are considered to be lacklustre in chemicals and rubber and plastic products.

3. Further decline in supply and recruitment difficulties; finished goods prices continued to rise at a steady pace

Supply difficulties continued to decline in November in industry (41%, down from 43%) and construction (36%, down from 41%), and are now significantly below their spring 2021 levels.

According to the business leaders in industry, the rate of increase in the prices of raw materials and finished products remained unchanged.

More specifically, 21% of business leaders in the manufacturing industry reported they had raised their selling prices in November. This proportion stood at 47% in construction and 17% in market services. Prior to the seasonal increases expected early next year, the outlook for December suggests a decrease in this share in industry (19%), construction (42%), and a slight increase in market services (20%).

Business leaders were also asked about their recruitment difficulties. These difficulties remained high at 53% across the board, but declined for the second month in a row, most notably in construction (55%, down from 60%).

4. Estimates derived mainly from the survey, supplemented by other indicators, suggest that the level of GDP in November was higher than that of October, and that GDP should then be almost stable in December

For November, using granular survey data and other available data, we estimate that GDP should increase compared to October. This is due to an improvement in industry, construction and market services.

Based on survey data, value added should grow in the food and manufacturing industry. However, like in the previous quarter, the energy sector (which is not covered by the survey) is expected to dampen growth in industry as a whole. Maintenance operations in nuclear power plants, on the supply side, and the reduction in consumption following sobriety policies, on the demand side, contribute to the decrease in production.

Activity in the services covered by the survey should pick up after an October disrupted by fuel shortages.

The high-frequency data, which we monitor to supplement the service sectors not or only partly covered by the survey, indicate a rebound in activity in transport and retail trade.

In December, business leaders expect PIB to be almost stable compared with November, albeit to differing degrees across sectors. However, the environment remains highly uncertain, particularly with regard to the cost and availability of energy.

Fourth-quarter GDP is thus expected to grow by around 0.1% compared with the previous quarter.

Download the PDF version of this document

Updated on the 25th of July 2024